Jensen Huang is the pied piper of this market, and Nvidia (NVDA) is his flute. Not only is the first company to breach the $5 trillion market cap mark showing no signs of stopping, but by association with it, stocks of other companies are also flying.

Take the case of Caterpillar (CAT), the infrastructure behemoth whose shares popped after Nvidia announced at its GTC conference that Caterpillar is using the company's Omniverse technologies to build digital twins of its factories and supply chains for use in advanced manufacturing such as predictive maintenance and dynamic scheduling. Although the location of the factories has not been disclosed, Caterpillar has been an under-the-radar beneficiary of the AI architecture buildup across the country.

About Caterpillar

Tracing its origins back to the early 1900s, the 1925-formed Caterpillar is a global leader in construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. Its primary markets include heavy machinery for building infrastructure (roads, bridges), mining operations, and energy & transportation systems. The company also provides financial products to support its equipment sales and services.

Valued at a market cap of $245.7 billion, the CAT stock has outperformed the S&P 500 ($SPX) this year with a rise of 62.5% on a year-to-date (YTD) basis. Notably, the stock also offers a dividend yield of 1.11%, and the company is a member of the prestigious “Dividend Aristocrat” club, having raised dividends consecutively over the past 32 years. Further, with a payout ratio of just 29.77%, the headroom for more growth certainly remains.

However, should a storied company like Caterpillar be seen only in the context of being a partner of Nvidia, or is it playing a much larger role in infrastructure creation for the AI revolution? And how are its financials shaping up in that process? Let's take a closer look.

Excellent Q3, But Issues There That Cannot Be Overlooked

Caterpillar's results for the most recent quarter were a blowout, with both revenue and earnings surpassing Street estimates comfortably. Total sales for Q3 2025 stood at $17.6 billion, which denoted a growth of 9.5% from the previous year. The core Machinery, Energy & Transportation segment saw its sales rise by 9.8% in the same period to $16.7 billion, as higher sales of equipment to end users were cited as the primary driver of growth by the company.

Earnings of $4.95 per share were much higher than the consensus estimate of $4.53 per share. However, it was down 4.2% on a year-over-year (YoY) basis, and it was the fifth straight quarter of YoY earnings decline from the company. A concerning sign, as operating margins also slipped to 17.3% in Q3 2025 from 19.5% in Q3 2024.

The case was similar with operating cash flows as well. Net cash from operating activities for the nine months ended Sept. 30 was $8.1 billion, down from $8.6 billion in the year-ago period. Overall, the company closed Q3 2025 with a cash balance of $7.5 billion, which was less than its short-term debt levels of $13.8 billion.

Further, the stock's rally has come at the altar of heady valuations, as it is currently trading at forward P/E, P/S, and P/CF of 29.34, 3.79, and 12.80, all much higher than the sector medians of 21.19, 1.73, and 16.44, respectively.

An American Champion With a New AI Role

Caterpillar, if it plays its cards correctly, can be a core participant in President Donald Trump's bid to bring manufacturing jobs back to the United States. A checkered company with a long track record, Caterpillar fits perfectly in Trump's “Made in USA” narrative.

And Caterpillar is making a concerted push to solidify its gains, evolving from its traditional heavy-equipment base into a broader provider of energy and technology solutions. A prime example is its dominance in oversized backup generators, which are standard in data centers to keep operations running smoothly during outages.

The surge in data center builds worldwide demands massive ascendancy in power supply, and Caterpillar fits squarely into that gap with its natural gas and diesel generators alongside industrial turbines. The Energy & Transportation division already stands as the company's top performer in both revenue and margins.

In the third quarter, segment sales rose 17% YoY to $8.4 billion, while power generation specifically climbed 31%, pushing the order backlog to $39.8 billion. Executives highlighted multi-year contracts with major cloud giants, plus plans to ramp up output and capacity starting in late 2026 through 2027.

Central to this momentum in Energy & Transportation is the Cat G3500K lineup of generator sets, rolled out in December 2024 for steady or nonstop power needs in tough environments. These gas-powered units deliver sharper efficiency and dependability, with the G3520K HR model syncing to the grid and handling full loads in just 4.5 minutes, down from about six minutes in the prior G3500H series. They hit peak engine efficiency near 89% in select setups, with better electrical and heat recovery across the board. Upcoming versions should handle biogas, mine methane, and hydrogen mixes too.

Outside the AI boom, Caterpillar's Resource Industries unit is primed to ride the wave of global energy shifts, which are spiking needs for metals like copper, nickel, and lithium. As those commodity prices firm up, mining firms gain clear motivation to upgrade gear, since higher yields directly lift their profitability.

Rounding out the picture, the Construction Industries group should keep humming along, fueled by the 2021 U.S. Infrastructure Investment and Jobs Act's $1.2 trillion package, including $550 billion in fresh outlays for highways, bridges, rail lines, power grids, and water systems.

Analyst Opinion

Some may point towards Caterpillar's financials and note that there is a slowdown. Yes, there is, but to me it seems transient, with greenshoots already visible, especially in the energy segment. Granted, earnings should resume their path towards growth as soon as possible, and the rates of revenue growth, with the new AI trigger, will be watched closely; however, this CAT should not be ignored. It has operations worldwide, with an American core, stable financials, and a dividend yield that provides a reliable source of income in this volatile economy.

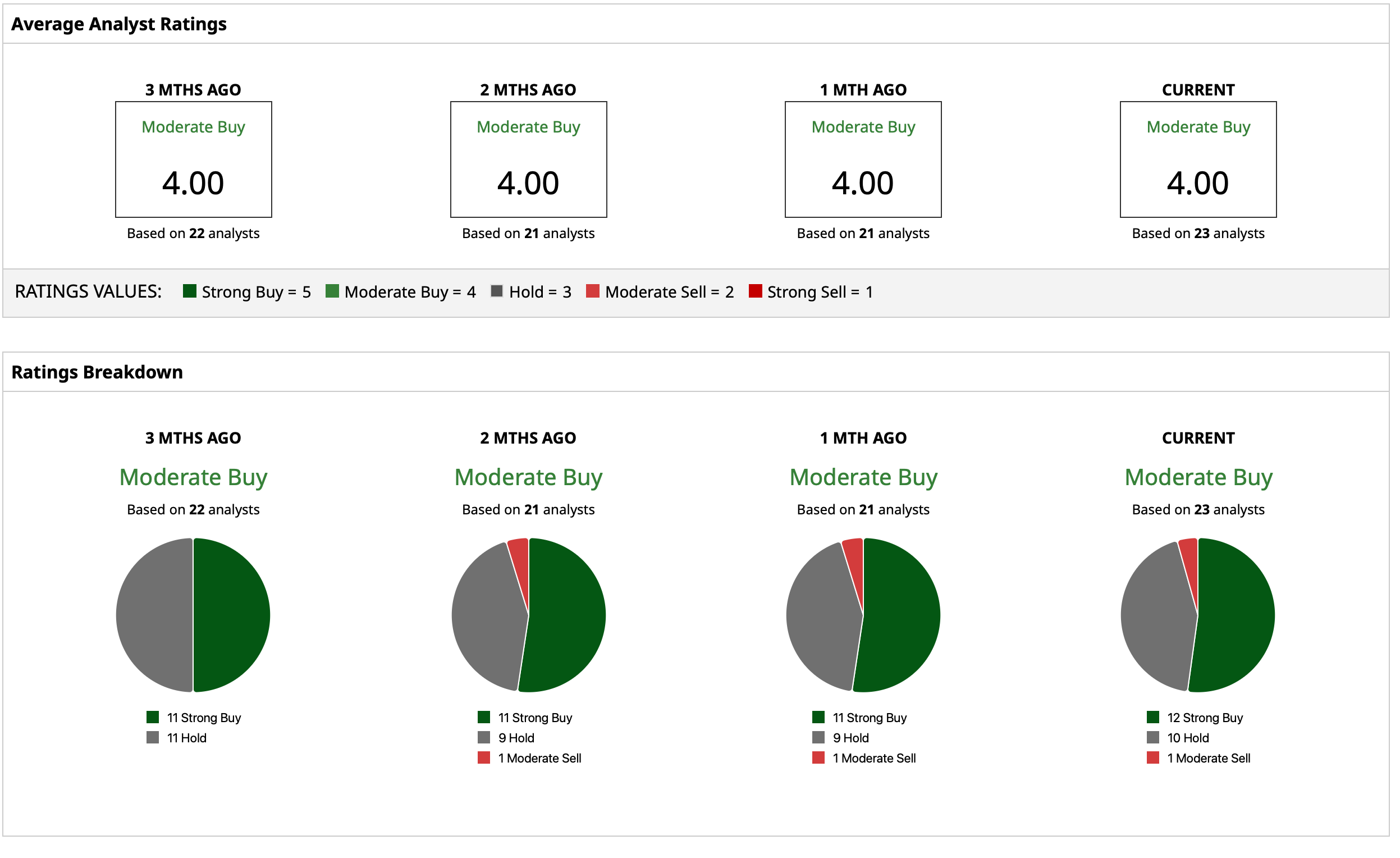

Thus, analysts remain cautiously optimistic about the CAT stock, attributing to it a rating of “Moderate Buy,” with a mean target price that has already been surpassed. The high target price of $650 denotes an upside potential of about 11% from current levels. Out of 23 analysts covering the stock, 12 have a “Strong Buy” rating, 10 have a “Hold” rating, and one has a “Moderate Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jensen Huang Says AI Is ‘Work,’ Not a ‘Tool.’ This 1 Blue-Chip Dividend Stock Is Bringing that Work to America

- Why PayPal Stock Deserves a Second Look Before 2025 Ends

- Is This Defensive Giant a Good Stock to Buy in a Volatile Market?

- This Dividend Stock Has Fallen as Gold Prices Crash. Should You Buy You Buy the Dip or Stay Far Away?