The e-commerce market is set to triple by 2030, and Shopify (SHOP) is a top contender to capture a good chunk of this growth. The company’s strength was on full display at the second quarter’s earnings report, registering a 31% year-over-year (YoY) sales growth. Will this continue at the next earnings report on Nov. 4?

The company has only missed consensus estimates once in the last nine quarterly meetings. That strength is likely to continue.

The highlight of the quarter in question was Shopify’s possible integration with ChatGPT. OpenAI already helps users find the right product to buy. However, it could now integrate a checkout on its platform without the users having to pay anything extra. Shopify believes such a move is natural as AI continues to reshape customer journeys and behavior. This won’t reflect any financial impact in the outgoing quarter but could well be a big part of the earnings call and outlook, even if a rare miss happens.

About Shopify Stock

Shopify is a platform that helps businesses set up their online marketplace, providing various tools that help merchants across the whole lifecycle of online shopping. Whether it is inventory management, invoicing, fulfilling orders, or even sourcing products, Shopify offers a seamless experience. The company is based in Ottawa, Canada.

SHOP stock has reached its all-time high, currently trading around $177. So far in 2025, the scrip has delivered above 65% return and has outperformed the benchmark Nasdaq Composite’s ($NASX) year-to-date (YTD) returns of 24% by a comprehensive 2.9x multiple. Driven by strong growth in the e-commerce segment and robust double-digit growth during the second quarter, the stock is up 236% from its 2025 low of $76.89 that it touched back in April. The company’s expanding Gross Merchandise Volume (GMV), which stood at $292.275 billion in 2024, is paving the way for such an accelerated bullish trend. Its partnership with OpenAI to deliver a more seamless consumer experience through instant checkouts in ChatGPT has also been a catalyst in recent weeks.

With such a price surge in 2025, investors would naturally have some form of skepticism regarding SHOP, which apparently looks overbought. However, it is one of the many stocks across different industry verticals that have benefited massively from recent AI-linked developments. Hence, looking at the stock’s stretched valuations in isolation might be a narrow-minded approach from potential investors. SHOP’s forward price-to-sales (P/S) multiple of 20.6x is 468% higher than its sector median. Similarly, the stock’s forward GAAP price-to-earnings (P/E) multiple of 202.8x is almost 5 times greater than the sector median. In terms of the forward EV/Sales metric, SHOP currently trades at a 20.1x multiple compared to a median of 3.7x.

Shopify Beats Revenue and Earnings Forecasts

SHOP’s second-quarter results, announced on Aug. 6, showed a comprehensive outperformance relative to consensus estimates. Revenues for the quarter stood at $2.68 billion, beating estimated figures by nearly a 5.25% margin. With a net income of $906 million during the quarter, the company posted a GAAP earnings per share (EPS) of $0.69, compared to consensus estimates of $0.20. This was also 430% higher than what the company posted during the same quarter in 2024.

The management also delivered a highly optimistic guidance for the third quarter, estimating revenue growth in the mid- to high 20s percentage compared to the same quarter in 2024. Operating expenses will be on the high side, forecasted at around 39% of revenues, amid stock-based compensation expenses of $130 million. The company also anticipates above 15% growth in cash flow margins.

On the earnings call, management highlighted two important points to soothe investor concerns. One of them related to the higher operating expenses, which the company said were necessary to support growth. The other is related to regulatory changes. However, since only 4% of the global GMV is eligible for de minimis exemptions, the impact of any regulatory issues will be minimal.

What Are Analysts Saying About SHOP Stock?

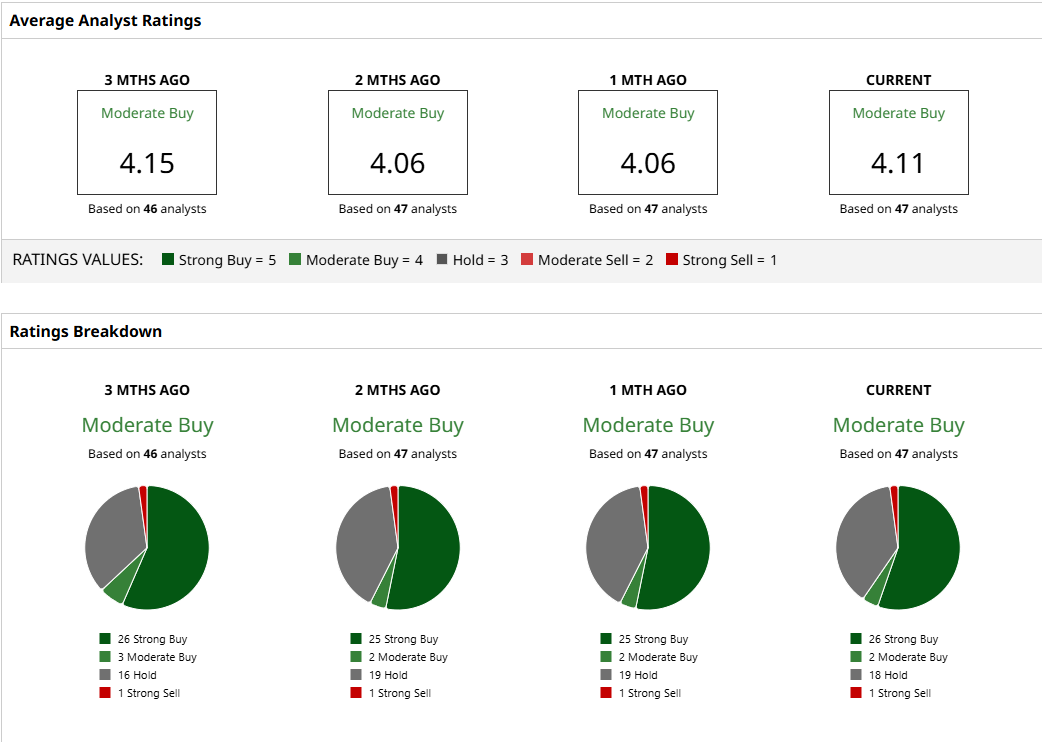

SHOP stock is currently trading about 8% above the mean target price of $161.71. The highest target price stands at $200, offering upside of 14% from current levels. Shopify is well-covered on Wall Street, with 47 analysts assigning a rating to the stock. 26 “Strong Buy” ratings and 18 “Hold” ratings suggest they are either extremely bullish or cautious. This is understandable, as a stock like Shopify quickly prices in new developments, and an earnings miss can bring volatility, something these analysts do not want to end up on the wrong side of. Traders, however, love to trade Shopify options in such a scenario.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Fintech Stock Under $400 to Buy and Hold Forever

- 'Our GPUs Are Everywhere’ According to CEO Jensen Huang as Nvidia Doubles Down on AI, Quantum, and 6G

- Chipotle Stock Is Plunging. Should You Buy the Dip Today?

- Welcome to the $4 Trillion Market Cap, Microsoft! Are There More Gains for MSFT Stock in Store?