Roblox’s 37.1% return over the past six months has outpaced the S&P 500 by 32.1%, and its stock price has climbed to $60.52 per share. This run-up might have investors contemplating their next move.

Following the strength, is RBLX a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does Roblox Spark Debate?

Best known for its wide assortment of user-generated content, Roblox (NYSE:RBLX) is an online gaming platform and game creation system.

Two Things to Like:

1. Daily Active Users Skyrocket, Fueling Growth Opportunities

As a video gaming company, Roblox generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

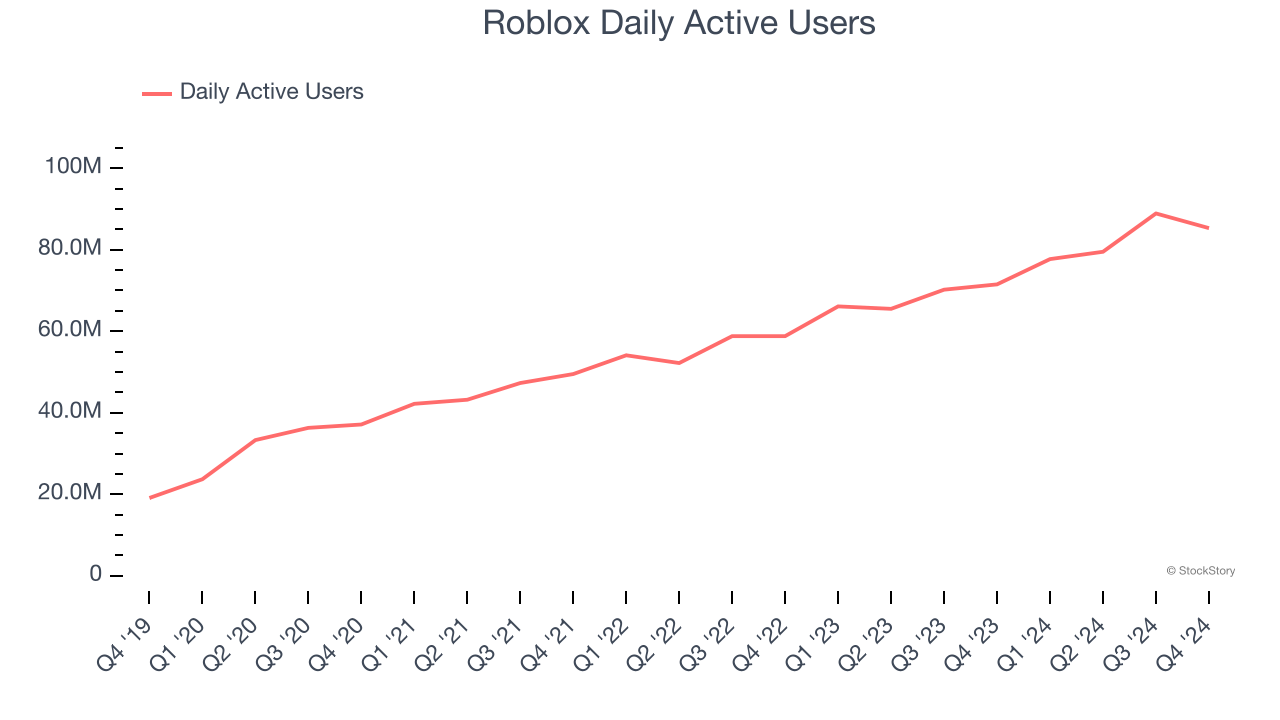

Over the last two years, Roblox’s daily active users, a key performance metric for the company, increased by 21.7% annually to 85.3 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

2. Elite Brand Reduces Need for Marketing Campaigns

Consumer internet businesses like Roblox grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Roblox is extremely efficient at acquiring new users, spending only 17.8% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving Roblox the freedom to invest its resources into new growth initiatives while maintaining optionality.

One Reason to be Careful:

Growth in Customer Spending Lags Peers

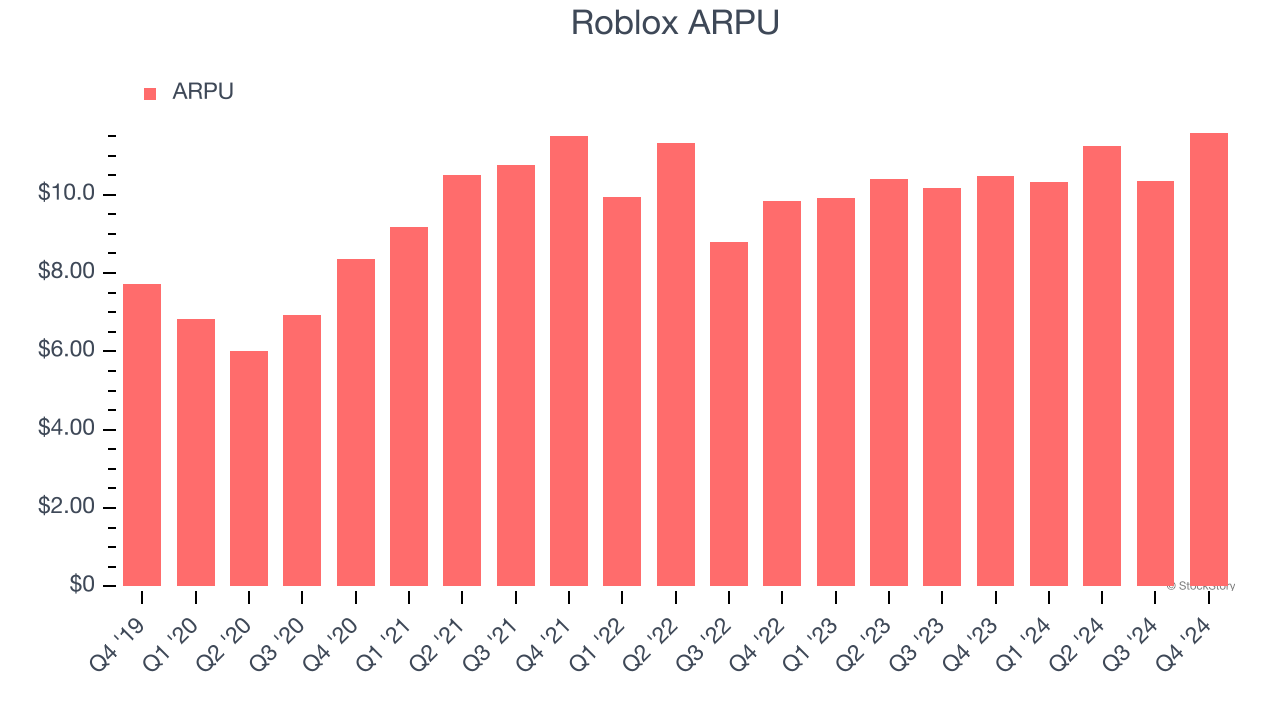

Average revenue per user (ARPU) is a critical metric to track for video gaming businesses like Roblox because it measures how much revenue each user generates, which is a function of how much paying users spend on its games.

Roblox’s ARPU growth has been mediocre over the last two years, averaging 4.7%. This isn’t great, but the increase in daily active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Roblox tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

Final Judgment

Roblox’s merits more than compensate for its flaws, and with its shares beating the market recently, the stock trades at 38.8× forward EV-to-EBITDA (or $60.52 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Roblox

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.