Live events and entertainment company Live Nation (NYSE: LYV) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 11% year on year to $3.38 billion. Its GAAP loss of $0.32 per share was 17.7% above analysts’ consensus estimates.

Is now the time to buy Live Nation? Find out by accessing our full research report, it’s free.

Live Nation (LYV) Q1 CY2025 Highlights:

- Revenue: $3.38 billion vs analyst estimates of $3.48 billion (11% year-on-year decline, 2.8% miss)

- EPS (GAAP): -$0.32 vs analyst estimates of -$0.39 (17.7% beat)

- Operating Margin: 3.4%, up from -1.1% in the same quarter last year

- Free Cash Flow Margin: 7.8%, up from 1.9% in the same quarter last year

- Market Capitalization: $30.7 billion

Company Overview

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

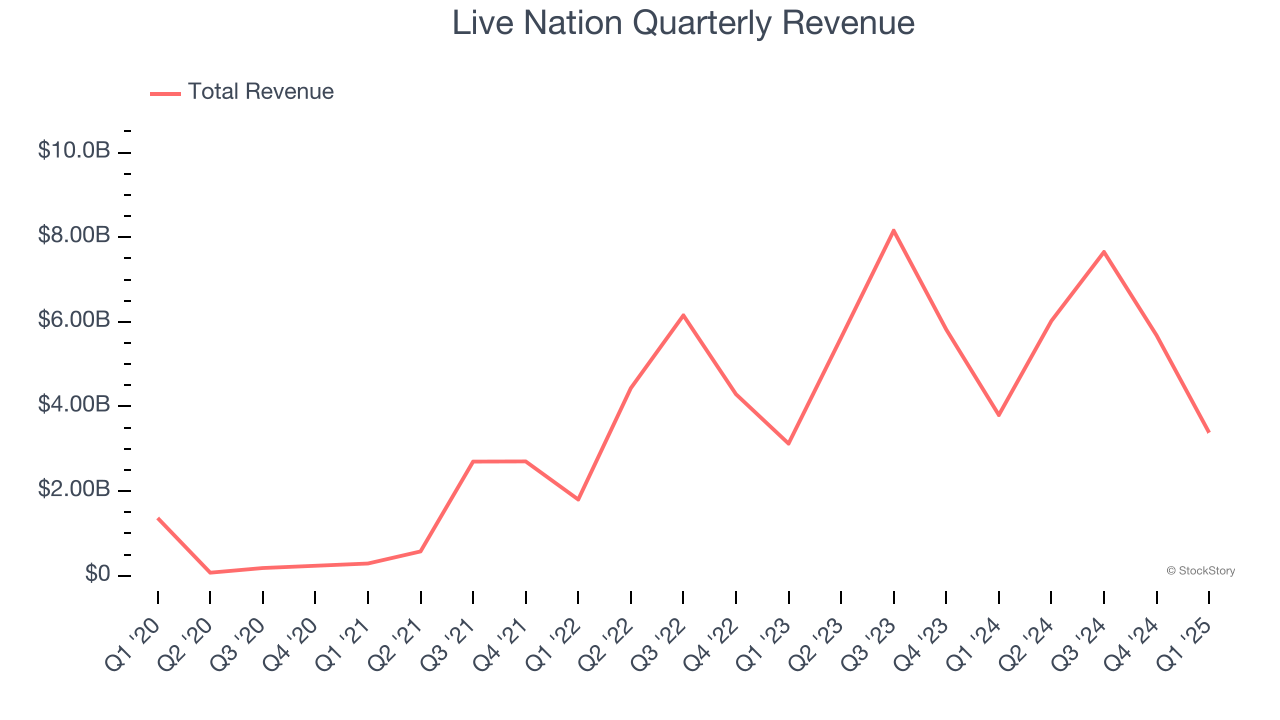

Sales Growth

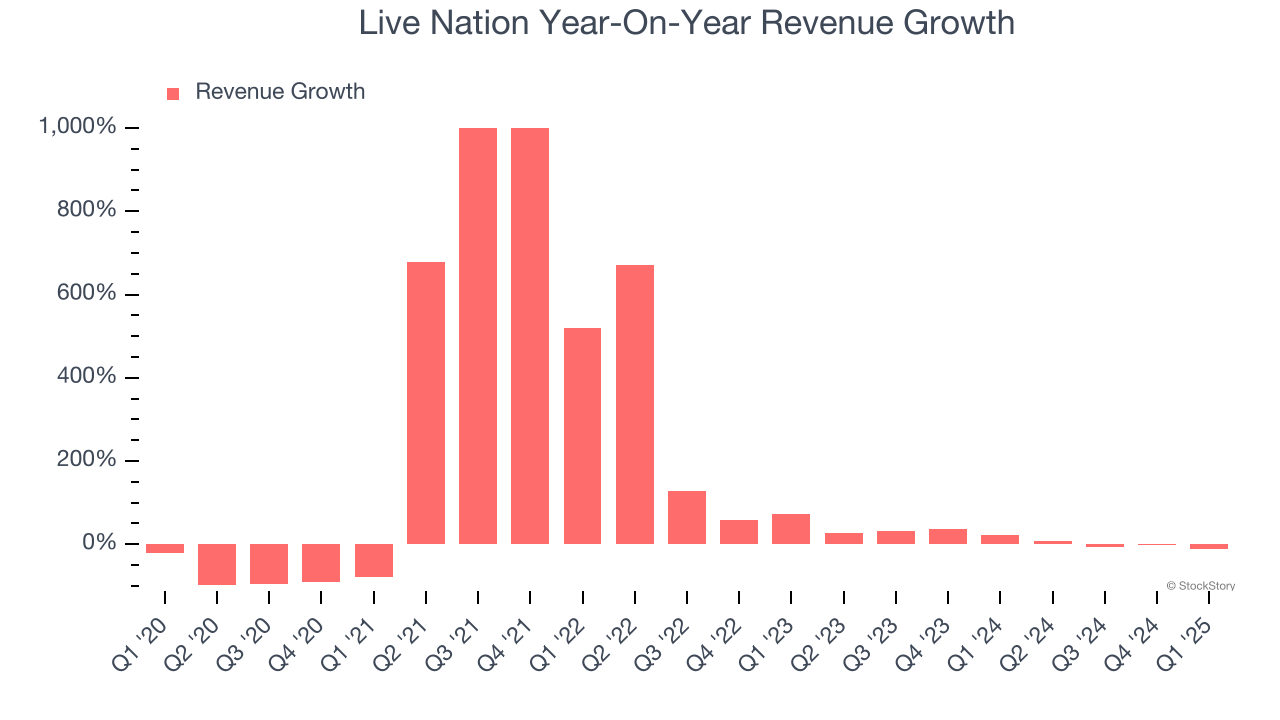

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Live Nation’s sales grew at a decent 15.2% compounded annual growth rate over the last five years. Its growth was slightly above the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Live Nation’s recent performance shows its demand has slowed as its annualized revenue growth of 12.4% over the last two years was below its five-year trend. Note that COVID hurt Live Nation’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

This quarter, Live Nation missed Wall Street’s estimates and reported a rather uninspiring 11% year-on-year revenue decline, generating $3.38 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 15.7% over the next 12 months, an improvement versus the last two years. This projection is particularly noteworthy for a company of its scale and indicates its newer products and services will spur better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

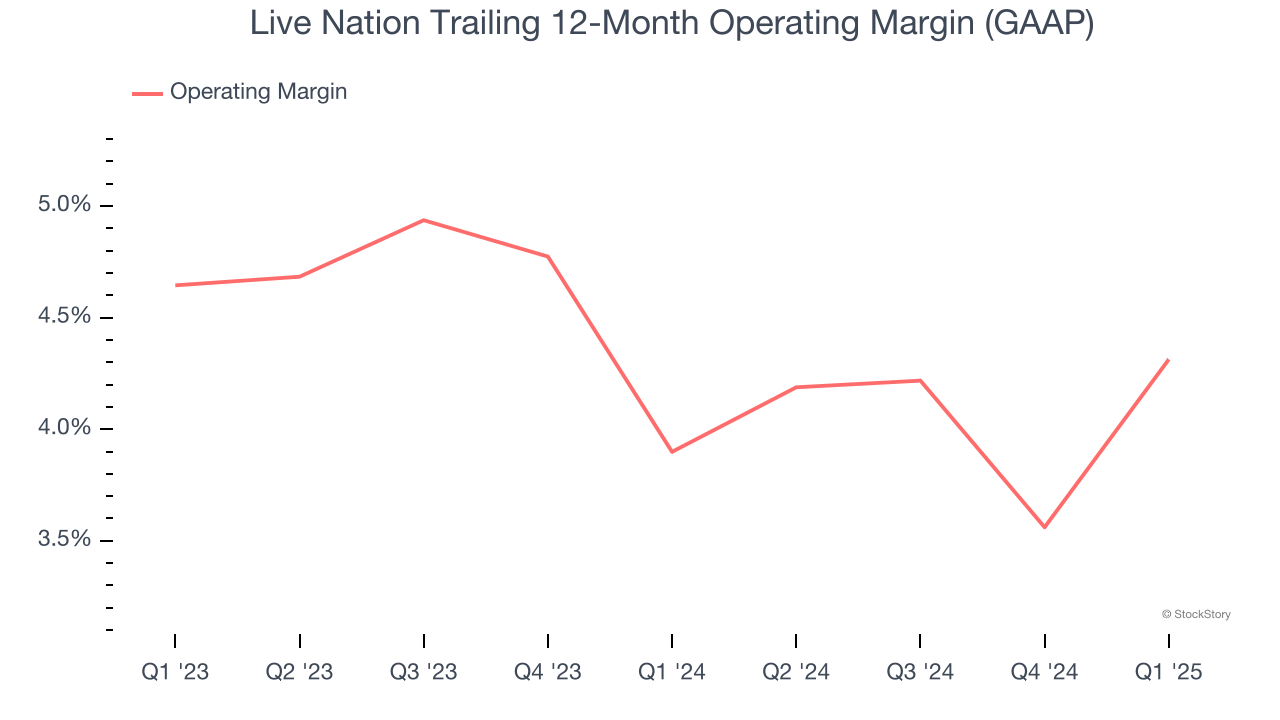

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Live Nation’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 4.1% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

In Q1, Live Nation generated an operating profit margin of 3.4%, up 4.5 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

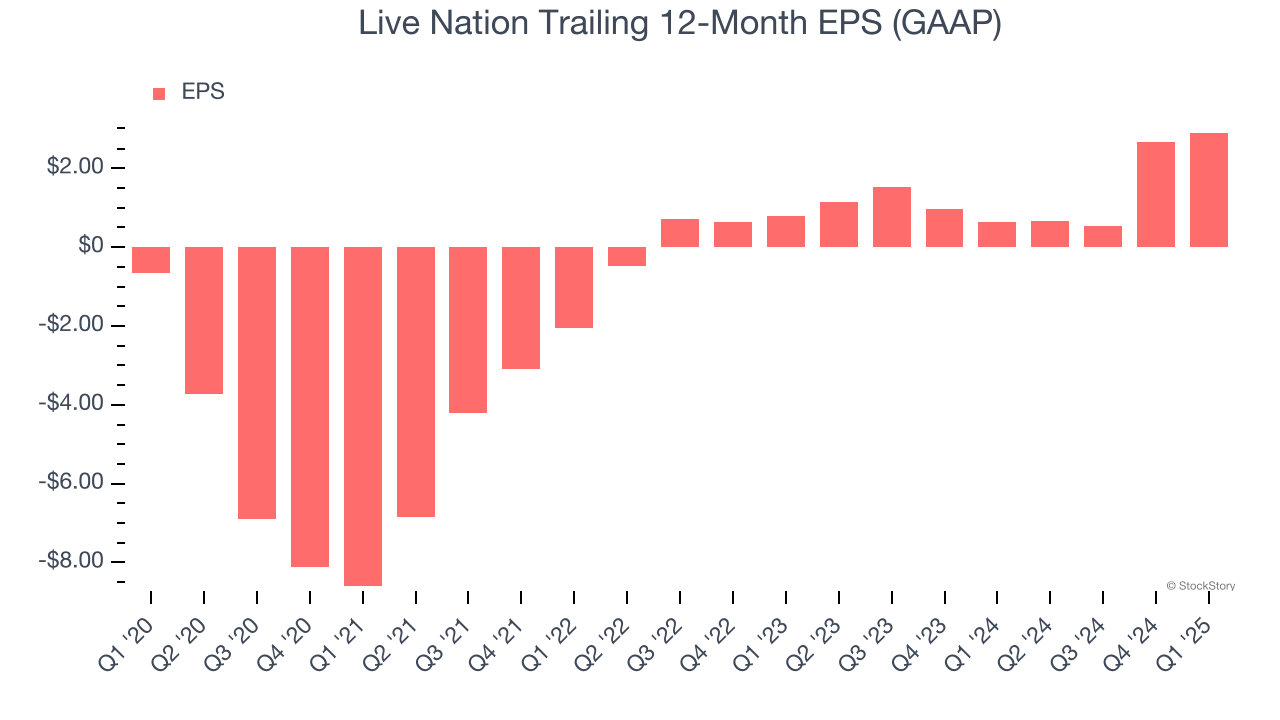

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Live Nation’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, Live Nation reported EPS at negative $0.32, up from negative $0.56 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Live Nation’s full-year EPS of $2.91 to shrink by 4.3%.

Key Takeaways from Live Nation’s Q1 Results

We were impressed by how significantly Live Nation blew past analysts’ EPS expectations this quarter. On the other hand, its revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $131.20 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.