With a market cap of $60.6 billion, Freeport-McMoRan Inc. (FCX) is a leading international mining company engaged in the exploration, development, and production of copper, gold, molybdenum, and silver. With major operations across North America, South America, and Indonesia, its key assets include the Grasberg mine in Indonesia, home to the world’s largest copper and gold reserves.

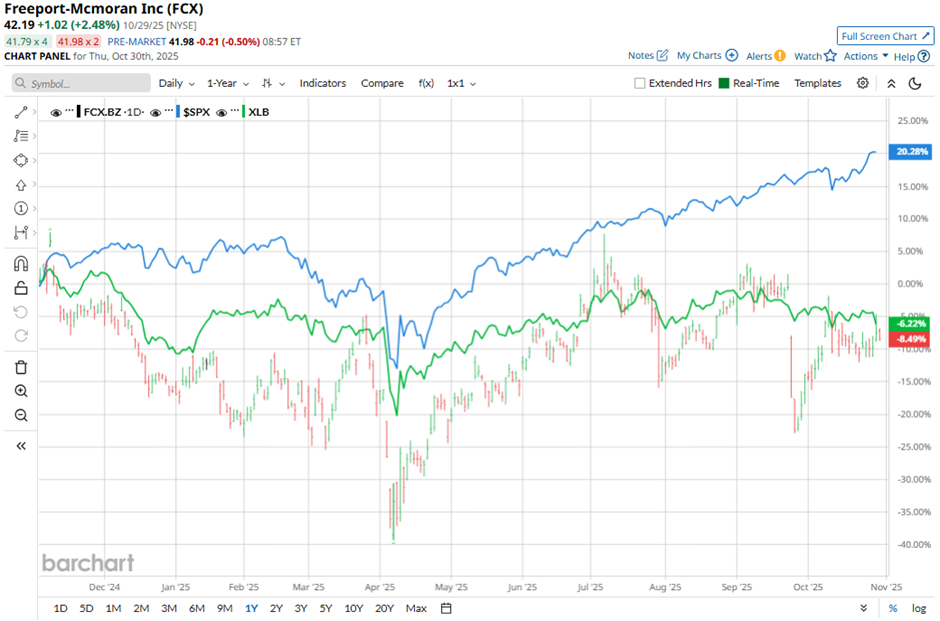

Shares of the Phoenix, Arizona-based company have underperformed the broader market over the past 52 weeks. FCX stock has declined nearly 9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.1%. Moreover, shares of the company have increased 9.9% on a YTD basis, compared to SPX's 17.2% return.

Looking closer, shares of the mining company have also lagged behind the Materials Select Sector SPDR Fund's (XLB) 8.3% dip over the past 52 weeks.

Shares of Freeport-McMoRan recovered 1.1% on Oct. 23 after the company posted stronger-than-expected Q3 2025 adjusted EPS of $0.50 and revenue of $6.97 billion. The rebound was driven by higher average realized copper prices of $4.68 per pound, up about 9% year-over-year, which offset lower production following the temporary suspension at the Grasberg mine.

For the fiscal year ending in December 2025, analysts expect FCX's adjusted EPS to remain unchanged year-over-year at $1.48. The company's earnings surprise history is strong. It has met or exceeded the consensus estimates in the last four quarters.

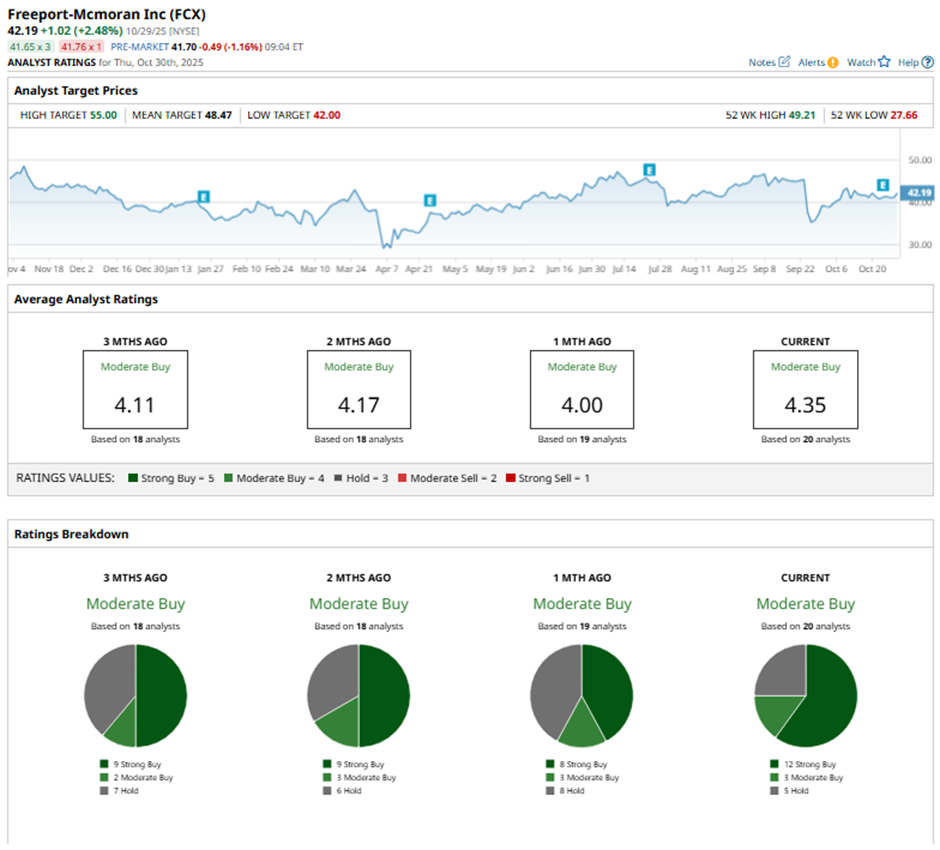

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, three “Moderate Buys,” and five “Holds.”

This configuration is more bullish than it was three months ago, when FCX had nine “Strong Buys” in total.

On Oct. 28, Scotiabank analyst Orest Wowkodaw raised Freeport-McMoRan’s price target to $51 and maintained a “Sector Perform“ rating.

The mean price target of $48.47 represents a 14.9% premium to FCX’s current price levels. The Street-high price target of $55 suggests a 30.4% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $9.5 Billion Reason to Buy This High-Performance Computing Stock

- This Data Center Stock Is Up 1,300% in Just 3 Years

- As Tesla Stock Disappoints on Earnings Yet Again, CEO Elon Musk Shares That This 1 Thing Is ‘His Biggest Concern’

- Ashes to Alpha: Adobe’s (ADBE) Implosion Offers an Opportunity for a Rebound