OREM, Utah, Nov. 13, 2024 (GLOBE NEWSWIRE) -- Complete Solaria, Inc. d/b/a Complete Solar (“Complete Solar” or the “Company”) (Nasdaq: CSLR), a solar technology, services, and installation company, today will present its Q3’24 results via webcast at 5:00 p.m. EST. Interested parties may access the webcast by registering here or by visiting the Events page within the IR section of the company website: investors.completesolar.com/news-events/events.

Q3’24 actuals and Q4’24 forecasts (based on non-GAAP results unless noted) are as follows:

- Complete Solar completed the successful acquisition of SunPower’s assets in the New Homes, Blue Raven, Dealer businesses, and rights to the SunPower brand

- The Company also won a Delaware Bankruptcy Court ruling giving it rights to the SunPower brand in the U.S.

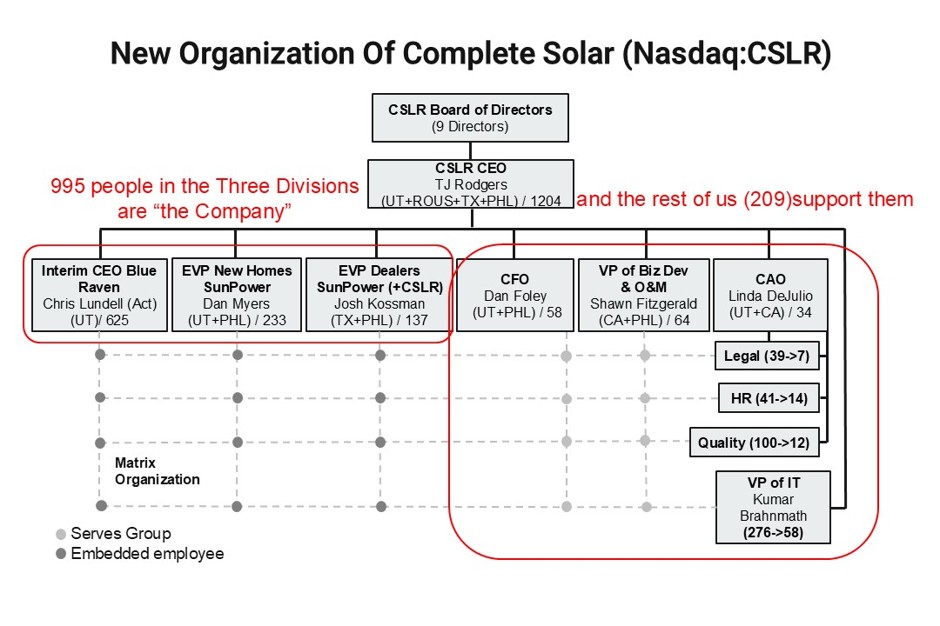

- 1204 SunPower employees have been hired by Complete Solar, which had only 65 employees to form “NewCo”

- In Q3 the Company raised $80 million through convertible debt offerings to provide capital for the $45 million SunPower asset acquisition and working capital, the last $14 million of which will transfer in early December 2024 from a Chinese investor.

Fellow Shareholders:

The revenue, earnings and cashflow for pre-merger Complete Solar Q3’24 are given below, compared with the Q2’24 & Q1’24 prior quarter actual results. This is the last 10Q filing (here) for the “old Complete Solar.”

| ($1000s, except gross margin) | GAAP | Non-GAAP1 | |||||||||||||||

| Q3 2024 | Q2 2024 | Q1 2024 | Q3 2024 | Q2 2024 | Q1 2024 | ||||||||||||

| Revenue | 5,536 | 4,492 | 10,040 | 5,536 | 4,492 | 10,040 | |||||||||||

| Gross Margin | -57 | % | -20 | % | 23 | % | 2 | % | -20 | % | 24 | % | |||||

| Operating Income | (29,768 | ) | (9,494 | ) | (7,544 | ) | (6,546 | ) | (6,624 | ) | (6,179 | ) | |||||

| Cash Balance | 79,502 | 1,839 | 1,786 | 79,502 | 1,839 | 1,889 | |||||||||||

| 1. GAAP/non-GAAP reconciliation attached. | |||||||||||||||||

Acquiring SunPower Assets

In early September ’24 Complete Solar was presented with an opportunity to hire SunPower employees and acquire SPWR assets that would scale Complete Solar and its value at a rate unachievable just weeks before. We needed to raise money ($80 million), to get approval from the SunPower board for our so-called stalking-horse chapter 11 plan in which our small company would acquire over 1,000 employees from solar icon SunPower Corporation that in effect was an IPO for the three divisions acquired from SunPower. The U.S. Bankruptcy Court in Delaware approved our plan, and we began the integration.

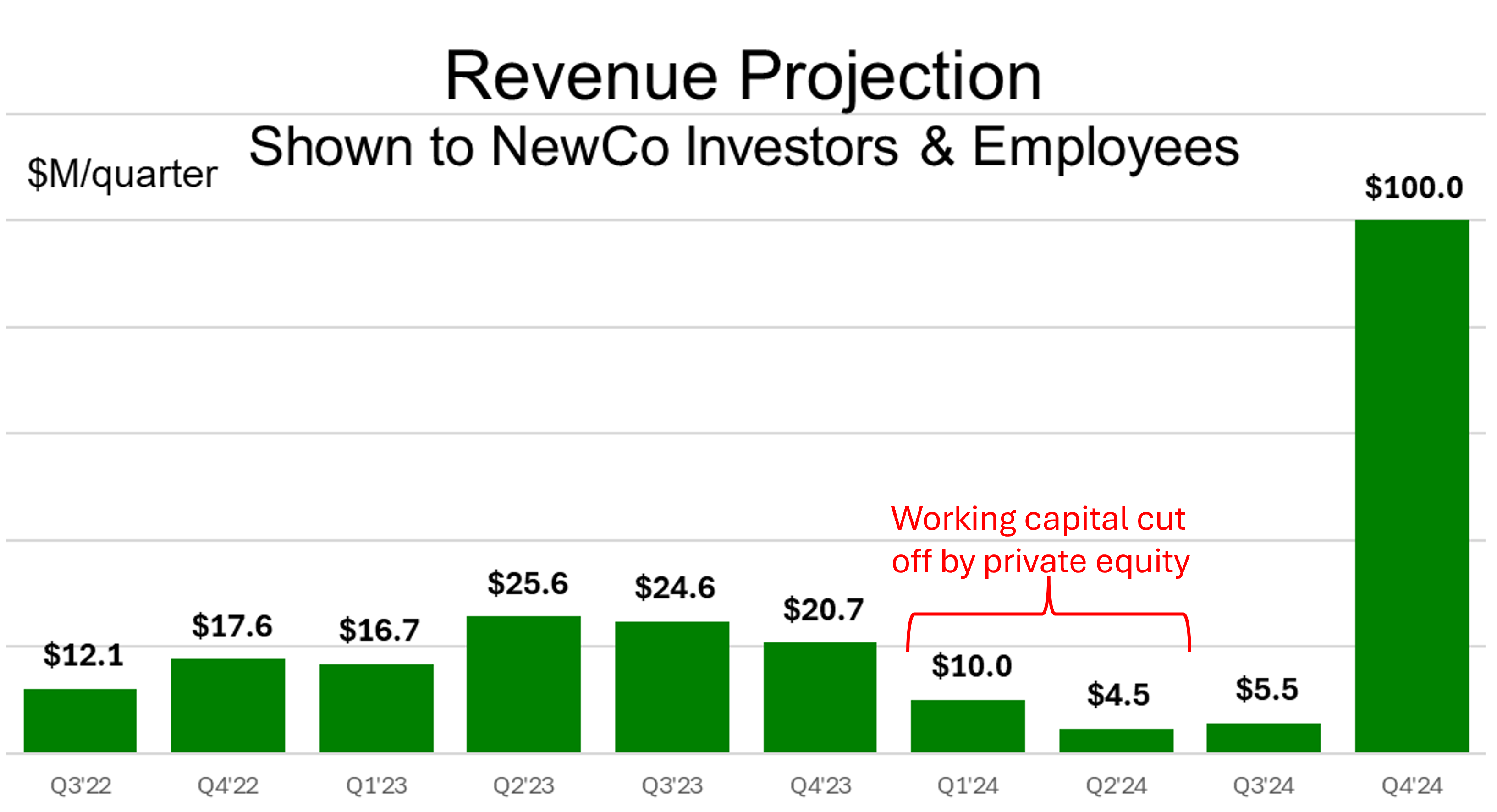

The first five-quarter plan (Q4’24-Q4’25) presented to investors in the $80 million funding presentation called for $100 million in revenue in Q4’24 for the combined company with a sustainable operating income loss of $1.0 million, followed in Q2’25 by its first profitable quarter ($0.4 million).

“NewCo” (Complete Solar Plus “Old SunPower” Plus its Blue Raven Solar Subsidiary)

The combined team worked throughout October and early November to reorganize into a new start-up like organization designed to be lean enough to achieve breakeven with $100 million in revenue. That organization is shown below as deployed in order of size in Utah, Rest of US, Texas and the Philippines. Certain administrative functions were centralized to provide great savings in headcount, also shown below:

Complete Solar Announces Preliminary Q3’24 Results

Our companies were not combined until October 1, 2024, so there are no GAAP and non-GAAP results to report for the combined business for Q3’24, but the following chart shows preliminary and unaudited Q3’24 results based on a simple summing of the separate results shown on November 6 to employees and investors.

| Operating Income | ||||||||||

| Division | Charter | Revenue | Prior Report by Division | |||||||

| New Homes | Sales to homebuilders | $53.2 | N/A | ($11.9) | ||||||

| Blue Raven Solar | Sales direct to customer | $43.5 | N/A | ($6.9) | ||||||

| Dealer (+ CSLR) | Sales of jobs from dealers | $ 20.61 | N/A | ($21.3) | ||||||

| $117.34 | ($73.8)2 | ($40.0)3 | ||||||||

1. Contains $5.5M in revenue from the “old CSLR” and $15.1M in revenue from the old SunPower “Dealer” Division now combined as NewCo’s “Dealer” Division. 2. Contains write-offs due to the bankruptcy & acquisition. 3. High costs due to running the pre-layoff employment levels of both companies during the quarter. 4. High revenue due to accumulated backlog at SunPower when it was shut down in Q1’24 and Q2’24.

- Combined revenue in Q3’24 for NewCo was $117.3 million. On a standalone basis, Complete Solar’s Q3’24 revenue was $5.5 million of the $20.6 reported for “Dealer”

- Revenue for Q4’24 is now expected to be $80 million, lower sequentially due to benefits accumulated backlog in Q3 that will not carry over to Q4’24

- The operating income loss is now expected to drop from ($40.0M) in Q3’24 to $2-11 million in Q4’24 due to the significant headcount reduction

Complete Solar CEO, T.J. Rodgers said, “On Wednesday, November 6, 2024 at our Orem, Utah HQ, we presented to over 1,000 employees the details of our Rev. 5 Annual Operating Plan for cutting headcount and other costs to achieve breakeven operating income in 2025.

Rodgers continued, “Our Q3’24 results of $117 million in combined revenue overstates our current revenue rate due to the pileup of SunPower backlog in Q1 & Q2’24. Our current belief is that our revenue will be $80 million in Q4’24, as calculated by extrapolating shipments to known customers from orders in mid-process in our factory.

Rodgers concluded, “Our Q3’24 opex of $43.5 million will shrink to $17.0 million in Q4’24 due to actions already implemented with more to follow in each quarter of 2025.”

About Complete Solar

With its recent acquisition of SunPower assets, Complete Solar has become a leading residential solar services provider in North America. Complete Solar’s digital platform and installation services support energy needs for customers wishing to make the transition to a more energy-efficient lifestyle. For more information visit www.completesolar.com.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America ("GAAP"), Complete Solar provides an additional financial metrics that is not prepared in accordance with GAAP ("non-GAAP"). Management uses non-GAAP financial measures, in addition to GAAP financial measures, as a measure of operating performance because the non-GAAP financial measure does not include the impact of items that management does not consider indicative of Complete Solar’s operating performance, such as amortization of goodwill and expensing employee stock options in addition to accounting for their dilutive effect. The non-GAAP financial measures do not replace the presentation of Complete Solar’s GAAP financial results and should only be used as a supplement to, not as a substitute for, Complete Solar’s financial results presented in accordance with GAAP.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in this press release include, without limitation, our expectations regarding our Q4 ’24 and fiscal 2025 financial performance, including with respect to our Q4 ’24 combined revenues and profit before tax loss, expectations and plans relating to further headcount reduction, cost control efforts, and our expectations with respect to when we achieve breakeven operating income and positive operating income. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our ability to implement further headcount reductions and cost controls, our ability to integrate and operate the combined business with the SunPower assets, our ability to achieve the anticipated benefits of the SunPower acquisition, global market conditions, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K filed with the SEC on April 1, 2024, our quarterly reports on Form 10-Q filed with the SEC and other documents that we have filed with, or will file with, the SEC. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this press release speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Complete Solar assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

| Company Contacts: | |

| Dan Foley | Sioban Hickie |

| CFO | Investor Relations |

| dfoley@completesolar.com | InvestorRelations@completesolar.com |

| (801) 477-5847 |

| Complete Solaria, Inc. | |||||||||||||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (PRELIMINARY) | |||||||||||||||||

| (In Thousands) | |||||||||||||||||

| COMPLETE SOLARIA, INC. - REPORTED | CSLR + ACQUIRED ASSETS1 | ||||||||||||||||

| 13 weeks ended | 13 weeks ended | 13 weeks ended | 13 weeks ended | 13 weeks ended1 | |||||||||||||

| Note | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 29, 2024 | September 29, 20241 | ||||||||||||

| GAAP operating loss from continuing operations | (16,055 | ) | (7,544 | ) | (9,494 | ) | (29,768 | ) | (73,764 | ) | |||||||

| Depreciation and amortization | A | - | 321 | - | - | 3,686 | |||||||||||

| Stock based compensation | B | 901 | 638 | 1,965 | 5,406 | 5,579 | |||||||||||

| Restructuring charges | C | 2,971 | 406 | 905 | 17,816 | 23,037 | |||||||||||

| Total of Non-GAAP adjustments | 3,872 | 1,365 | 2,870 | 23,222 | 32,302 | ||||||||||||

| Non-GAAP net loss | (12,183 | ) | (6,179 | ) | (6,624 | ) | (6,546 | ) | (41,462 | ) | |||||||

| Notes: | |||||||||||||||||

| (1) | Complete Solaria acquired SunPower assets (as described in the asset purchase agreement) on October 1, 2024. GAAP and Non-GAAP figures in this column reflect unaudited results as if Complete Solaria owned these assets as of July 1, 2024. | ||||||||||||||||

| (A) | Depreciation and amortization: Depreciation and amortization related to capital expenditures. | ||||||||||||||||

| (B) | Stock-based compensation: Stock-based compensation relates to our equity incentive awards and for services paid in warrants. Stock-based compensation is a non-cash expense. | ||||||||||||||||

| (C) | Restructuring charges: Costs primarily related to acquisition, headcount reductions, severance and other non-recurring charges. | ||||||||||||||||

Source: Complete Solar, Inc.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/69f8526f-2992-4a95-8d35-2c44e198d9e8

https://www.globenewswire.com/NewsRoom/AttachmentNg/7f16f41b-cd7e-428a-bbd3-d29f935d74cc