With a market cap of $214.8 billion, Merck & Co., Inc. (MRK) is a research-driven biopharmaceutical company committed to using cutting-edge science to save and improve lives around the world. For more than 130 years, the company has advanced innovative medicines and vaccines while upholding its core values of integrity, respect for people, and putting patients first.

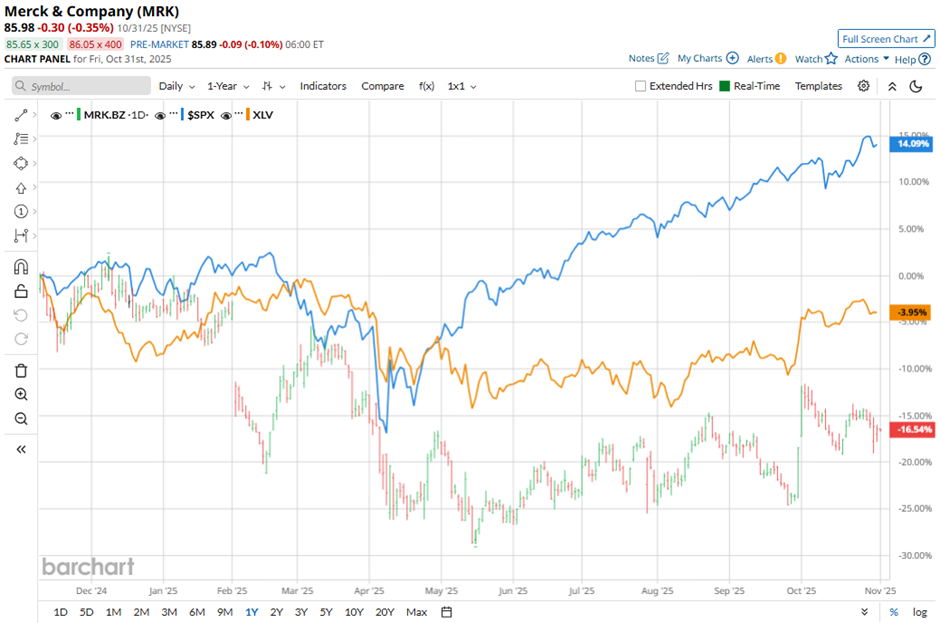

Shares of the Rahway, New Jersey-based company have underperformed the broader market over the past 52 weeks. The stock has declined nearly 18% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 17.7%. Moreover, shares of Merck & Co. are down 13.6% on a YTD basis, compared to SPX’s 16.3% gain.

Focusing more closely, shares of the pharmaceutical company have also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 2.6% drop over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $2.58 and revenue of $17.28 billion, Merck & Co. shares fell marginally on Oct. 30. The decline came after the company lowered the high end of its full-year revenue forecast to $64.5 billion - $65 billion. Additionally, concerns over slowing Keytruda growth, weaker-than-expected Winrevair sales, and falling Gardasil sales in China weighed on sentiment.

For the current fiscal year, ending in December 2025, analysts expect MRK’s adjusted EPS to grow 17.1% year-over-year to $8.96. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

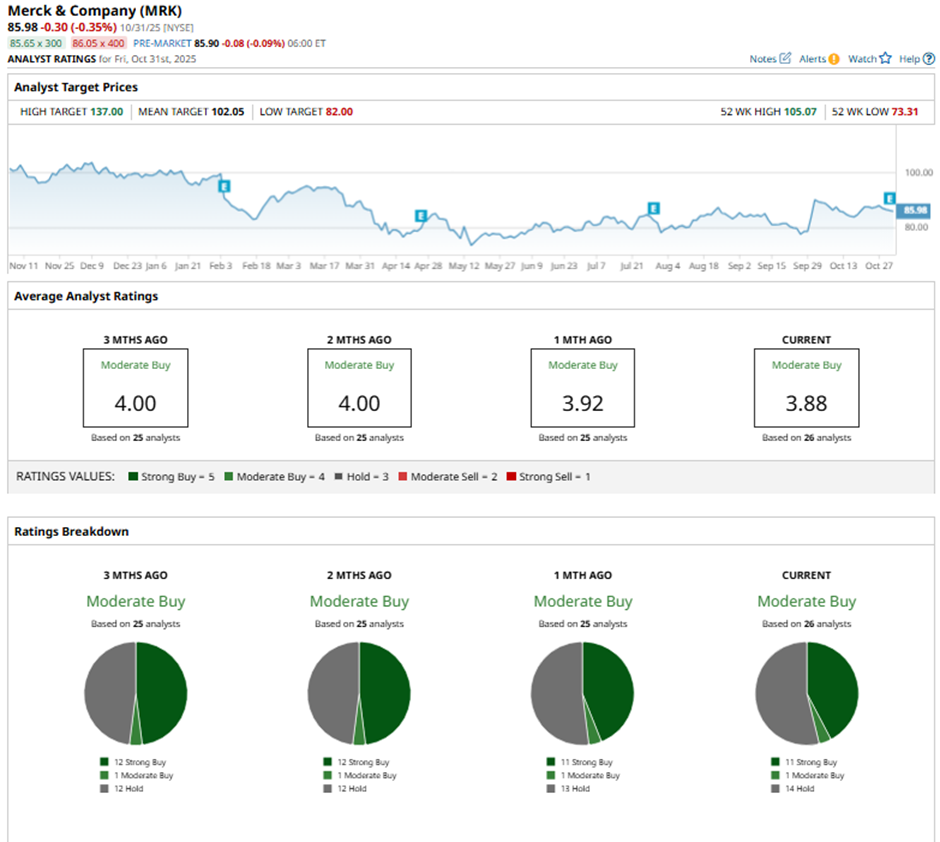

Among the 26 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” and 14 “Holds.”

This configuration is slightly less bullish than three months ago, with 12 “Strong Buy” ratings on the stock.

On Oct. 22, Bernstein analyst Courtney Breen maintained a Hold rating on Merck & Co. and set a price target of $95.

The mean price target of $102.05 represents an 18.7% premium to MRK’s current price levels. The Street-high price target of $137 suggests a 59.3% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart