COLUMBUS, OH / ACCESSWIRE / May 1, 2023 / SCI Engineered Materials, Inc. ("SCI") (OTCQB:SCIA), today reported financial results for the three months ended March 31, 2023. SCI is a global supplier and manufacturer of advanced materials for physical vapor deposition thin film applications who works closely with end users and OEMs to develop innovative, customized solutions.

Jeremy Young, President, and Chief Executive Officer, said, "We are encouraged by our solid start in 2023 and first quarter financial results. The increase in total revenue was due to strong volume throughout the quarter. We continue to benefit from recent customer additions, especially for a growing number of toll services utilizing SCI's vacuum hot presses. Our marketing plans for 2023 include exhibiting at additional industry trade shows which have a specific market focus and increasing our sales team staff."

Revenue

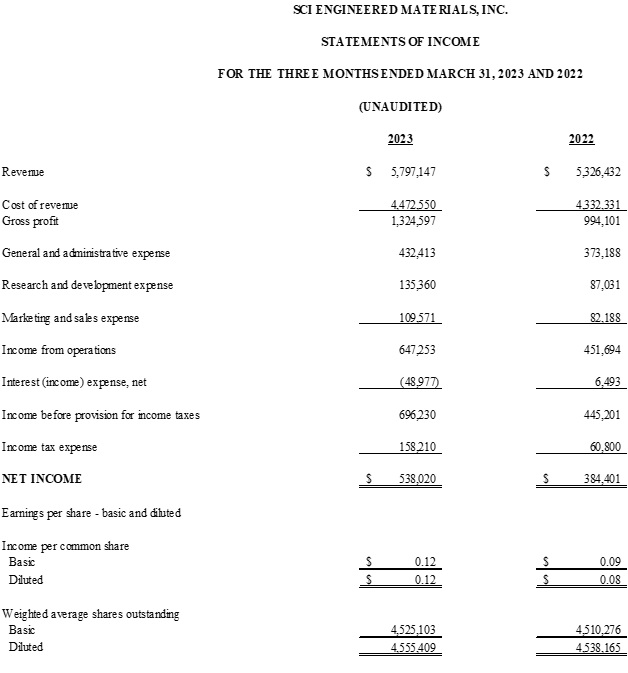

Revenue for the first three months of 2023 increased 9% to $5,797,147 from $5,326,432 for the same period a year ago. Higher volume was the key factor that contributed to the year-over-year increase, despite lower raw material costs.

Order backlog was approximately $5.1 million on March 31, 2023, versus $4.1 million at 2022 year-end and $3.0 million on the same date last year.

Gross profit

Gross profit was $1,324,597 for the 2023 first quarter versus $994,101 the prior year. The increase was attributable to higher revenue and to a lesser extent favorable product mix.

Operating expenses

Operating expenses (general and administrative, research and development (R&D), and marketing and sales) were $677,344 for the three months ended March 31, 2023, compared to $542,407 the prior year. The largest increase was in general and administrative expenses, followed by research and development and marketing and sales expenses to support the Company's growth. Higher research and development expenses included initiatives focused on custom specialty materials and additive manufacturing applications. During the first quarter of 2023 the Company exhibited for the first time at an international photonics trade show and launched targeted online corporate visibility and product campaigns.

Interest (income)/expense, net

Interest income, net was $48,977 for the 2023 first quarter compared to interest expense of $6,493 for the same period a year ago. Interest income in the first quarter of 2023 increased due to the approximately $2.0 million investment in marketable securities during the fourth quarter of 2022 and the overall increase in interest rates. Interest expense continues to decline as the Company reduces outstanding balances for equipment leases.

Income taxes

Income tax expense for the first three months of 2023 was $158,210 versus $60,800 for the same period a year ago. The effective tax rate for the first quarter of 2023 was 22.7% compared to the tax rate for calendar year 2022 of 21.7%.

Net income

Net income increased 40% to $538,020 from $384,401 for the same period last year. The increase was due to higher revenue, gross profit and interest income, partially offset by higher operating and income tax expenses.

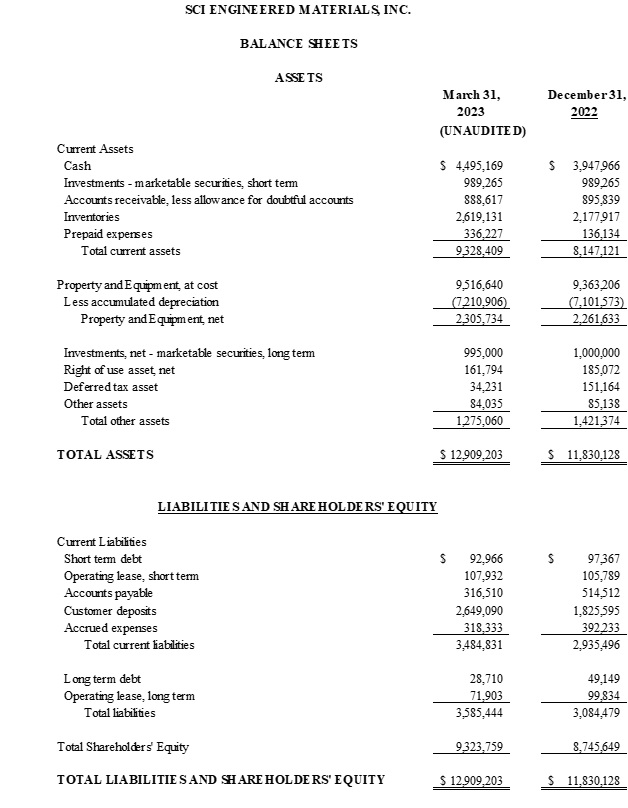

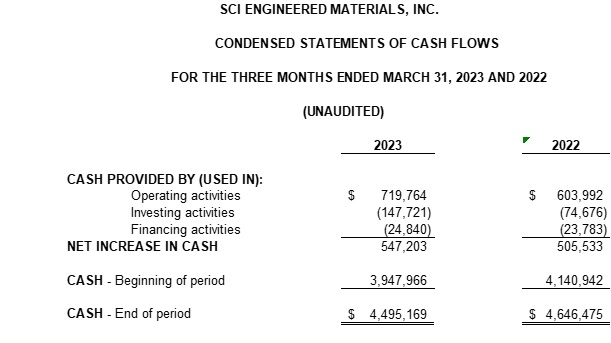

Cash and investments

Cash on hand was $4,495,169 on March 31, 2023, compared to $3,947,966 on December 31, 2022, benefiting from net cash provided by operating activities during the first three months of 2023. There were also approximately $2.0 million of investments in marketable securities at the end of the 2023 first quarter and 2022 year-end.

Debt outstanding

Debt outstanding was $121,676 on March 31, 2023, compared to $146,516 on December 31, 2022. The Company made principal payments of $24,840 during the first three months of 2023 related to finance lease obligations.

About SCI Engineered Materials, Inc.

SCI Engineered Materials is a global supplier and manufacturer of advanced materials for PVD thin film applications who works closely with end users and OEMs to develop innovative, customized solutions. Additional information is available at www.sciengineeredmaterials.com or follow SCI Engineered Materials, Inc. at:

https://www.linkedin.com/company/sci-engineered-materials.-inc

https://www.facebook.com/sciengineeredmaterials/

https://www.twitter.com/SciMaterials

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created thereby. Those statements include, but are not limited to, all statements regarding intent, beliefs, expectations, projections, customer guidance, forecasts, plans of the Company and its management. These forward-looking statements involve numerous risks and uncertainties, including without limitation, other risks and uncertainties detailed from time to time in the Company's Securities and Exchange Commission filings, including the Company's Annual Report on Form 10-K for the year ended December 31, 2022. One or more of these factors have affected and could affect the Company's projections in the future. Therefore, there can be no assurances that the forward-looking statements included in this press release will prove to be accurate. Due to the significant uncertainties in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company, or any other persons, that the objectives and plans of the Company will be achieved. All forward-looking statements made in this press release are based on information presently available to the management of the Company. The Company assumes no obligation to update any forward-looking statements.

Contact: Robert Lentz

(614) 439-6006

SOURCE: SCI Engineered Materials, Inc.

View source version on accesswire.com:

https://www.accesswire.com/752040/SCI-Engineered-Materials-Inc-Reports-2023-First-Quarter-Results