What a brutal six months it’s been for Energy Recovery. The stock has dropped 26.2% and now trades at $12.82, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Following the pullback, is now an opportune time to buy ERII? Find out in our full research report, it’s free.

Why Is ERII a Good Business?

Having saved far more than a trillion gallons of water, Energy Recovery (NASDAQ: ERII) provides energy recovery devices to the water treatment, oil and gas, and chemical processing sectors.

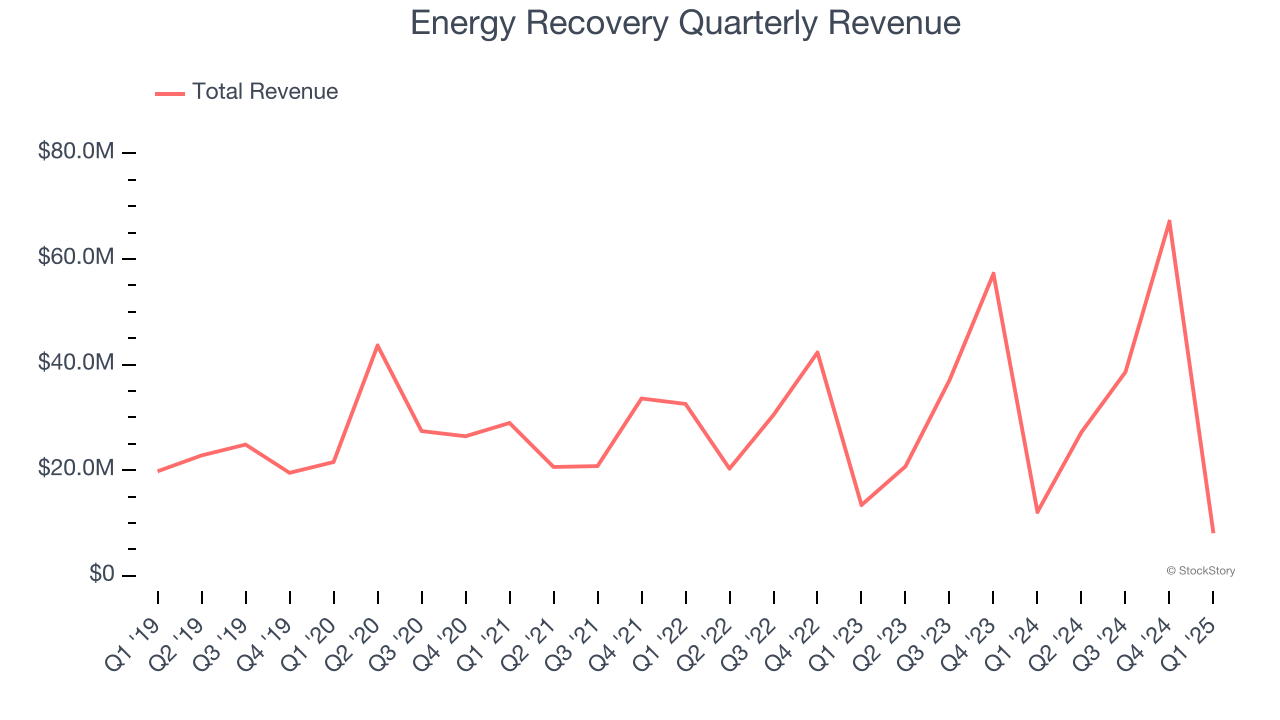

1. Long-Term Revenue Growth Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Energy Recovery’s 9.7% annualized revenue growth over the last five years was solid. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

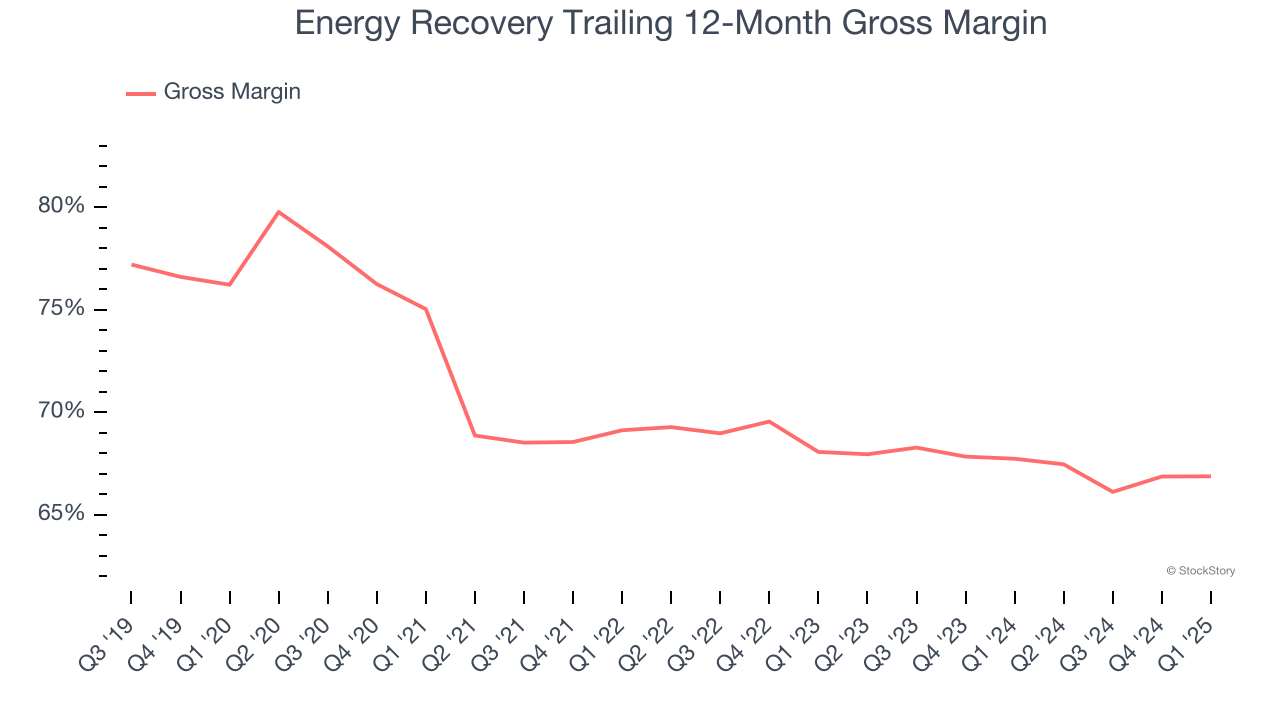

2. Elite Gross Margin Powers Best-In-Class Business Model

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Energy Recovery has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 69.4% gross margin over the last five years. That means Energy Recovery only paid its suppliers $30.64 for every $100 in revenue.

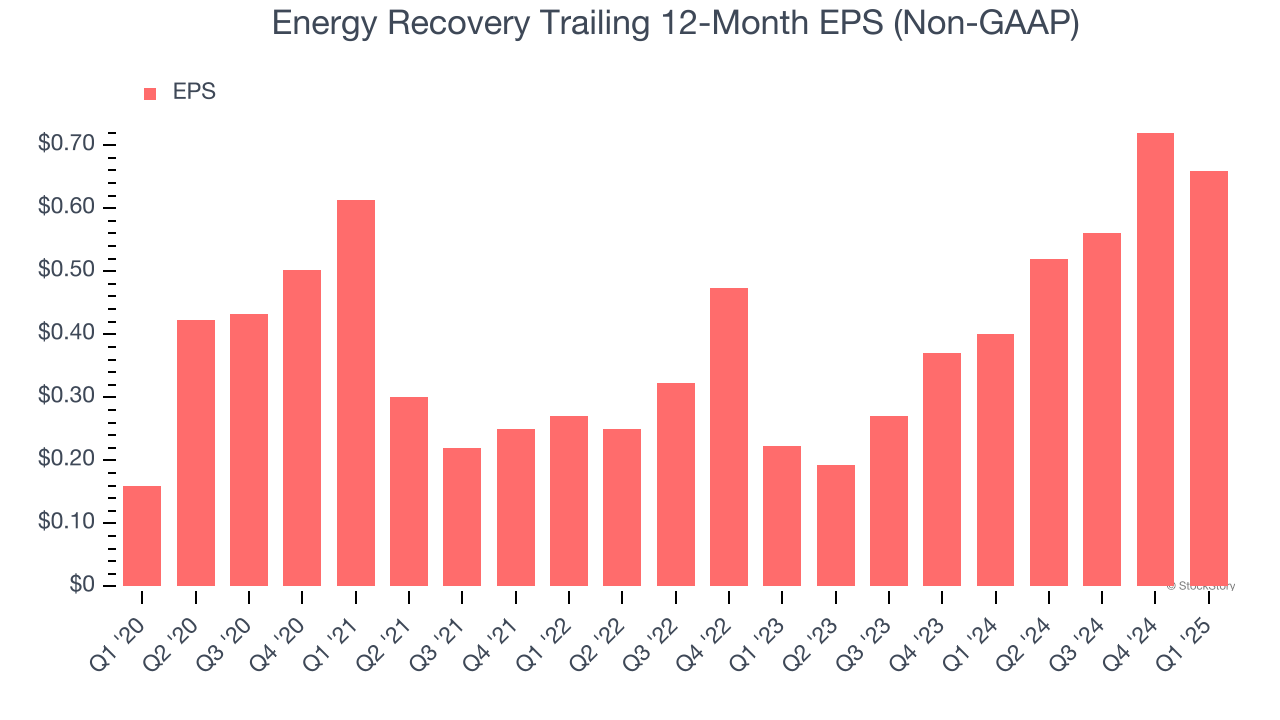

3. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Energy Recovery’s EPS grew at an astounding 32.7% compounded annual growth rate over the last five years, higher than its 9.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we're bullish on Energy Recovery. With the recent decline, the stock trades at 15.7× forward P/E (or $12.82 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.