Artisan Partners trades at $43.40 and has moved in lockstep with the market. Its shares have returned 21.6% over the last six months while the S&P 500 has gained 22.9%.

Is now the time to buy Artisan Partners, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Artisan Partners Not Exciting?

We don't have much confidence in Artisan Partners. Here are two reasons we avoid APAM and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

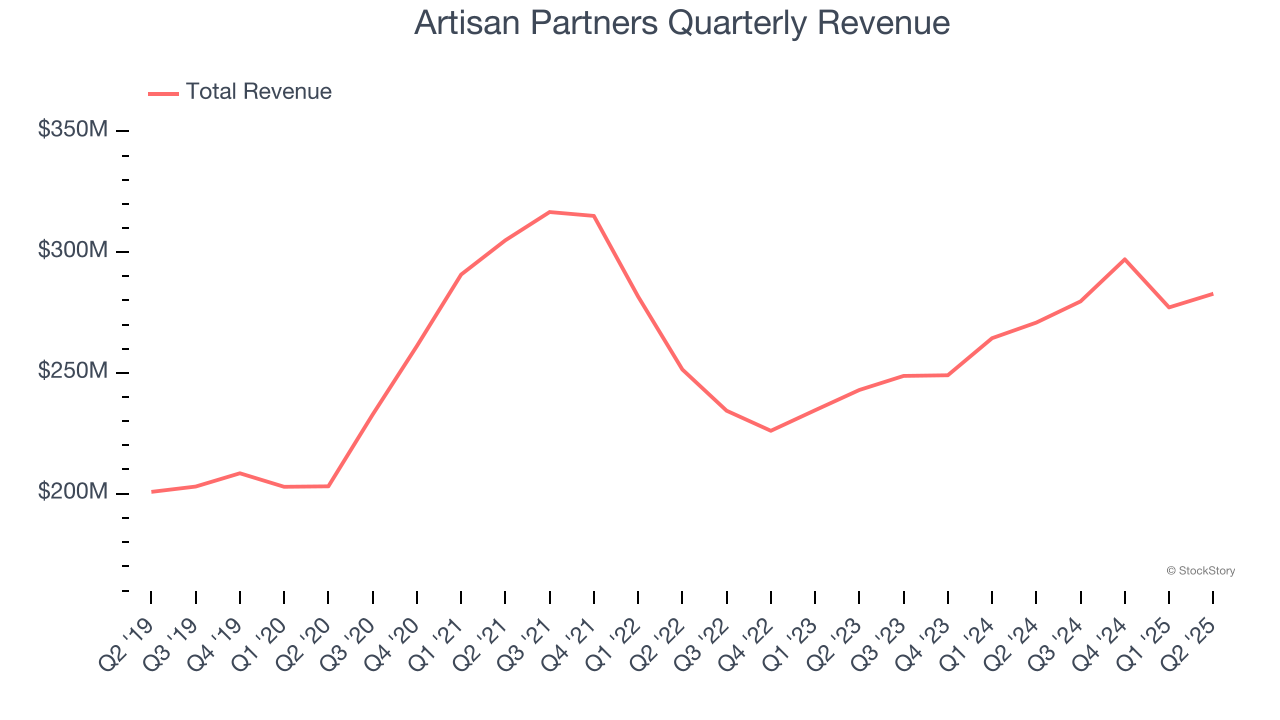

Over the last five years, Artisan Partners grew its revenue at a mediocre 6.8% compounded annual growth rate. This fell short of our benchmark for the financials sector.

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

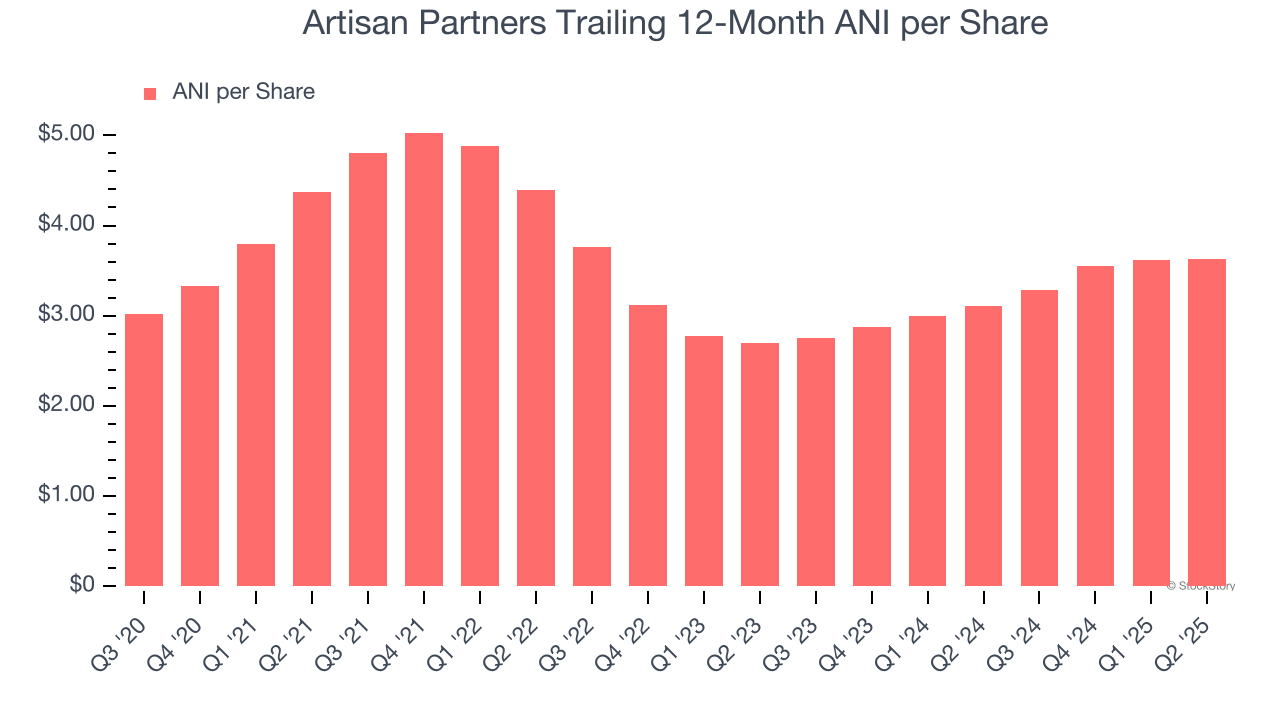

Artisan Partners’s unimpressive 5% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Final Judgment

Artisan Partners’s business quality ultimately falls short of our standards. That said, the stock currently trades at 11.1× forward P/E (or $43.40 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d suggest looking at the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.