Volatility comes and goes... but through that, some companies consistently keep paying.

Dividend Kings are the elite group of companies that have offered shareholders 50 years of consistent dividend growth. These companies have beaten recessions, periods of inflation, and various market uncertainties while delivering stable and long-term payouts. This is the kind of consistency that offers retirees the possibility of generational wealth.

But not all Dividend Kings are a buy today. Some have higher cash flow and more stable payout ratios, some offer higher yields, and some have Wall Street’s stamp of approval. I prefer a trifecta - companies that tick all the boxes. That's why today, I'll cover the Dividend Kings that meet all these criteria.

How I Came Up With The Following Stocks

I used Barchart’s Stock Screener to find the highest-yielding companies on my watchlist.

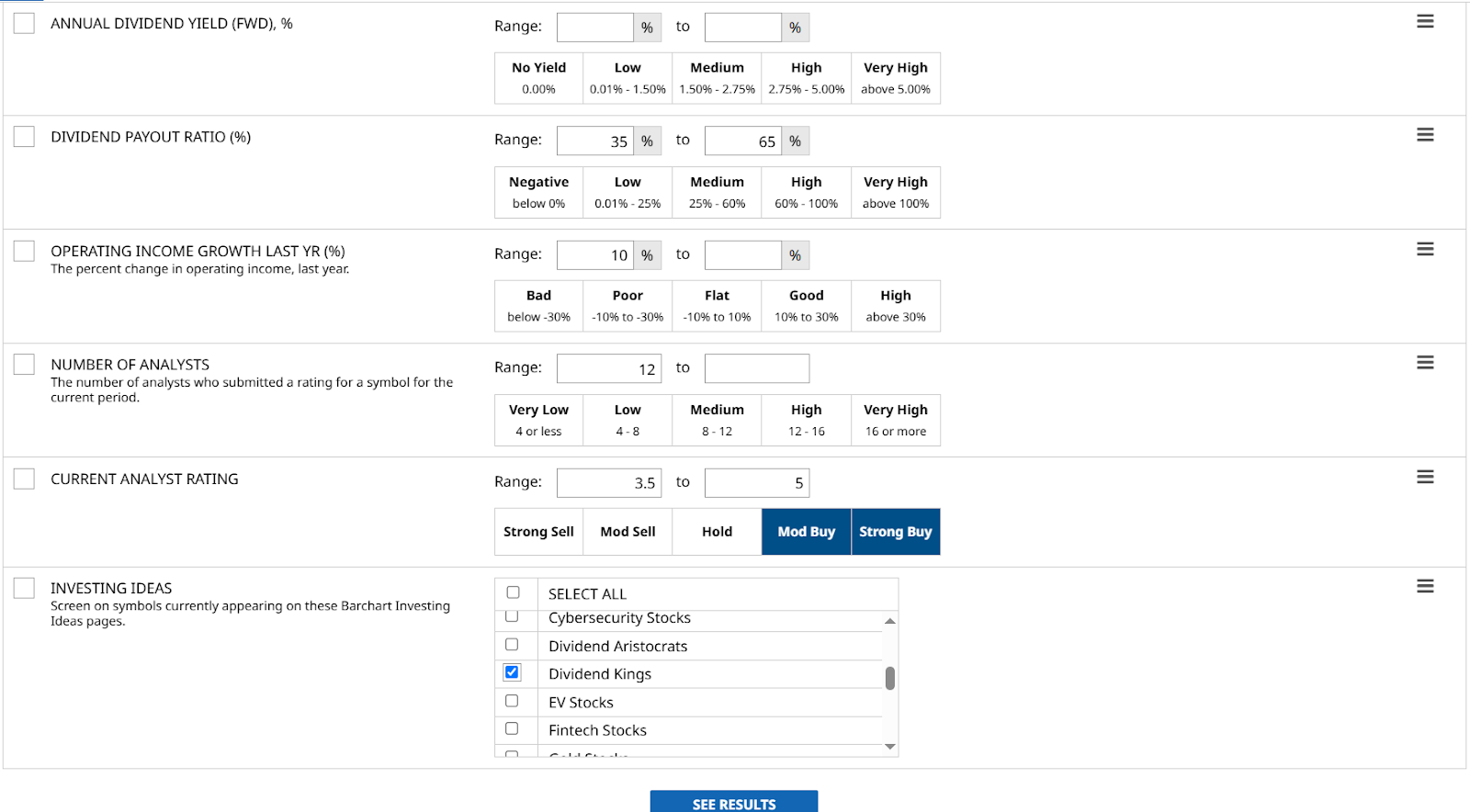

- Annual Dividend Yield (FWD), %: Left to blank so I can sort it from highest to lowest

- Dividend Payout Ratio (%): 35 – 65%. This is the sweet spot as I am looking for companies that pay fair dividends without overextending. This also means that they are balancing customer value and company growth.

- Operating Income Growth Last Year (%): At least 10%

- Number of Analysts: 12 or higher. A higher number means higher confidence in the rating.

- Current Analyst Rating: 3.5 – 5. Stocks that analysts call a “Moderate” to “Strong Buy”. Only the best will do.

- Investing Ideas: Dividend Kings. I’m looking to limit my search to companies that exhibited long-term resilience and consistent performance.

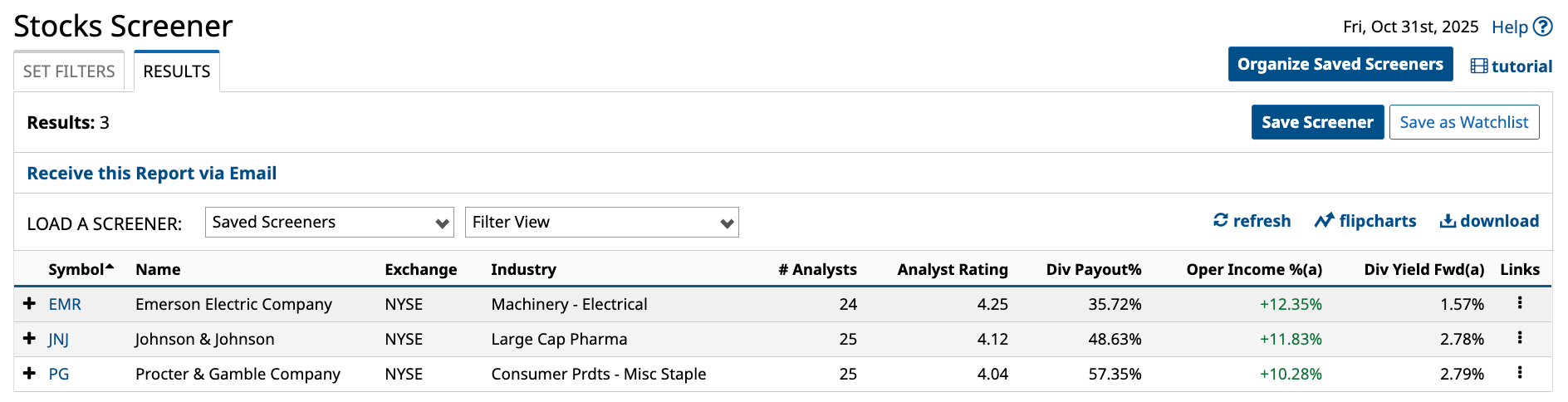

I got exactly three results after running the screen. I will cover them based on the highest to lowest dividend yield:

Let’s get to the first Dividend King, starting with:

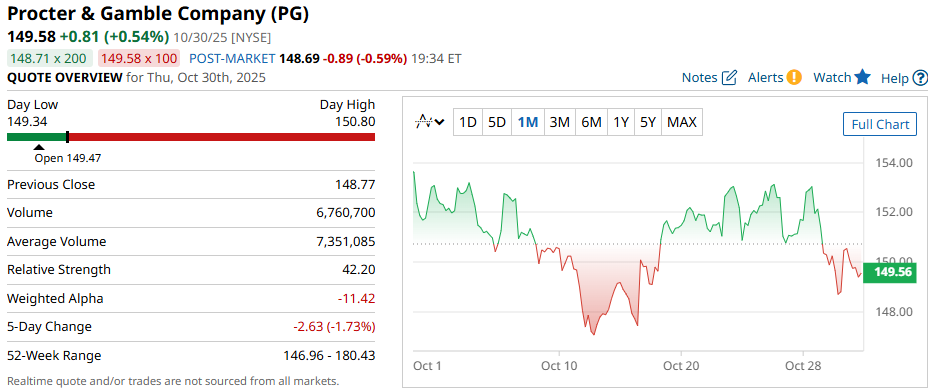

Procter & Gamble Company (PG)

Procter & Gamble manufactures consumer goods that people use worldwide. The company was founded in 1837 and now supplies a wide range of products, including health, baby, fabric, home, beauty, and grooming.

You most likely have some of their products at home, as it’s the company behind Pampers, Tide, Crest, and more. In fact, P&G's Charmin just launched its largest toilet paper roll yet, the Forever Roll, which features 1,700 sheets that can last up to one month, resulting in strong consumer interest. It is backed by a 30-day money-back guarantee, highlighting the company's convenience-driven approach.

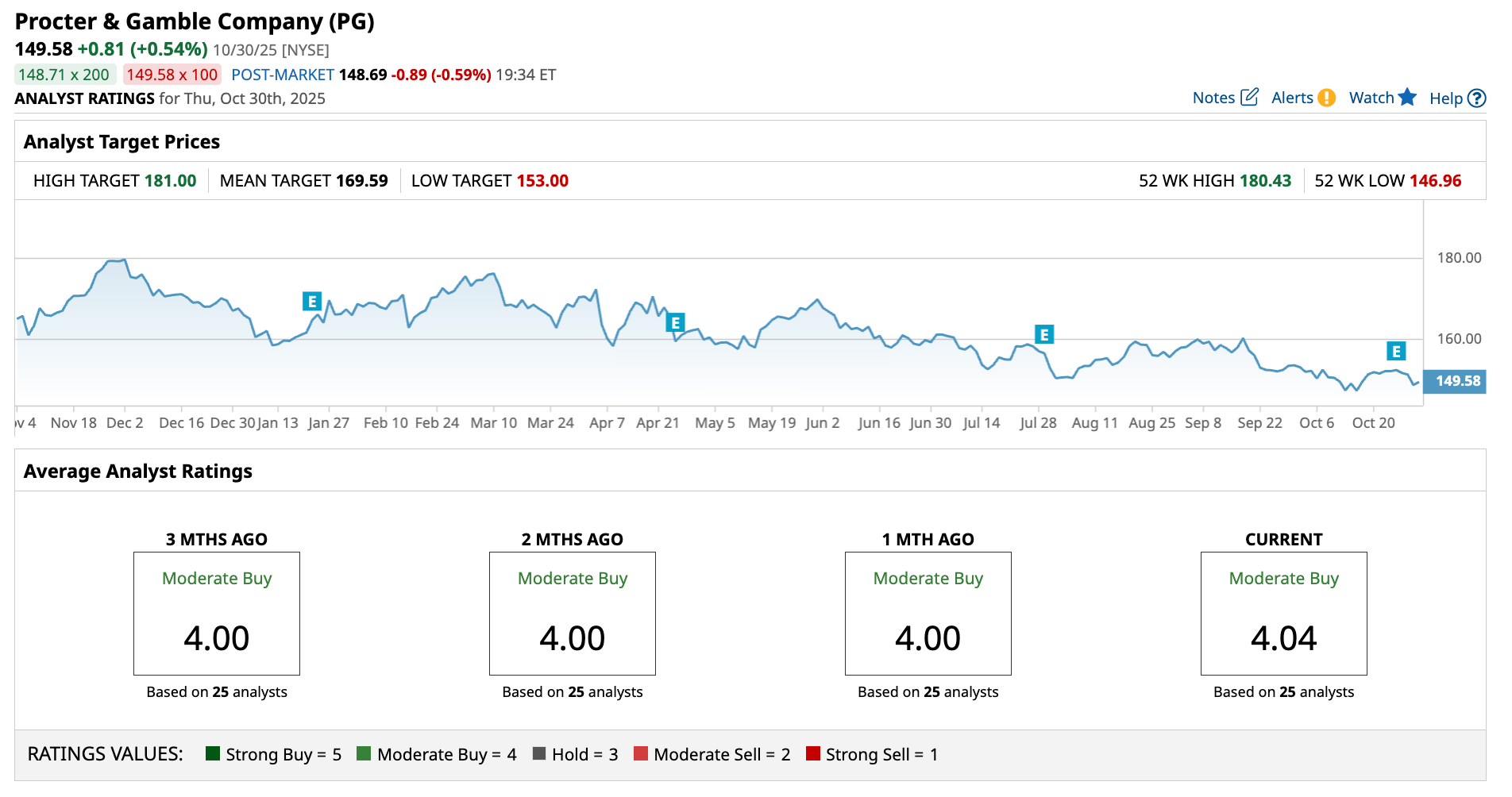

According to the company’s most recent financials, P&G reported sales rose 3% YOY to $22.4 billion with net income up 20%. The company also pays a forward annual dividend of $4.23, translating to an approx. yield of 2.8%. And with a dividend payout ratio of approximately 57%, it reflects a balance between shareholder value and company growth - exactly what income-focused investors want. And Wall Street tends to agree.

A consensus among 25 analysts rates the stock a “Moderate Buy”, a sentiment consistent for the past three months.

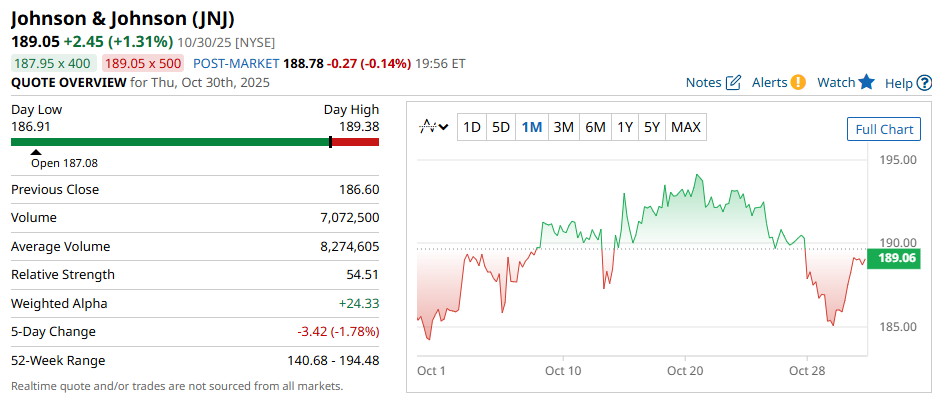

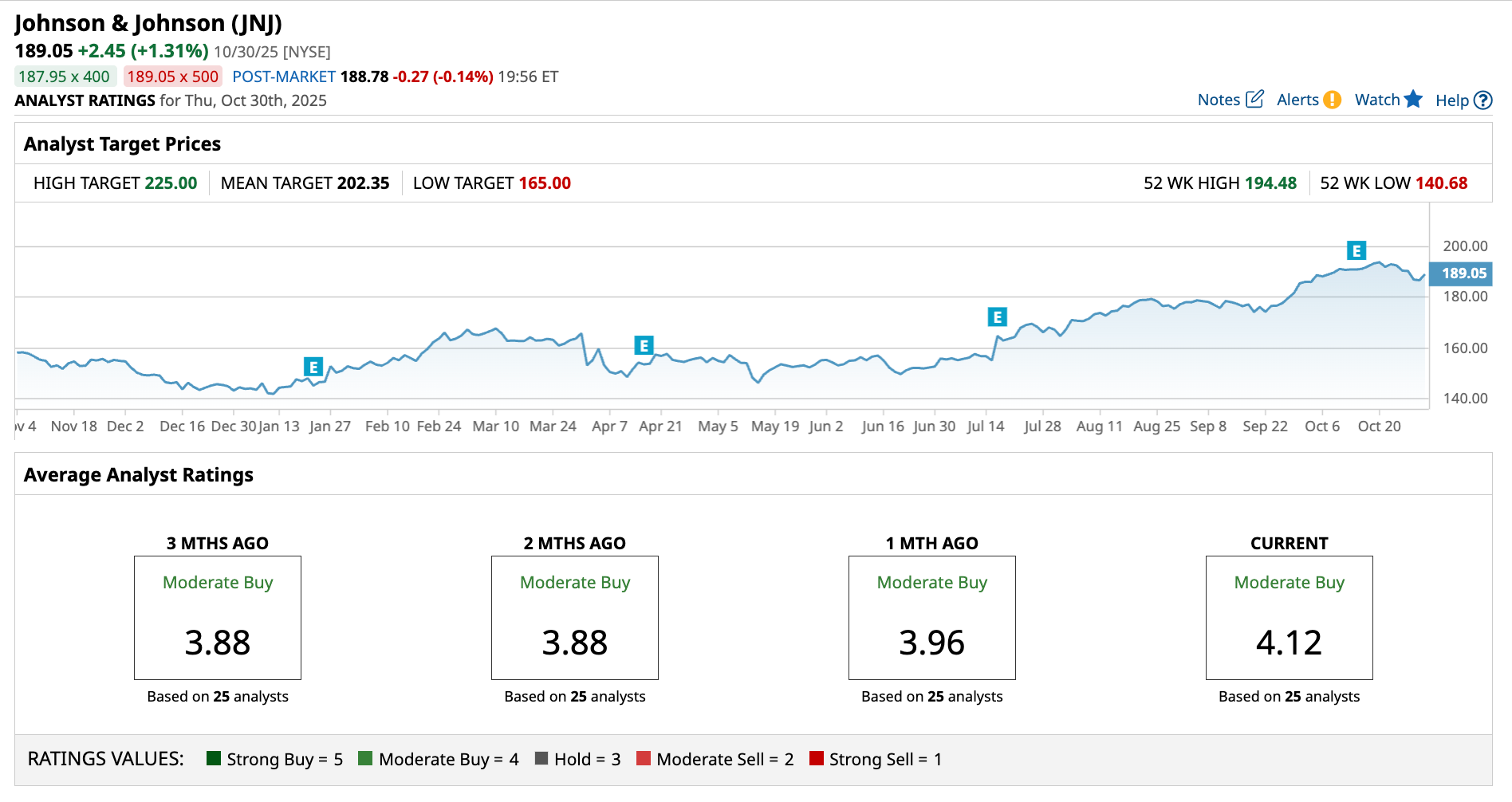

Johnson & Johnson (JNJ)

The next Dividend King on my list is Johnson & Johnson, a company that was founded in 1886 and is now one of the driving forces in healthcare. The company is famous for making products like Band-Aid and Listerine, but it does much more. Today, it operates under two main segments: J&J Innovative Medicine and MedTech.

Notably, Johnson & Johnson MedTech just announced that it’s working with NVIDIA to integrate AI simulation in developing its next-generation robotic surgery systems. NVIDIA will provide highly realistic virtual operating rooms and models to improve surgeon training, expected in 2026.

In its most recent quarterly financials, Johnson & Johnson reported sales were up around 7% YOY to $24 billion, and net income rose over 91% to $5.2 billion. They also pay a forward annual dividend of $5.20, translating to a yield of approx. 2.8%. And with a 49% dividend payout ratio, there’s a high potential for further dividend growth.

A consensus among 25 analysts rates the stock a “Moderate Buy”, with a conviction strengthening over the past three months.

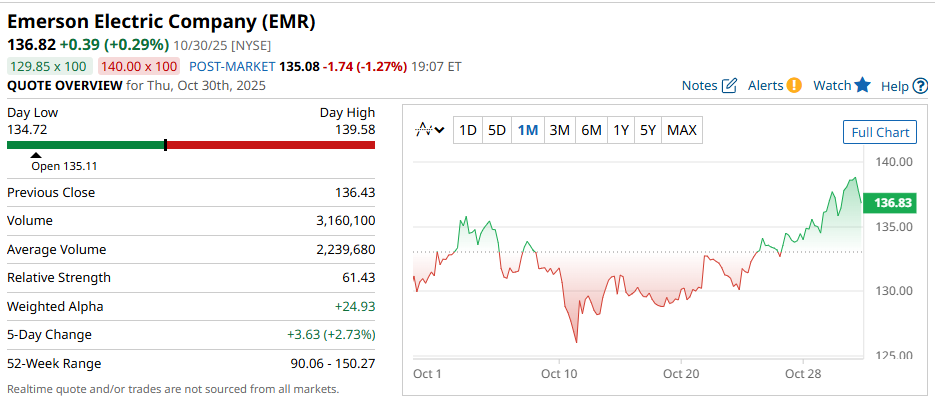

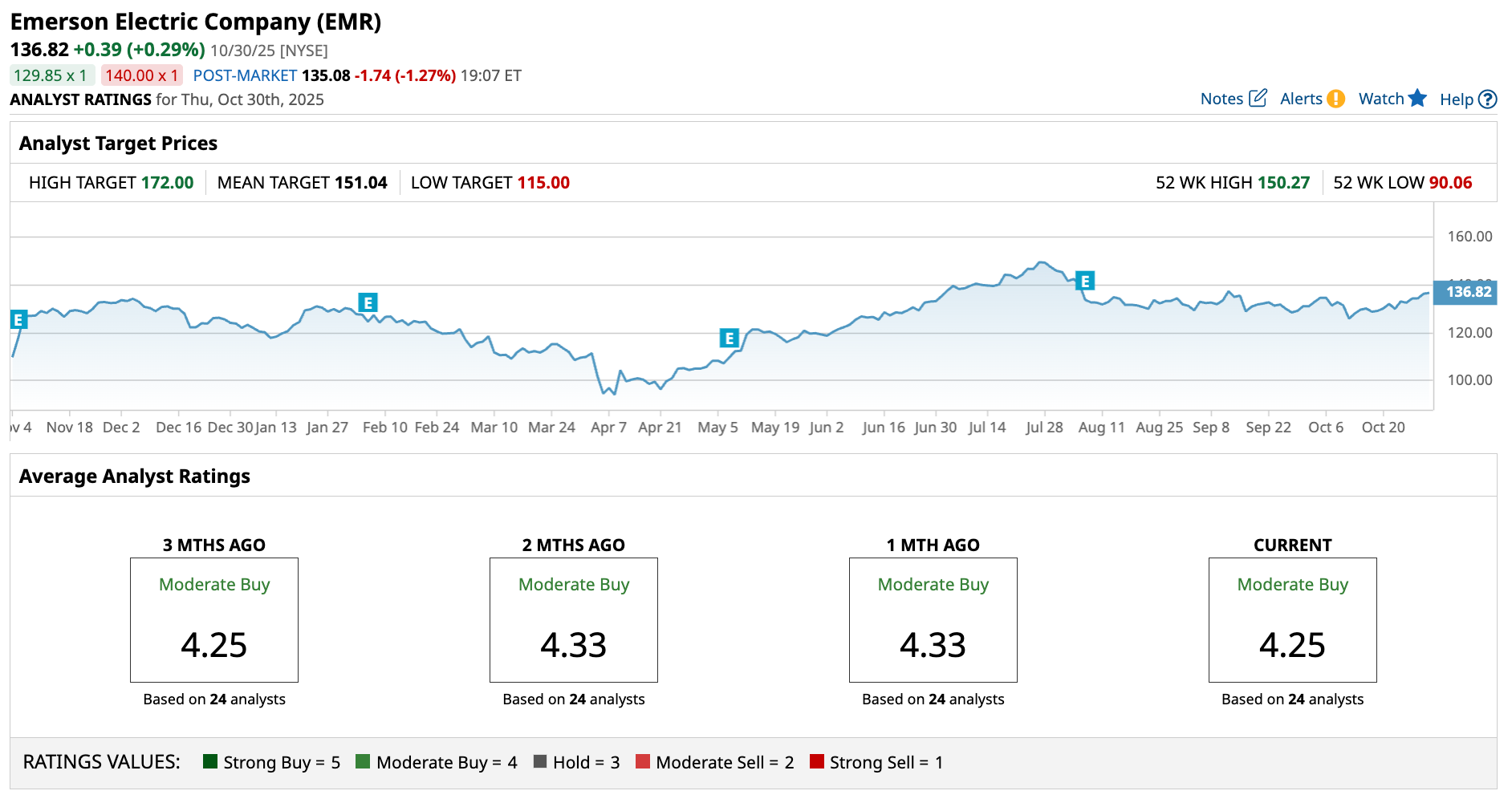

Emerson Electric Company (EMR)

The last Dividend King on my list is Emerson Electric, a company that was founded in 1809 and today specializes in automation solutions while helping industrial and commercial businesses achieve efficiency and sustainability.

Speaking of efficiency, Emerson recently launched its upgraded AMS Trex Device Communicator that now supports Bluetooth connectivity, app support, and increased processing power. In English? Field techs love it because it can calibrate over 2,500 field instruments with one tool.

In its most recent quarterly financials, Emerson reported sales rose ~4% YOY to $4.55 billion and net income was up over 78% to $586 million. The company also pays a forward annual dividend of $2.11 a share, translating to a yield of around 1.5%. Emerson also has a very healthy 35.72% dividend yield payout ratio that will allow the company to easily increase the payout.

A consensus among 24 analysts rates the stock a “Moderate Buy”, a sentiment that has been consistent over the past three months.

Final Thoughts

These three Dividend Kings: Procter & Gamble, Johnson & Johnson, and Emerson Electric are a testament to what long-term consistency looks like. Aside from their proven records, these companies exhibit growing profitability and dividends even amidst changing market environments, making them an attractive choice for income-focused investors.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Only 3 Dividend Kings You’ll Ever Need for a Lifetime of Income

- This Pair of New 2X ETFs Goes Double or Nothing on Big Tech. Should You Chase the Volatility in Apple, Nvidia, and Microsoft Now?

- Analysts Say You Should Ignore ‘Short-Term Blips’ and Keep Buying Microsoft Stock

- This Penny Stock Just Reported a 1,000% Increase in Revenue. Should You Buy It Here?