Since November 2024, Titan International has been in a holding pattern, posting a small loss of 1.9% while floating around $7.23.

Is now the time to buy Titan International, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Titan International Will Underperform?

We're cautious about Titan International. Here are three reasons why there are better opportunities than TWI and a stock we'd rather own.

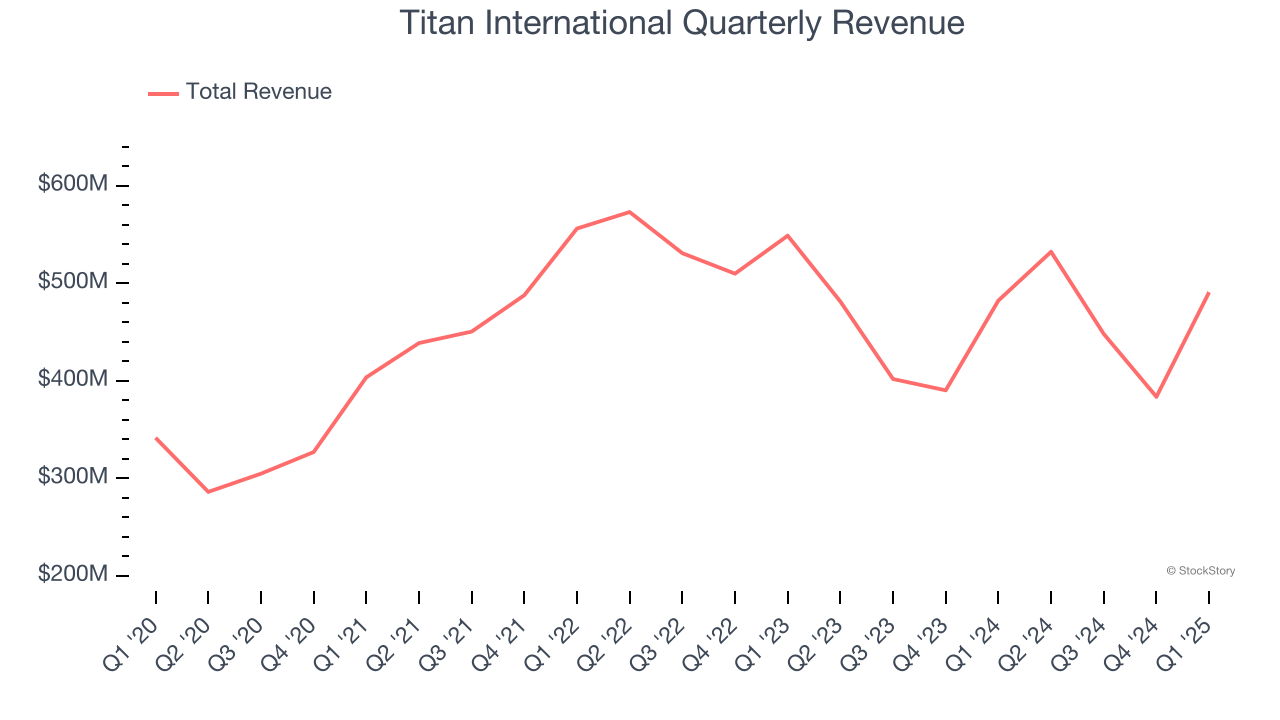

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Titan International’s sales grew at a mediocre 6.1% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector.

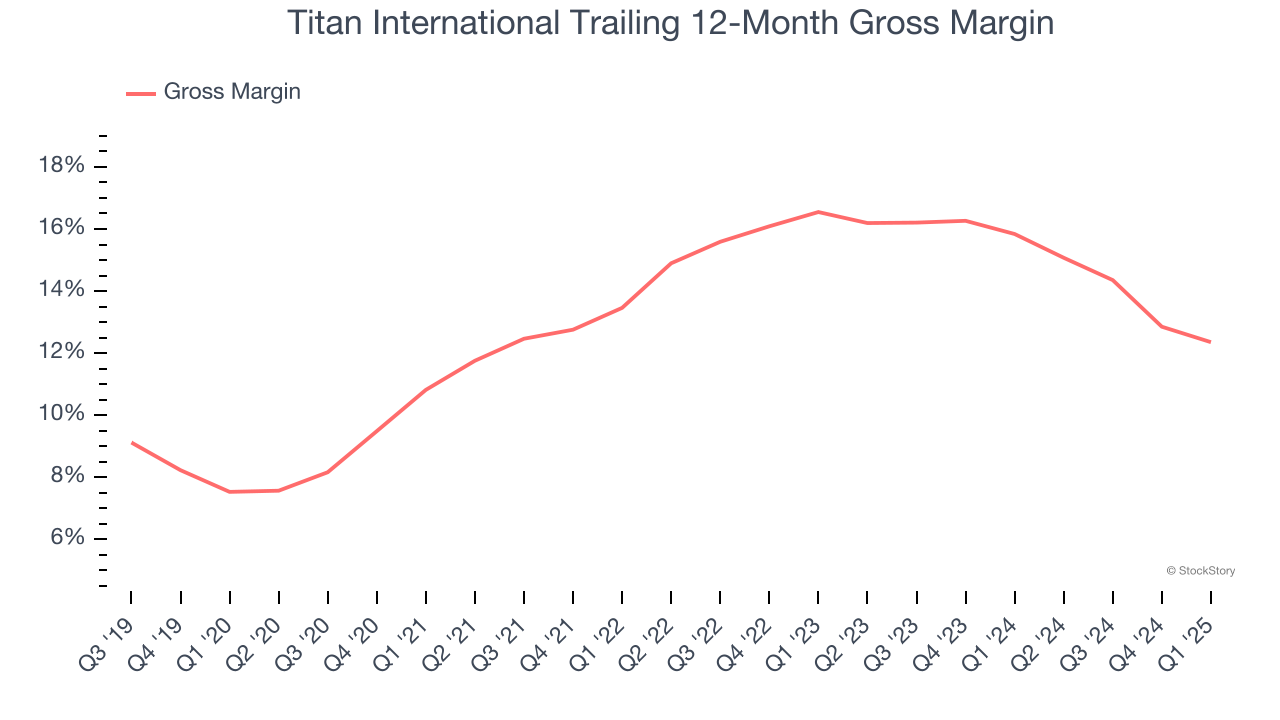

2. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Titan International has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 14% gross margin over the last five years. That means Titan International paid its suppliers a lot of money ($85.95 for every $100 in revenue) to run its business.

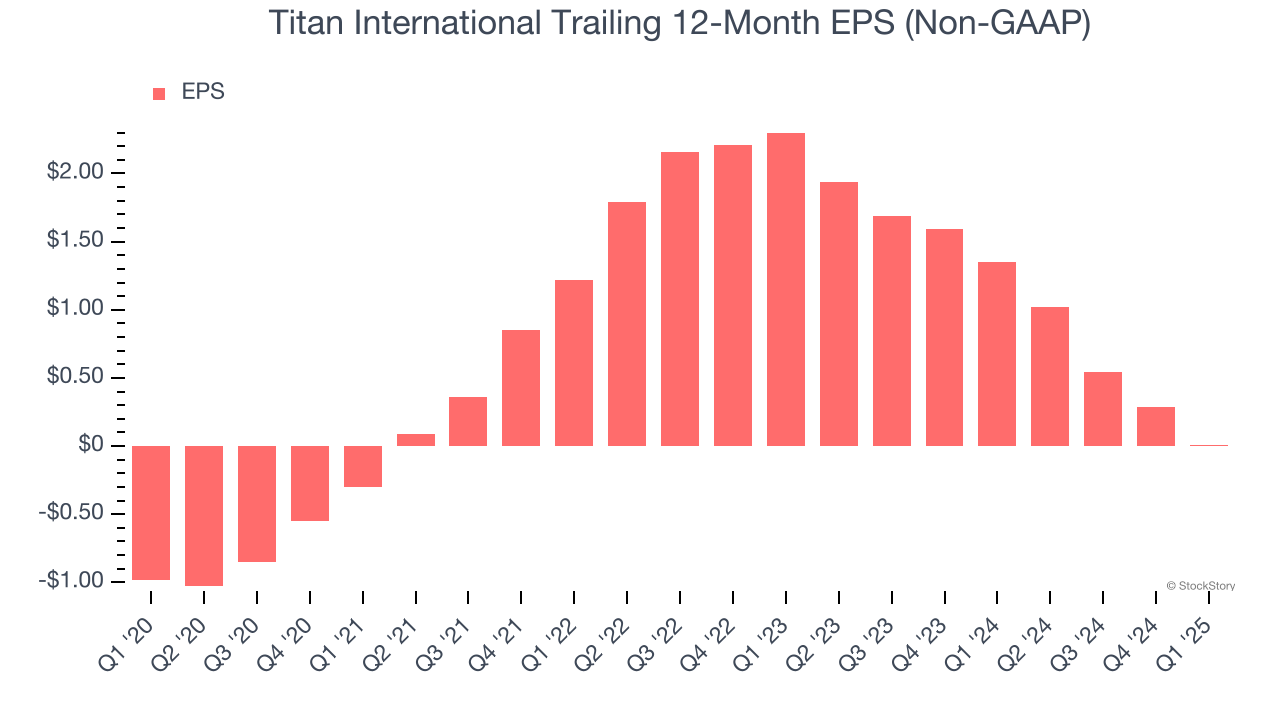

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Titan International, its EPS declined by more than its revenue over the last two years, dropping 93.4%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

We see the value of companies helping their customers, but in the case of Titan International, we’re out. That said, the stock currently trades at 19.4× forward P/E (or $7.23 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.