Global Business Travel has gotten torched over the last six months - since December 2024, its stock price has dropped 32.4% to $6.33 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Global Business Travel, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Global Business Travel Not Exciting?

Even with the cheaper entry price, we're swiping left on Global Business Travel for now. Here are three reasons why there are better opportunities than GBTG and a stock we'd rather own.

1. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Global Business Travel’s revenue to rise by 1.9%, a deceleration versus This projection is underwhelming and implies its products and services will face some demand challenges.

2. Low Gross Margin Reveals Weak Structural Profitability

For software companies like Global Business Travel, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Global Business Travel’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 60.8% gross margin over the last year. Said differently, Global Business Travel had to pay a chunky $39.15 to its service providers for every $100 in revenue.

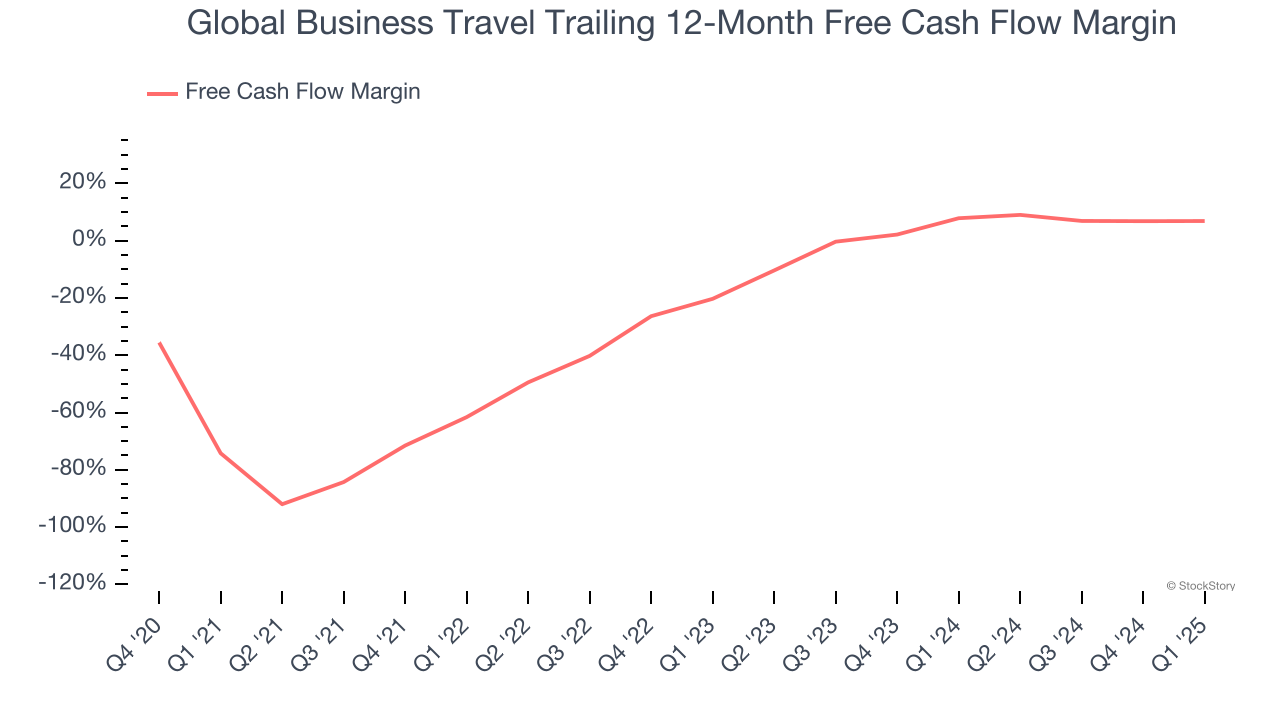

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Global Business Travel has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.9%, subpar for a software business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Global Business Travel to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

Final Judgment

Global Business Travel’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 1.2× forward price-to-sales (or $6.33 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward one of our top software and edge computing picks.

Stocks We Like More Than Global Business Travel

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.