With a market cap of $13.6 billion, Jack Henry & Associates, Inc. (JKHY) is a financial technology company that connects people and financial institutions through technology solutions and payment processing services. It operates through four segments: Core, Payments, Complementary, and Corporate and Other, offering platforms and services ranging from core banking systems and digital/mobile banking to payment processing, risk management, and hardware solutions.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Jack Henry & Associates fits this criterion perfectly. The company provides a range of products including SilverLake, Symitar, CIF 20/20, Core Director, and the Banno Digital Platform.

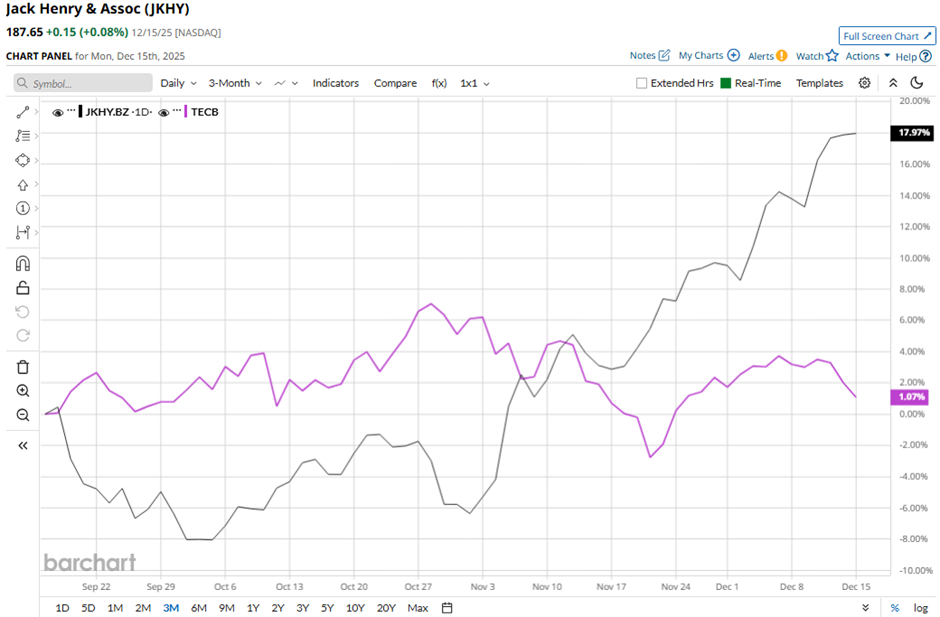

Shares of the Monett, Missouri-based company have dipped 4.3% from its 52-week high of $196. Over the past three months, JKHY stock has increased 18.4%, outpacing the iShares U.S. Tech Breakthrough Multisector ETF's (TECB) 1.1% rise during the same period.

In the longer term, shares of the payment processing company have risen 7.1% on a YTD basis, underperforming TECB’s 13.8% return. Moreover, JKHY stock has gained 4.4% over the past 52 weeks, compared to TECB’s 9.4% rise over the same time frame.

Yet, the stock has been trading above its 50-day moving average since November.

Shares of JKHY jumped 4.9% following its Q1 2026 results on Nov. 4, reporting EPS of $1.97, which beat analyst estimates. Investors reacted positively to revenue of $644.7 million, up 7.3% year-over-year, alongside a 21% increase in net income to $144 million. Sentiment was further boosted by the company raising its fiscal 2026 guidance, projecting revenue of $2.49 billion - $2.51 billion and EPS of $6.38 - $6.49, above its prior outlook.

In comparison, rival Accenture plc (ACN) has lagged behind JKHY stock. ACN stock has declined 21.9% on a YTD basis and 23.4% over the past 52 weeks.

Despite the stock’s outperformance relative to its peers, analysts are cautiously optimistic about its prospects. JKHY stock has a consensus rating of “Moderate Buy” from the 17 analysts covering the stock, and as of writing, it is trading above the mean price target of $181.62.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart