The big tech earnings season has officially kicked off, paving the way for one of the most closely watched periods on Wall Street. Investors are tuning in as industry giants like Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), and Meta (META) report their latest earnings this week.

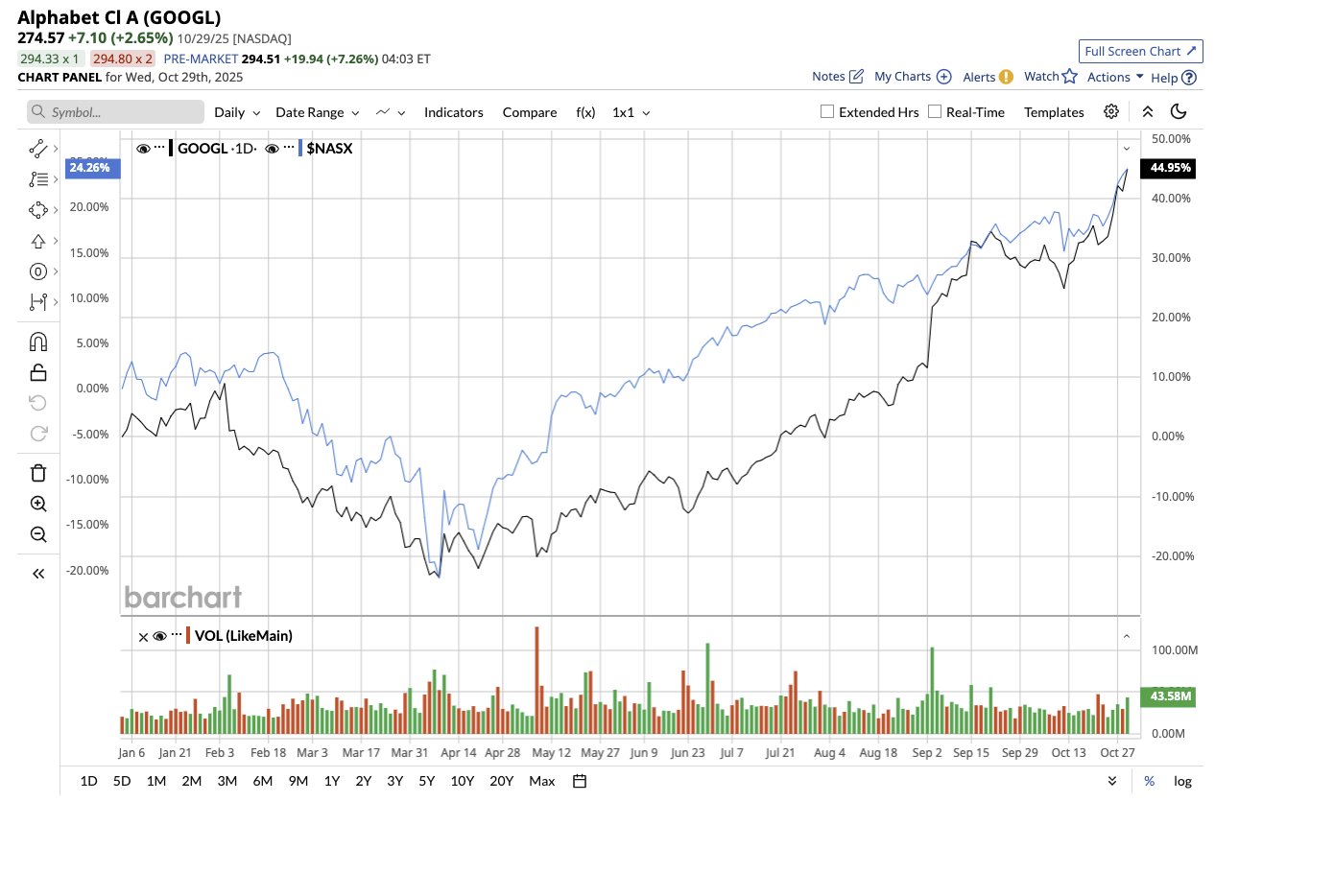

Alphabet, the parent company of Google, just delivered its first-ever $100 billion-plus quarter on Oct. 29, sending the stock up more than 3%. GOOGL stock has risen 50.3% year-to-date, surpassing the tech-heavy Nasdaq Composite Index ($NASX) gain of 23%.

Let’s dig into its third-quarter earnings to determine why it may be the smartest AI investment heading into 2026.

The $100 Billion Quarter: A Milestone of Scale and Diversification

With AI now driving tangible results across Search, Cloud, YouTube, and subscriptions, Alphabet’s transition from a search engine to a full-stack AI powerhouse is happening faster than many expected. In the third quarter, Alphabet posted $102.3 billion in total revenue, nearly three times that of the same quarter five years ago. Revenue also rose 16% year over year, exceeding consensus estimates by $2.2 billion. Alphabet’s net income also increased by 35.3% to $2.87 per share, cementing its position as one of the most profitable tech companies.

CEO Sundar Pichai stressed that Alphabet’s AI-first strategy, which began years ago, is now paying off. Search remains Google’s primary revenue generator, and AI-powered features like AI Overviews and AI Mode are supercharging it. Revenues from Search and other advertising increased 15% to $56.6 billion, driven by strong advances in retail and financial services. Google Services revenue increased 14% to $87.1 billion from the year before, driven by double-digit growth in both Search and YouTube. Even more striking, Google Cloud’s total revenue increased by 34% to $15.2 billion, driven by strong enterprise demand for its AI-optimized infrastructure and Gemini models. As a result of this surge in demand, Google Cloud’s backlog increased by 46% sequentially and 82% year-over-year, totaling $155 billion. YouTube remains another breakout success story. Advertising revenue increased by 15% to $10.3 billion, thanks to strong performance in direct response commercials and the continued popularity of YouTube Shorts and living room viewership.

Investing Aggressively in AI Infrastructure

Alphabet’s AI infrastructure is the backbone that powers all Google products. The company is scaling both Nvidia (NVDA) GPUs and its own Tensor Processing Units (TPUs), including the next seventh-generation TPU, Ironwood, which will be publicly accessible soon. Notably, Anthropic, an AI research firm, intends to use up to 1 million TPUs, highlighting the demand for Google’s computing capabilities.

Alphabet maintains its dominance in AI research with Gemini 2.5 Pro, Veo, Genie 3, and Nano Banana. The company intends to release Gemini 3 later this year, which will further improve the company’s AI ecosystem. Google isn’t slowing down its AI buildout. Capital expenditures totaled $24 billion in Q3, mostly for servers, data centers, and networking. Capital expenditures for the whole year 2025 are expected to be between $91 billion and $93 billion, with another "significant increase" projected for 2026.

This massive investment wave is aimed at keeping pace with demand for AI compute power. Over 60% of this expense is planned for servers, ensuring that Google remains the most advanced and dependable AI infrastructure provider. Free cash flow of $24.5 billion was another highlight in the quarter, leaving Google with a massive $98.5 billion cash reserve to reinvest in AI and return to shareholders. The company repurchased $11.5 billion of stock and paid $2.5 billion in dividends in the third quarter alone.

Is GOOGL Stock a Buy, Hold, or Sell on Wall Street?

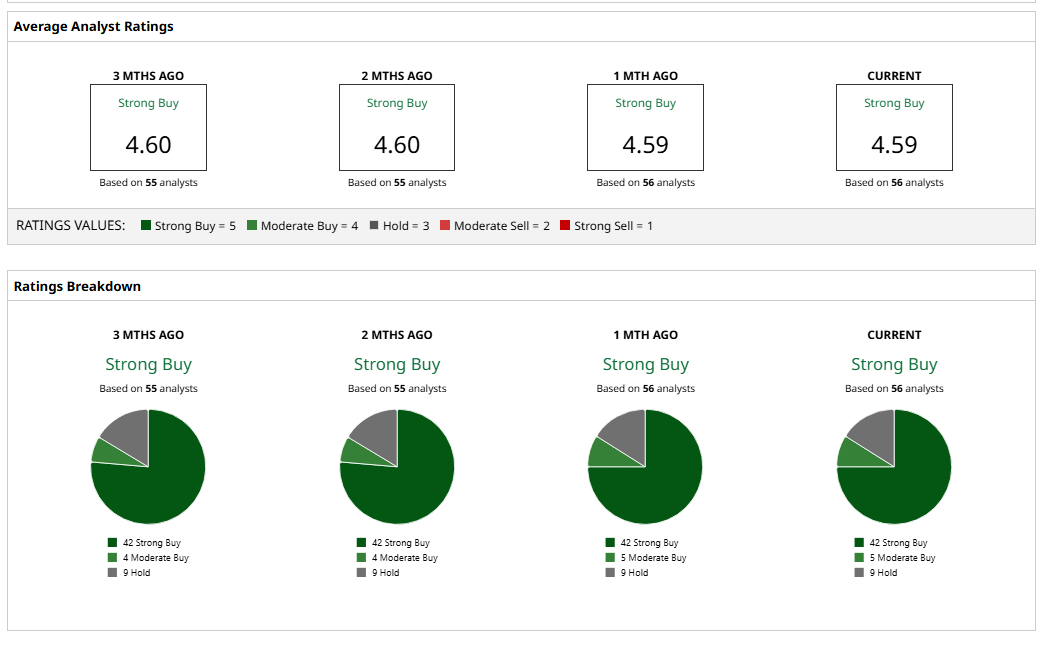

Overall, on Wall Street, GOOGL stock is a “Strong Buy.” Of the 56 analysts covering the stock, 42 rate it a “Strong Buy,” five say it is a “Moderate Buy,” and nine rate it a “Hold.” The stock has surpassed the average target price of $266.60. However, its high price estimate of $310 suggests the stock has upside potential of 9% over the next 12 months.

Alphabet’s legacy products now powered by AI, its technological edge, skyrocketing profits, a fortress balance sheet, and accelerating enterprise AI demand all provide a strong case for why Google stock could be the smartest AI stock to buy before 2025 ends.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart