With a market cap of $9.6 billion, A. O. Smith Corporation (AOS) is a global manufacturer and marketer of residential and commercial water heating, boiler, heat pump, tank, and water treatment products, serving customers across North America, China, Europe, and India. Its diverse product portfolio supports a wide range of applications, including homes, restaurants, hotels, hospitals, schools, and other commercial and industrial facilities.

Companies valued less than $10 billion are generally classified as “mid-cap” stocks, and A. O. Smith fits this criterion perfectly. The company sells its products under well-known brands such as A. O. Smith, State, Lochinvar, and Aquasana through wholesale, retail, and e-commerce channels.

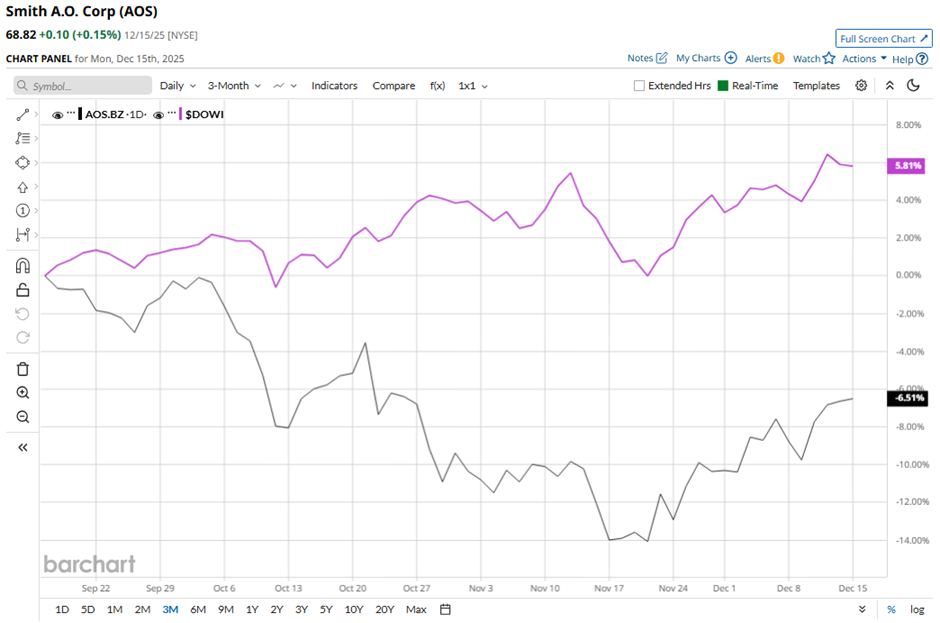

Shares of the Milwaukee, Wisconsin-based company have declined nearly 11% from its 52-week high of $77.31. Over the past three months, its shares have decreased 6.1%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 5.5% rise during the same period.

Longer term, AOS stock is up marginally on a YTD basis, lagging behind DOWI's 13.8% gain. Moreover, shares of the maker of water heaters and boilers have dipped 5.1% over the past 52 weeks, compared to DOWI’s 10.5% increase over the same time frame.

Despite recent fluctuations, the stock has fallen below its 50-day moving average since October.

Despite beating expectations with Q3 2025 EPS of $0.94 and revenue of $942.5 million, A. O. Smith shares fell 2.6% on Oct. 28 because the company lowered its full-year 2025 outlook. Management cut its sales guidance to flat to up 1% and narrowed EPS guidance to $3.70 - $3.85, citing continued economic weakness in China, where sales declined 12% in local currency, and softening new home construction in North America.

In comparison, rival GE Vernova Inc. (GEV) has outperformed AOS stock. GEV stock has surged 107.1% YTD and 105.2% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic about its prospects. AOS stock has a consensus rating of “Moderate Buy” from 13 analysts in coverage, and the mean price target of $78.50 is a premium of 14.1% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart