Oklo (OKLO) has emerged as the market’s newest sensation, and rightly so. The nuclear energy disruptor has caught the eye of Wall Street’s sharpest minds, with Wedbush reaffirming its bullish “Outperform” rating after the company’s third-quarter fiscal 2025 earnings results.

The endorsement arrived even as the company reported a larger-than-expected quarterly loss and remained without commercial revenue. However, Wedbush’s faith stems from Oklo’s enviable positioning at the intersection of two seismic forces reshaping the global economy: artificial intelligence (AI) and the resurgence of nuclear power.

With the world’s data centers expanding at record speed, hungry for energy that is both abundant and reliable, computing capacity is forecast to grow tenfold by 2030. In response, Oklo is making tangible progress to meet that demand.

The company's expansion is being further fueled by regulatory tailwinds. For example, the Department of Energy has approved the construction and operation of a nuclear facility, opening the door for Oklo's future operations under the supervision of the Nuclear Regulatory Commission and marking a contemporary route for quick deployment.

To truly grasp the magnitude of what this means for Oklo’s journey and its standing among market peers, let's dig deeper to understand the stance on OKLO stock.

About Oklo Stock

Based in Santa Clara, California, Oklo develops advanced fission power plants to provide clean, reliable, and affordable energy at scale. With a market capitalization of roughly $15 billion, the company also commercializes nuclear fuel recycling technology that converts nuclear waste into usable fuel for its reactors.

Over the past 52 weeks, OKLO shares have surged 308%, reflecting extraordinary investor enthusiasm. In the last six months, the stock has climbed 164%, and over the most recent three months, OKLO has risen 32%. In sharp contrast, the First Trust Bloomberg Nuclear Power ETF (RCTR) has advanced only 8% over the same three-month period.

This contrast demonstrates how Oklo has surpassed the larger nuclear business by a significant margin, highlighting its rising dominance and the market's belief that the firm is setting the pace for innovation and growth across the industry.

Additionally, OKLO stock hit a 52-week high of $193.84 on Oct. 15. Overall, investors seem confident about the company’s growing presence in the energy and AI businesses.

A Closer Look at Oklo’s Q3 Earnings

On Nov 11, Oklo unveiled its fiscal 2025 third-quarter results, wherein the company’s net loss widened 198% year-over-year (YOY) to $29.7 million. That figure topped Wall Street’s expected $18.2 million loss, as Oklo poured capital into scaling its next-generation fission technology. Per-share also losses rose 150% from the prior-year quarter to $0.20, missing the $0.13 consensus estimate and widening from last year’s $0.08.

Operating expenses rose 196% YOY to $36.3 million. The increase came from higher payroll expenses, capital market activity fees, and $9.1 million in non-cash stock compensation.

Despite being pre-revenue, Oklo closed the quarter with $931.8 million in current assets, bolstered by a $540 million capital raise through an at-the-market offering. The company now has the liquidity to push its projects forward without financial strain.

Oklo made important operational strides during the quarter as well. The company was selected for three projects under the U.S. Department of Energy’s Reactor Pilot Program. The program allows companies to begin construction while licensing continues, which can significantly shorten project timelines.

Oklo also broke ground on its first Aurora powerhouse at the Idaho National Laboratory. The firm secured approval for its Nuclear Safety Design Agreement within two weeks, which marked a major regulatory achievement. Oklo plans to deploy its first commercial Aurora plant by 2027. The company announced up to $1.68 billion in planned investments for an Advanced Fuel Center in Tennessee as well, which could create more than 800 jobs.

The firm remains committed to the long term despite its quarterly financial loss. Analysts expect Oklo's Q4 fiscal 2025 loss per share to widen 67% YOY to $0.15 but project its full-year loss to narrow 22% to $0.58, reflecting steady long-term growth.

What Do Analysts Expect for Oklo Stock?

Wedbush Securities analyst Daniel Ives remains upbeat on Oklo, maintaining an “Outperform” rating and a $150 price target. B. Riley analyst Ryan Pfingst has also doubled down on shares, raising his price target to $129 from $58, citing Oklo’s smoother path to licensing with the Nuclear Regulatory Commission under the Department of Energy’s updated authorization framework.

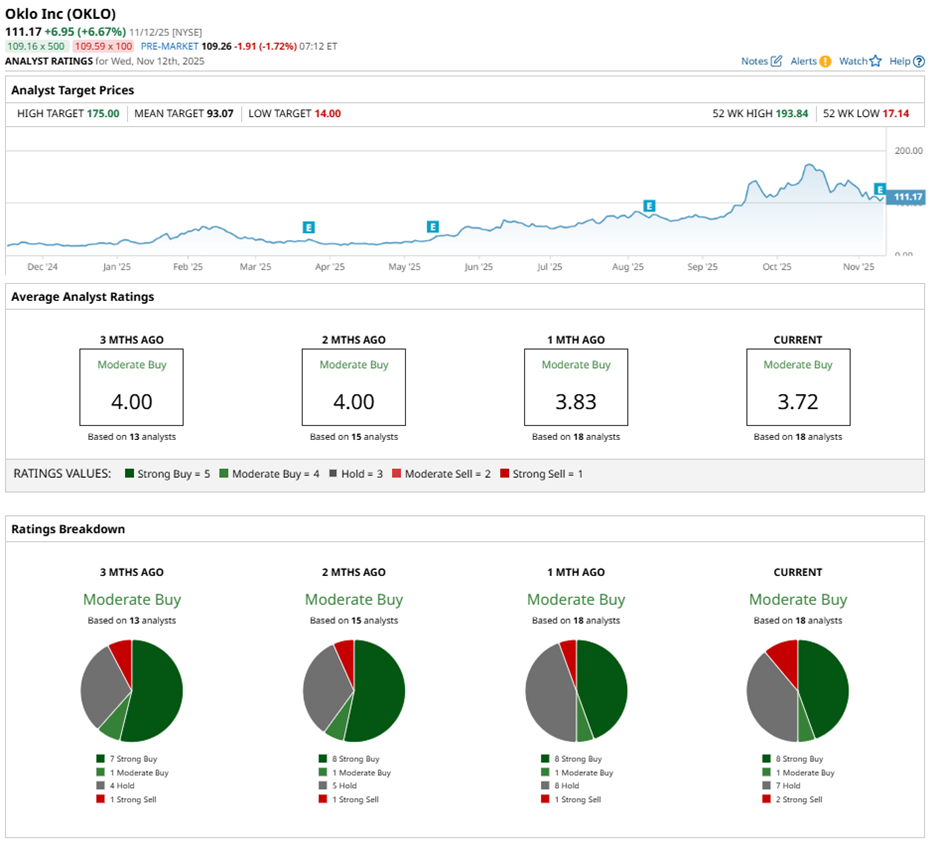

Analyst sentiment remains firmly positive with an overall “Moderate Buy” consensus rating. Among 18 analysts tracking the stock, eight rate it a “Strong Buy,” one calls it a “Moderate Buy,” seven suggest a “Hold,” and two advise a “Strong Sell" rating.

OKLO stock is trading just below its average price target of $99.64. Meanwhile, the Street-high target of $175 represents potential gain of 79% from current price levels. Analysts are showing firm confidence that Oklo’s momentum rests on solid fundamentals rather than fleeting market hype.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Says Investors Should Measure Their Investing Success On ‘Slugging Percentage, Not Batting Average’

- Oklo Is ‘Setting the Stage’ for a Revolution in Nuclear Energy. Should You Buy OKLO Stock Here?

- This Semiconductor Stock Just Got a New Street-High Price Target. Should You Buy It Now?

- Nasdaq Year-End Playbook Decode 5-Year Correlations and Seasonal Q4