Customer platform provider HubSpot (NYSE: HUBS) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 20.9% year on year to $809.5 million. Guidance for next quarter’s revenue was better than expected at $829 million at the midpoint, 0.5% above analysts’ estimates. Its non-GAAP profit of $2.66 per share was 2.9% above analysts’ consensus estimates.

Is now the time to buy HubSpot? Find out by accessing our full research report, it’s free for active Edge members.

HubSpot (HUBS) Q3 CY2025 Highlights:

- HubSpot adds Clara Shih, Meta’s head of business AI, to board of directors as worries mount about AI's impact on the business

- Revenue: $809.5 million vs analyst estimates of $785.7 million (20.9% year-on-year growth, 3% beat)

- Adjusted EPS: $2.66 vs analyst estimates of $2.59 (2.9% beat)

- Adjusted Operating Income: $161.5 million vs analyst estimates of $157.3 million (19.9% margin, 2.6% beat)

- Revenue Guidance for Q4 CY2025 is $829 million at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $9.61 at the midpoint, a 1.2% increase

- Operating Margin: 1.4%, up from -1.4% in the same quarter last year

- Free Cash Flow Margin: 18.2%, up from 15.3% in the previous quarter

- Customers: 278,880, up from 267,982 in the previous quarter

- Market Capitalization: $24.87 billion

“Q3 was another solid quarter of continued customer expansion and revenue growth,” said Yamini Rangan, Chief Executive Officer at HubSpot.

Company Overview

Born from the idea that traditional interruptive marketing was becoming less effective, HubSpot (NYSE: HUBS) provides an integrated platform that helps businesses attract, engage, and manage customer relationships through marketing, sales, service, and content management tools.

Revenue Growth

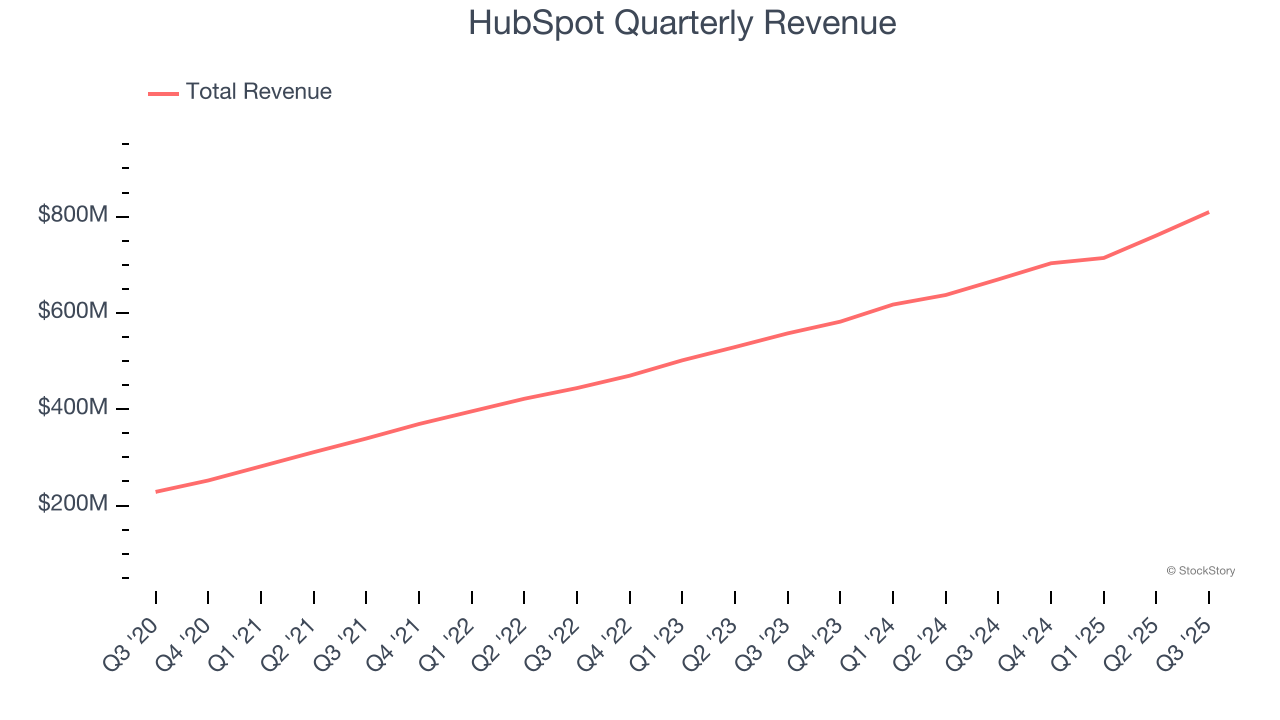

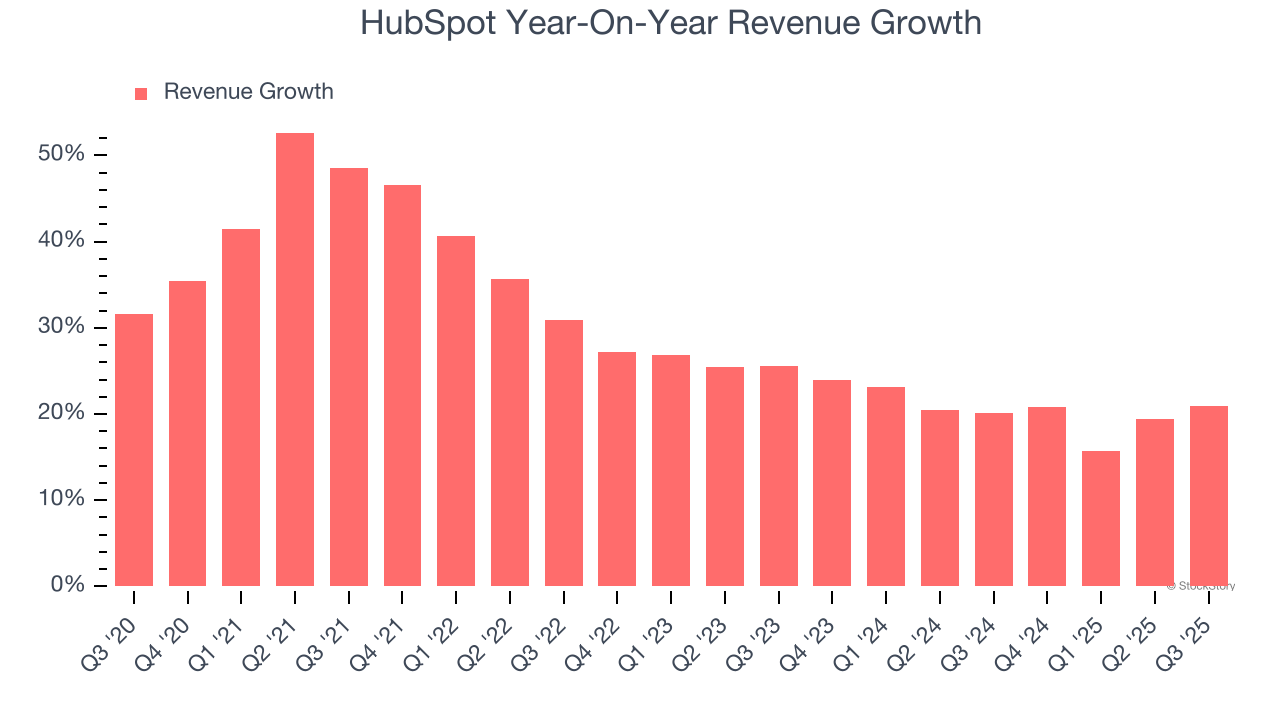

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, HubSpot grew its sales at an impressive 29.6% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. HubSpot’s annualized revenue growth of 20.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, HubSpot reported robust year-on-year revenue growth of 20.9%, and its $809.5 million of revenue topped Wall Street estimates by 3%. Company management is currently guiding for a 17.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and suggests the market sees some success for its newer products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

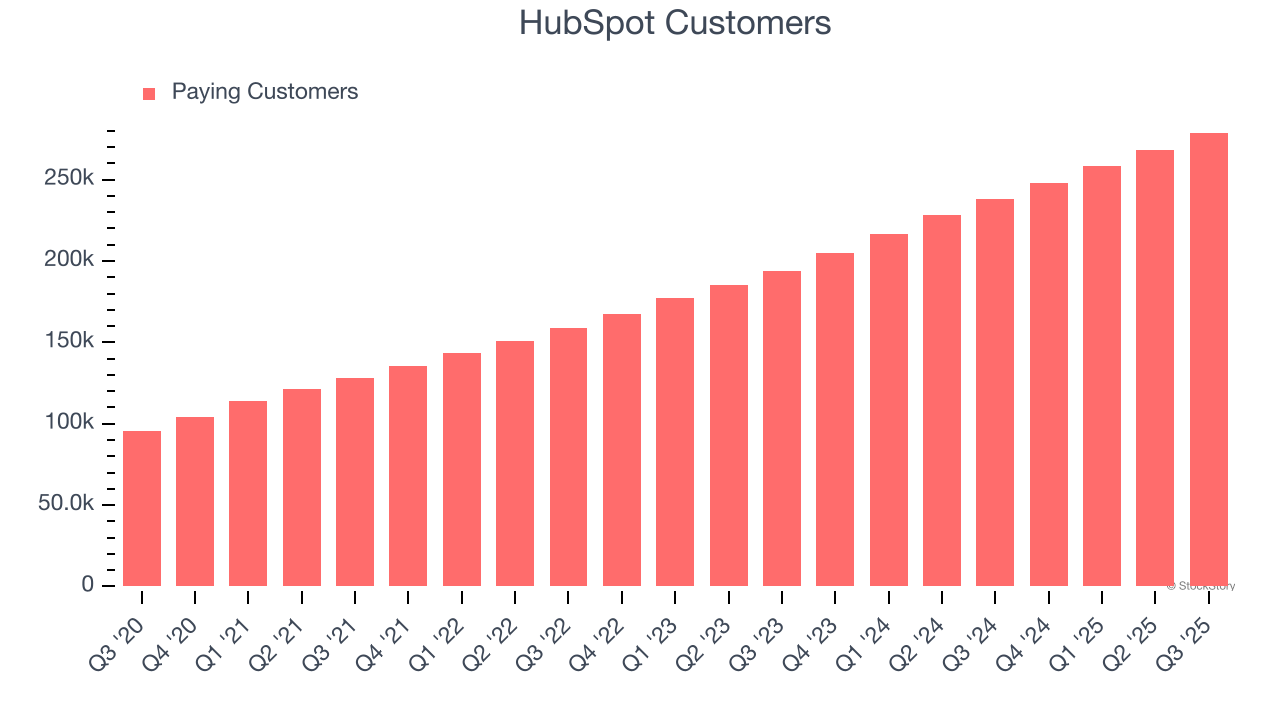

Customer Base

HubSpot reported 278,880 customers at the end of the quarter, a sequential increase of 10,898. That’s a little better than last quarter and a fair bit above the typical growth we’ve seen over the previous year. Shareholders should take this as an indication that HubSpot’s go-to-market strategy is working well.

Key Takeaways from HubSpot’s Q3 Results

It was good to see HubSpot provide full-year EPS guidance that slightly beat analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. Additionally, HubSpot added Clara Shih, Meta’s head of business AI, to the board of directors as worries mount about AI's impact on the business. Overall, this print had some key positives, but it wasn't enough. The market seemed to be hoping for more, and the stock traded down 12.3% to $406.98 immediately after reporting.

So do we think HubSpot is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.