Cork, Ireland-based Johnson Controls International plc (JCI) engineers, manufactures, commissions, and retrofits building products and systems. With a market cap of $74.2 billion, Johnson Controls' operations span the U.S., Europe, the Indo-Pacific, and internationally.

JCI has notably outperformed the broader market in 2025 and over the past year. The stock has soared 44.7% on a YTD basis and 49.7% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 16% gains on a YTD basis and 17.4% returns over the past year.

Narrowing the focus, JCI has also outpaced the SPDR S&P Homebuilders ETF’s (XHB) marginal gains in 2025 and a 9.1% decline over the past 52 weeks.

Johnson Controls’ stock prices gained 1.1% in the trading session following the release of its better-than-expected Q3 results on Jul. 29. Driven by solid organic growth, the company’s overall topline for the quarter grew 2.6% year-over-year to $6.1 billion, beating the Street’s expectations by 1.1%. Further, its adjusted EPS surged 10.5% year-over-year to $1.05, exceeding the consensus estimates by 5%. On an even more positive note, JCI’s systems and services backlog increased by 11% organically to $14.6 billion, boosting investor confidence.

For fiscal 2025, which ended in September, analysts expect JCI to deliver an adjusted EPS of $3.70, marginally down from $3.71 reported in 2024. However, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

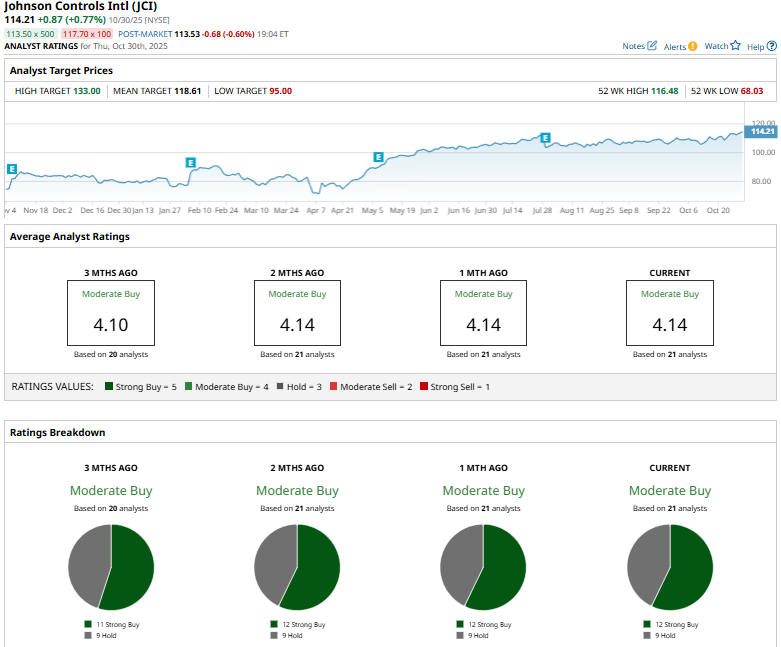

JCI has a consensus “Moderate Buy” rating overall. Of the 21 analysts covering the stock, opinions include 12 “Strong Buys” and nine “Holds.”

This configuration is slightly more optimistic than three months ago, when 11 analysts gave “Strong Buy” recommendations.

On Oct. 15, JP Morgan (JPM) analyst Stephen Tusa reiterated an “Overweight” rating on JCI and raised the price target from $105 to $125.

JCI’s mean price target of $118.61 suggests a modest 3.9% upside potential. Meanwhile, the street-high target of $133 represents a notable 16.5% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- PayPal Is Paying Its First-Ever Dividend. Should You Snap Up PYPL Stock Now?

- Use This Treasury Strategy to Invest in US Bonds for Steady Income

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- 1 Fintech Stock Under $400 to Buy and Hold Forever