Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Macy's (NYSE: M) and the best and worst performers in the general merchandise retail industry.

General merchandise retailers–also called broadline retailers–know you’re busy and don’t want to drive around wasting time and gas, so they offer a one-stop shop. Convenience is the name of the game, so these stores may sell clothing in one section, toys in another, and home decor in a third. This concept has evolved over time from department stores to more niche concepts targeting bargain hunters or young adults, and e-commerce has forced these retailers to be extra sharp in their value propositions to consumers, whether that’s unique product or competitive prices.

The 8 general merchandise retail stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was 1.8% below.

Luckily, general merchandise retail stocks have performed well with share prices up 11.1% on average since the latest earnings results.

Macy's (NYSE: M)

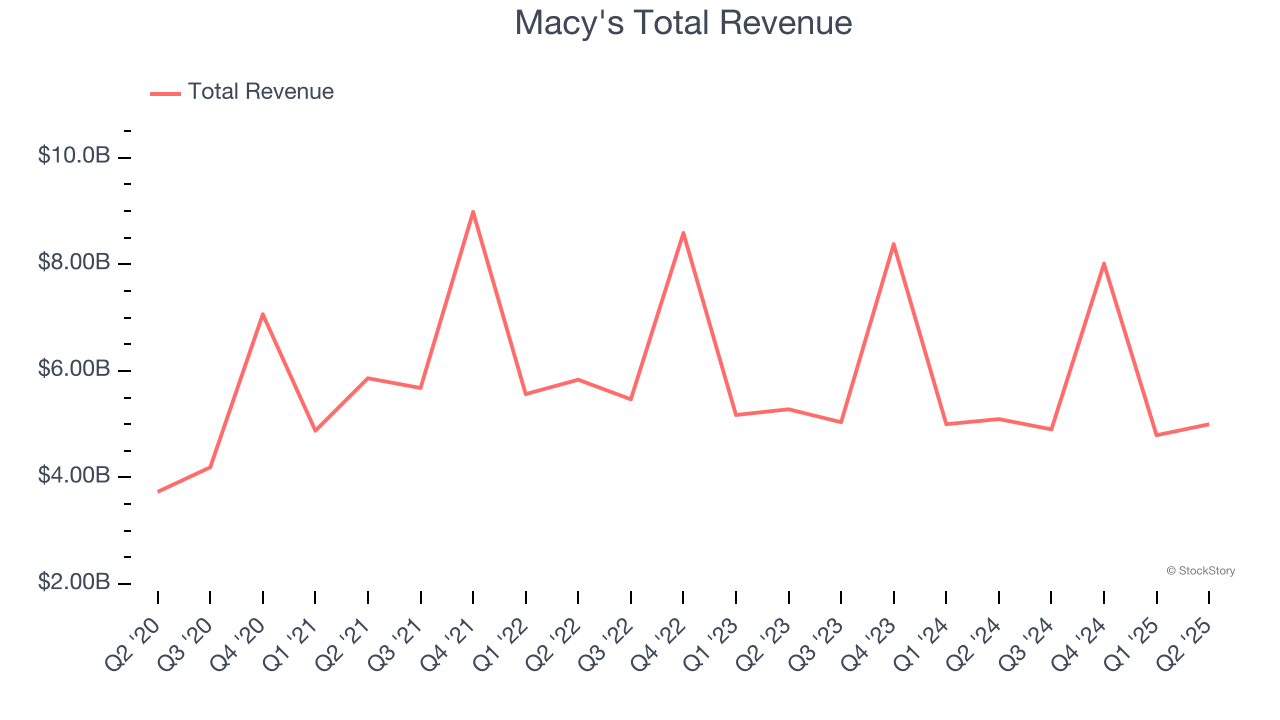

With a storied history that began with its 1858 founding, Macy’s (NYSE: M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Macy's reported revenues of $5.00 billion, down 1.9% year on year. This print exceeded analysts’ expectations by 2.7%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

“Our teams achieved better than expected top- and bottom-line results during the second quarter, driven by our strongest comparable sales growth in 12 quarters, reflecting the strong performance in Macy’s Reimagine 125 locations, Bloomingdale’s and Bluemercury,” said Tony Spring, chairman and chief executive officer of Macy’s,

Macy's delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 27.8% since reporting and currently trades at $17.25.

Is now the time to buy Macy's? Access our full analysis of the earnings results here, it’s free.

Best Q2: Kohl's (NYSE: KSS)

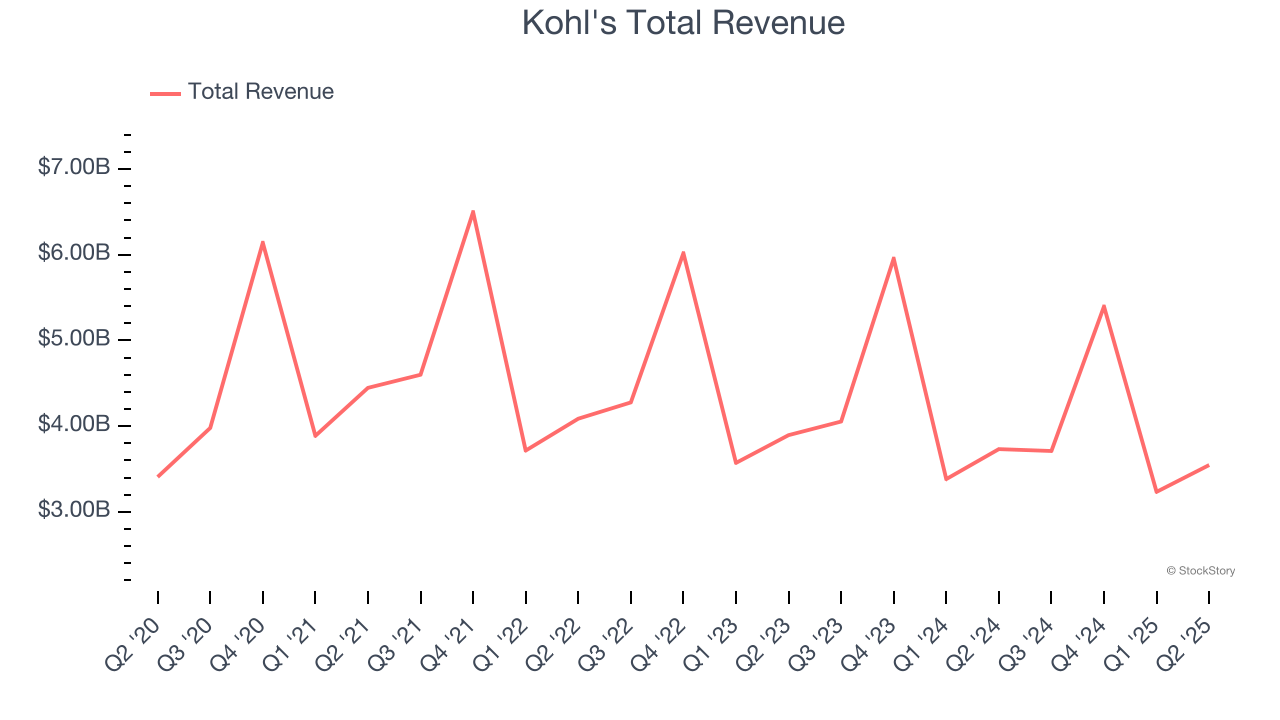

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE: KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

Kohl's reported revenues of $3.55 billion, down 5% year on year, outperforming analysts’ expectations by 1.4%. The business had a stunning quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ gross margin estimates.

The market seems happy with the results as the stock is up 27% since reporting. It currently trades at $16.55.

Is now the time to buy Kohl's? Access our full analysis of the earnings results here, it’s free.

TJX (NYSE: TJX)

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE: TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

TJX reported revenues of $14.4 billion, up 6.9% year on year, exceeding analysts’ expectations by 1.7%. It was a satisfactory quarter as it also posted an impressive beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

Interestingly, the stock is up 3% since the results and currently trades at $138.71.

Read our full analysis of TJX’s results here.

Five Below (NASDAQ: FIVE)

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ: FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

Five Below reported revenues of $1.03 billion, up 23.7% year on year. This print surpassed analysts’ expectations by 3.5%. Overall, it was an exceptional quarter as it also logged EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

Five Below delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 6.1% since reporting and currently trades at $153.40.

Read our full, actionable report on Five Below here, it’s free.

Burlington (NYSE: BURL)

Founded in 1972 as a discount coat and outerwear retailer, Burlington Stores (NYSE: BURL) is now an off-price retailer that has broadened into general apparel, footwear, and home goods.

Burlington reported revenues of $2.71 billion, up 9.7% year on year. This number beat analysts’ expectations by 2.5%. It was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and a beat of analysts’ EPS estimates.

The stock is up 4% since reporting and currently trades at $291.53.

Read our full, actionable report on Burlington here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.