Nvidia (NVDA) continues to cement its position as the backbone of the artificial intelligence revolution. Recently, Nvidia CEO Jensen Huang emphasized that the company's chips have become nearly ubiquitous across the tech landscape. The chipmaker's latest moves demonstrate an aggressive expansion strategy that goes beyond its core GPU business.

Two days back, Nvidia announced a $1 billion investment in Nokia (NOK) as the two companies aim to shape future connectivity standards. This deal will see the tech giants collaborate on developing next-generation 6G cellular technology. Here, Nokia will adapt its network software to run on Nvidia's chips and address a fast-growing market that analysts expect to exceed $200 billion by 2030.

NOK stock surged 22% following the announcement, reflecting investor confidence in the collaboration. T-Mobile (TMUS) will begin testing these AI-powered network technologies in 2026, positioning American telecom providers to lead in advanced connectivity infrastructure.

This Nokia investment follows a pattern of strategic equity stakes Nvidia has taken in recent months. The chipmaker committed $5 billion to Intel (INTC) in September and pledged $100 billion to OpenAI. Additional investments include $500 million in autonomous vehicle startup Wayve and $667 million in UK cloud provider Nscale.

The telecommunications partnership represents more than network upgrades and creates infrastructure for AI processing at the edge of networks, which should support everything from smartphones to drones and augmented reality devices.

With mobile ChatGPT usage accounting for nearly half of its 800 million weekly users, the demand for AI-capable networks continues to grow rapidly. Nvidia's positioning across multiple technology sectors reinforces Huang's assertion about the company's pervasive presence in modern computing infrastructure.

Nvidia’s Widening AI Moat

NVDA stock continues to attract investor attention as the AI behemoth expands its reach beyond traditional computing into critical sectors like healthcare, government operations, and scientific research. Its latest partnerships demonstrate how deeply Nvidia’s technology is embedding itself into the infrastructure of major institutions.

Pharmaceutical giant Eli Lilly (LLY) deployed what it calls the world's most powerful AI factory owned by a drug company. The system runs on 1,016 of Nvidia's Blackwell Ultra GPUs and represents a massive leap in computing power. To put this in perspective, a single one of these GPUs equals roughly 7 million of the Cray supercomputers Lilly used back in 1992. The entire system can perform over 9 quintillion calculations per second, helping compress drug discovery timelines and accelerate breakthroughs in personalized medicine.

This AI factory lets Lilly scientists analyze entire genome sequences, predict patient outcomes, and explore countless biochemical possibilities much faster than before. The company also uses Nvidia's technology to create digital twins of manufacturing lines, test supply chain changes virtually, and deploy intelligent robots for quality inspection. Lilly has committed $50 billion to expanding its U.S. manufacturing footprint, with this AI infrastructure creating thousands of high-wage jobs.

Meanwhile, Nvidia partnered with Oracle (ORCL) to build the Department of Energy's largest AI supercomputer. The Solstice system will feature 100,000 Blackwell GPUs, while a second system, Equinox, will include 10,000 more.

Both will be located at Argonne National Laboratory and deliver a combined 2,200 exaflops of AI performance. These supercomputers will enable scientists to develop advanced AI models for research spanning healthcare to materials science.

Nvidia also unveiled its AI Factory for Government reference design, working with companies such as Palantir (PLTR), CrowdStrike (CRWD), and ServiceNow (NOW) to deliver secure AI infrastructure to federal agencies. The company is making its Aerial software open source, allowing developers worldwide to build next-generation 5G and 6G networks.

These strategic moves position Nvidia as essential infrastructure across pharmaceuticals, telecommunications, government operations, and scientific research, potentially supporting the stock's premium valuation.

Is NVDA Stock Overvalued?

Nvidia just surpassed the $5 trillion market cap milestone and is up nearly 29,000% over the past decade. It means a $1,000 investment in NVDA stock in October 2015 would be worth close to $290,000 today.

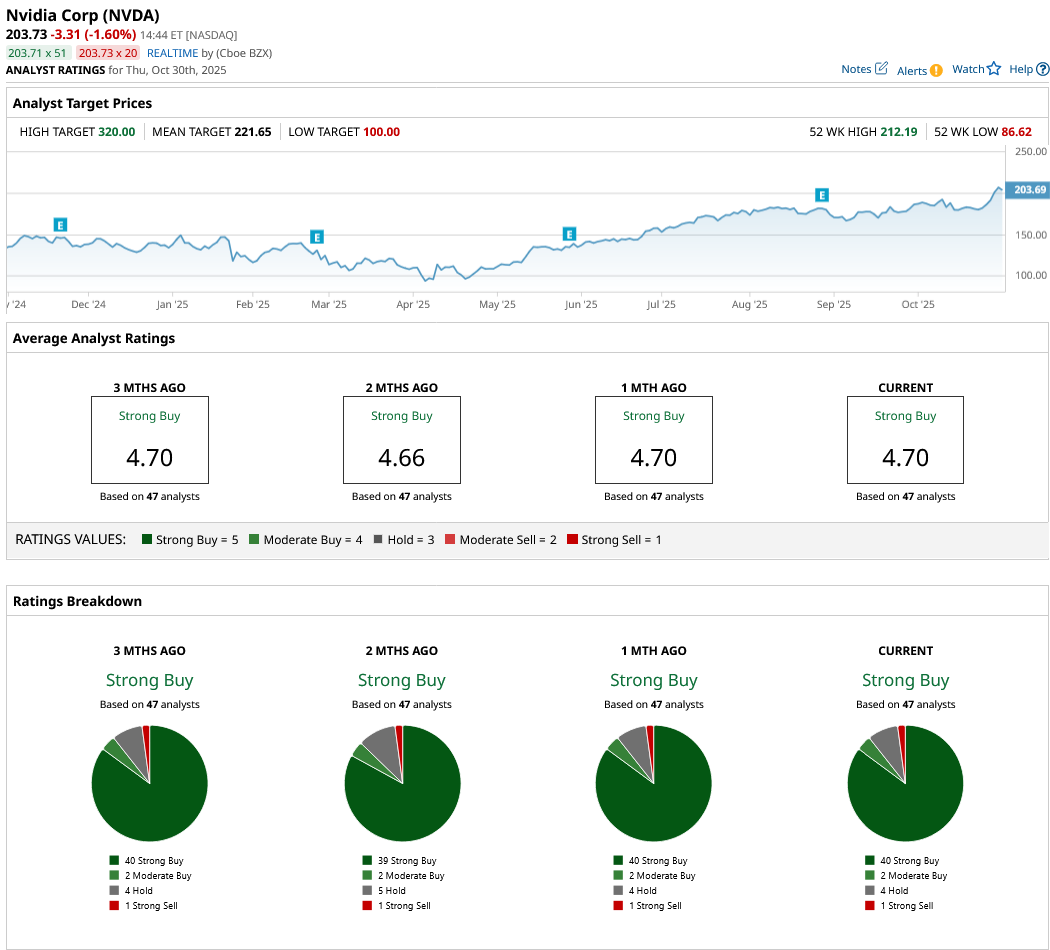

Out of the 47 analysts covering NVDA stock, 40 recommend “Strong Buy,” two recommend “Moderate Buy,” four recommend “Hold,” and one recommends “Strong Sell.” The average NVDA stock price target is $222 above the current price of $203.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Use This Treasury Strategy to Invest in US Bonds for Steady Income

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- 1 Fintech Stock Under $400 to Buy and Hold Forever

- 'Our GPUs Are Everywhere’ According to CEO Jensen Huang as Nvidia Doubles Down on AI, Quantum, and 6G