Tesla (TSLA) delivered record third-quarter results that CEO Elon Musk believes represent just the beginning of a transportation revolution powered by artificial intelligence (AI).

The electric vehicle (EV) maker posted new highs across deliveries, energy deployments, and free cash flow, generating $4 billion while building total cash and investments to over $41 billion. In Q3 of 2025, Greater China deliveries jumped 33% sequentially, while Asia-Pacific climbed 29%. North America rose 28% as the company continues to expand its addressable market.

These financial results provide the foundation for what Musk described as a “critical inflection point” for Tesla.

“We are really just at the beginning of scaling at a quite massive level, full self-driving and robotaxi, and fundamentally changing the nature of transport,” added Travis Axelrod, Tesla's VP of Investor Relations. “I think people just do not quite appreciate the degree to which this will take off. It's honestly going to be like a shock wave.”

Valued at a market cap of $1.53 trillion, Tesla is the largest automobile company globally. TSLA stock has surged by nearly 80% over the past year and trades not far from its all-time high.

Tesla’s Real-World AI Leadership Takes Shape

Musk emphasized that Tesla leads in real-world artificial intelligence with the “highest intelligence density” of any AI system currently in production, a critical advantage as the company scales its autonomous driving ambitions.

The numbers back up this AI leadership claim. Tesla's Full Self-Driving (FSD) software has now accumulated six billion miles of customer usage, providing the massive real-world dataset that powers continuous improvements.

The Robotaxi fleet has covered over 1.25 million miles across Austin and Bay Area operations, with management expecting to remove safety drivers in Austin by year-end. The expansion pipeline includes eight to ten metro areas, such as Nevada, Florida, and Arizona, where regulatory applications are already underway.

What makes the opportunity compelling is how early Tesla is in monetizing this technology. Only 12% of the current fleet pays for FSD, leaving substantial runway for adoption as the software improves and gains regulatory approvals in key markets like China and Europe.

Version 14 introduces major architectural improvements that Musk says will make the car feel like a living creature, with reasoning capabilities set to arrive before year-end that will enable smarter parking decisions and more human-like driving behavior.

The hardware roadmap amplifies this software advantage. Tesla's upcoming AI5 chip delivers 40 times the performance of AI4 in some metrics through radical simplification focused exclusively on Tesla's specific needs, rather than serving multiple customers like Nvidia (NVDA). This integration of purpose-built hardware with massive real-world training data creates competitive moats that become harder to replicate as the dataset grows.

Tesla Is Expanding Beyond the Vehicle Business

Beyond vehicles, Tesla's energy storage business achieved record deployments, gross profit, and margins, despite tariff headwinds totaling more than $400 million in the quarter. The Megapack 3 and upcoming Megapack 4 address critical grid capacity constraints, with surging demand from AI data center applications.

Management sees potential to effectively double U.S. energy output through battery buffering without building new power plants, a massive market opportunity as electricity demand accelerates.

The Optimus humanoid robot program represents perhaps the most ambitious bet. Tesla targets a production launch by late 2026, aiming to reach 1 million annual units. Musk described the engineering challenge as immense, particularly the hand-and-forearm design requiring human-level dexterity, but believes Tesla's unique combination of manufacturing scale, real-world AI, and vertical integration positions it to succeed where others cannot.

Capital expenditures will increase substantially in 2026 to support these AI initiatives and production expansion as the company pursues what Musk calls sustainable abundance.

What Is the TSLA Stock Price Target?

Analysts tracking Tesla forecast revenue to fall by 3% year-over-year (YoY) in 2025, while net income is estimated to decline by 31.6%. However, between 2025 and 2029, Tesla is forecast to grow revenue by 24.7% annually, while earnings are projected to expand at a compounded annual growth rate of 60%.

If TSLA meets these lofty growth targets, it could deliver outsized gains for shareholders. If the EV giant is priced at 75x earnings, which is not too steep, it could gain 40% over the next 40 months.

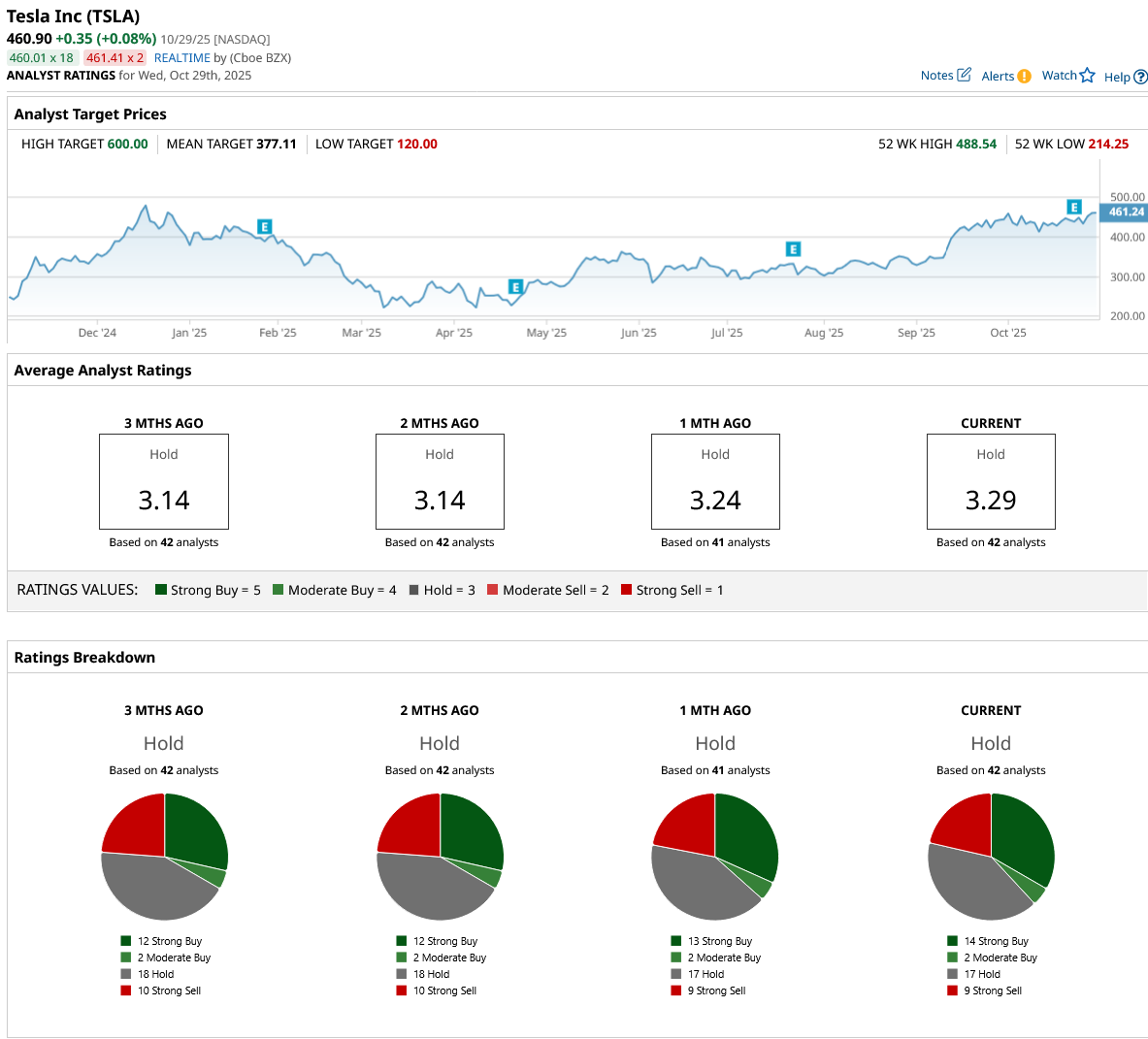

Out of the 42 analysts covering TSLA stock, the average recommendation is unchanged in recent months at a “Hold.” The average Tesla stock price target is $377, about 17% below the current price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- It's 'Going to Be Like a Shockwave' When Tesla's AI Innovations Hit. Should You Buy TSLA Stock First?

- Adobe Systems Bear Put Spread Could Return 233% in this Down Move

- Stocks Fall Before the Open After Mixed Big Tech Earnings, Trump-Xi Summit

- Dear Apple Stock Fans, Mark Your Calendars for October 30