Oklahoma City-based Expand Energy Corporation (EXE) operates as an independent natural gas production company in the United States. With a market cap of $26.3 billion, the company engages in acquisition, exploration, and development of properties to produce oil, natural gas, and natural gas liquids.

Companies worth $10 billion or more are generally described as "large-cap stocks." EXE fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the energy sector.

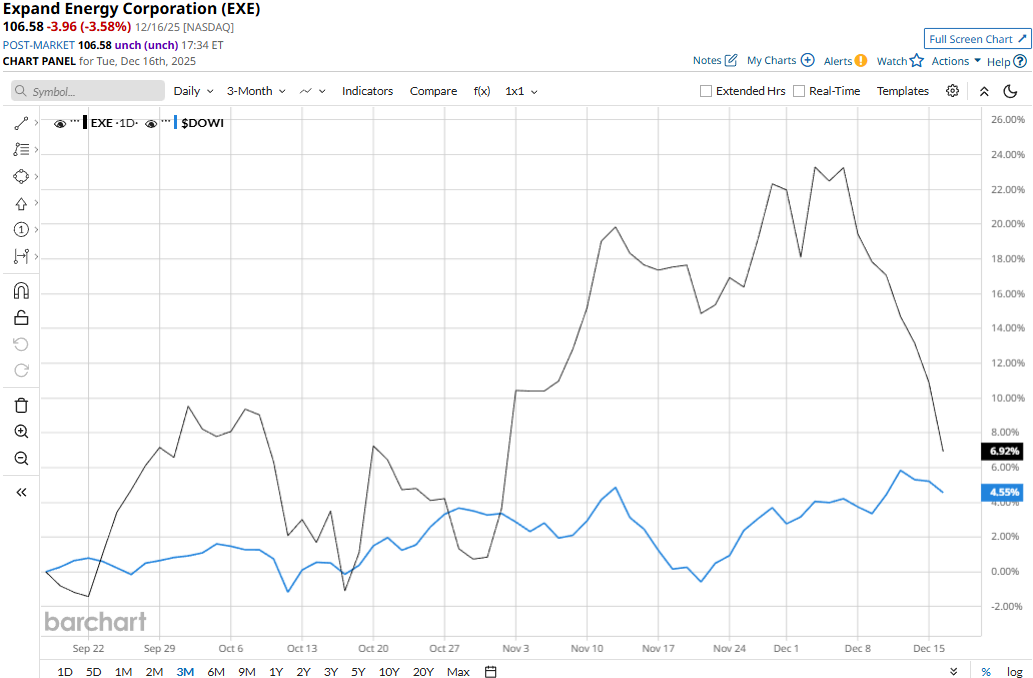

Expand Energy touched its all-time high of $126.62 on Dec. 5 and is currently trading 15.8% below that peak. Meanwhile, EXE stock prices have soared 9.3% over the past three months, outpacing the Dow Jones Industrial Average’s ($DOWI) 5.2% uptick during the same time frame.

Over the longer term, EXE stock has gained 7.1% on a YTD basis and 10.2% over the past 52 weeks, lagging behind the Dow’s 13.1% surge in 2025, but outpacing the index’s 10.1% returns over the past year by a small margin.

EXE has traded mostly above its 200-day moving average since early November and its 50-day moving average since late September, underscoring its recent uptick.

Expand Energy’s stock prices observed a marginal dip in the trading session following the release of its Q3 results on Oct. 28. The company observed a massive surge in oil, natural gas, and natural gas liquids sales, along with a notable growth in marketing revenues and a high contribution from derivatives. Overall, the company’s topline grew from $648 million in the year-ago quarter to approximately $3 billion. Meanwhile, its adjusted EPS skyrocketed 506.3% year-over-year to $0.97, beating the consensus estimates by 10.2%.

Further, when compared to its peer, EXE has notably outperformed EOG Resources, Inc.’s (EOG) 17% decline on a YTD basis and 18.3% plunge over the past 52 weeks.

Among the 28 analysts covering the EXE stock, the consensus rating is a “Strong Buy.” As of writing, EXE’s mean price target of $134.19 suggests a 25.9% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This High-Yield Dividend Stock Trades at a Third of Its Record Highs: Is It a Buy for 2026?

- Elon Musk Warns He Wants to ‘Slow Down AI and Robotics’ But Says It’s Impossible and ‘Advancing at a Very Rapid Pace’

- Buy the Dip, or Panic Sell? What This Powerful Chart Indicator is Telling Us About the Stock Market Now.

- Should You Buy the Dip in Alibaba Stock?