With a market cap of $156.6 billion, Analog Devices, Inc. (ADI) is a global semiconductor company that designs, manufactures, and markets integrated circuits, software, and subsystems used to convert, manage, and process real-world signals. Its products serve a wide range of industries including industrial, automotive, communications, aerospace, defense, and healthcare across markets worldwide.

Shares of the Wilmington, Massachusetts-based company have surpassed the broader market over the past 52 weeks. ADI stock has surged 54.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14%. Moreover, shares of Analog Devices are up 18.2% on a YTD basis, compared to SPX's 1.3% gain.

In addition, shares of the semiconductor maker has also outpaced the State Street Technology Select Sector SPDR ETF's (XLK) 20.2% return over the past 52 weeks.

Shares of Analog Devices climbed 5.3% on Nov. 25, 2025, after the company reported strong Q4 2025 results, with adjusted EPS of $2.26 and revenue of $3.08 billion, both exceeding expectations. The rally was further driven by an upbeat Q1 2026 outlook, with the company forecasting revenue of $3.1 billion (±$100 million) and adjusted EPS of $2.29, both above Wall Street estimates. Investors were also encouraged by signs of a broad recovery, including 34% year-over-year growth in the industrial segment to $1.43 billion and stronger-than-expected communications revenue of $389.8 million.

For the fiscal year ending in October 2026, analysts expect ADI's adjusted EPS to increase nearly 28% year-over-year to $9.97. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

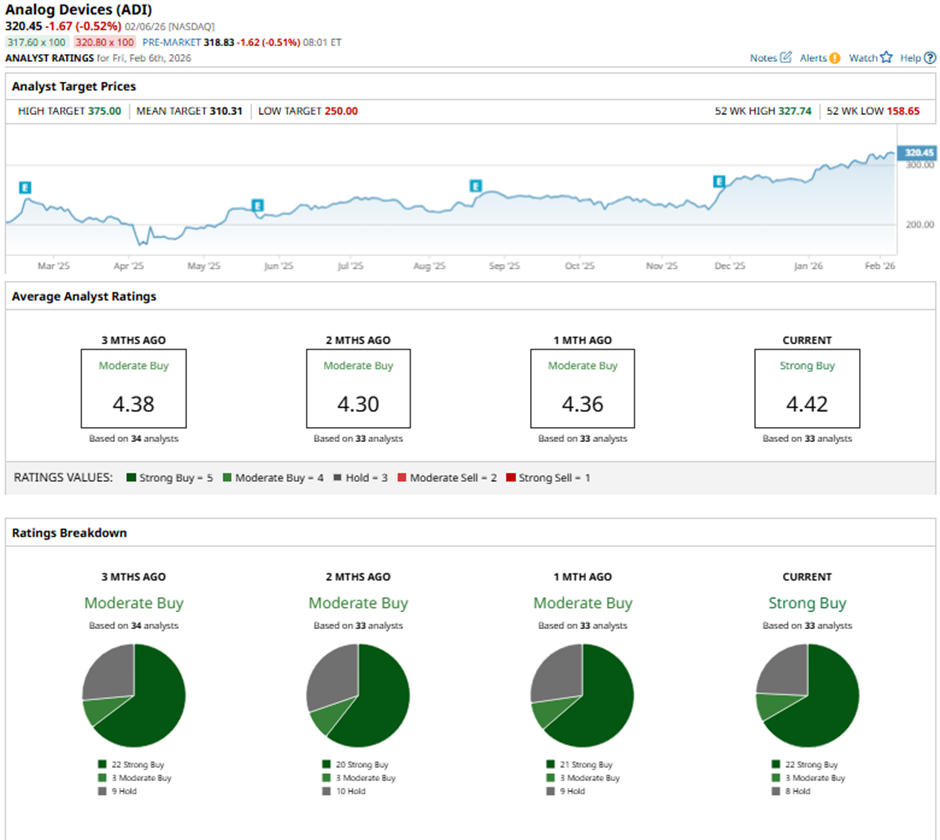

Among the 33 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 22 “Strong Buy” ratings, three “Moderate Buys,” and eight “Holds.”

On Jan. 16, Morgan Stanley analyst Joseph Moore raised Analog Devices’ price target to $314 and maintained an “Overweight” rating.

As of writing, the stock is trading above the mean price target of $310.31. The Street-high price target of $375 implies a potential upside of 17% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart