Western Digital (WDC) stock has skyrocketed nearly 280% this year and is the top performer in the S&P 500 Index ($SPX). The driving force behind this stellar rally is the strong artificial intelligence (AI)-driven demand for its storage solutions.

While much of the attention has gone to the companies developing AI models and software, the foundation of this technological revolution depends on hardware, particularly data storage. That’s where Western Digital shines. The company designs and manufactures storage devices based on hard disk drive (HDD) technology, which help in storing vast amounts of data generated and processed by AI systems.

As AI adoption accelerates globally, data centers and cloud service providers are racing to secure high-capacity drives. This surge in demand is also driving up prices and creating favorable conditions for storage manufacturers, such as Western Digital. The result has been a sharp rise in revenue and profits.

In fiscal 2025, Western Digital’s revenue increased by 51%, and its gross margin expanded significantly as average selling prices and stronger demand drove profitability. The momentum hasn’t slowed in fiscal 2026. During the first quarter, revenue climbed another 27% year-over-year, while adjusted gross margin widened by 660 basis points. WDC’s adjusted earnings per share (EPS) soared 137% compared to the same period last year, reflecting solid demand and the company’s continued operational strength and pricing power.

While WDC is witnessing strong demand, its valuation remains attractive relative to its earnings growth trajectory. The company’s exposure to the expanding AI ecosystem and improving fundamentals suggest that there could still be room for the stock to run.

Western Digital Set for Continued Growth in 2026 and Beyond

Western Digital is well-positioned for solid growth in 2026 and the years ahead, driven by a rapid shift toward AI-driven workloads. As hyperscalers accelerate their investment in AI and data-intensive applications, the demand for massive storage capacity is skyrocketing, supporting the need for Western Digital’s high-capacity drives.

The company’s latest ePMR products, which deliver high capacity, are seeing record adoption, with shipments exceeding 2.2 million units during the last reported quarter.

To stay ahead of this demand curve, Western Digital is investing in new technologies while improving manufacturing efficiency through automation and AI tools. The increasing complexity and longer lead times of high-capacity drives are also prompting customers to plan further ahead, strengthening long-term partnerships.

That forward visibility is already translating into solid orders. Western Digital’s seven largest customers have placed purchase orders extending into the first half of 2026, with five covering the entire year. One major hyperscale client has even signed an agreement through 2027. These orders endorse the company’s technology roadmap and reliability.

A key pillar of that roadmap is the transition to Heat-Assisted Magnetic Recording (HAMR) technology, which promises to significantly expand storage density. Western Digital is on track to begin HAMR qualification with one hyperscale customer in early 2026 and plans to include up to three more by year-end, paving the way for volume production in the first half of 2027. Meanwhile, the company will begin qualifying its next-generation ePMR drives in early 2026, ensuring continuity and scalability for its data center partners.

Beyond its hard drive business, Western Digital’s platforms division is also benefiting from robust growth in both on-premise and cloud storage, supported by the rise of AI, social media, and data-rich applications.

With multiple growth engines firing, Western Digital is well-positioned to deliver sustained revenue growth and profitability in 2026 and beyond.

WDC Stock: Is It Too Late to Buy?

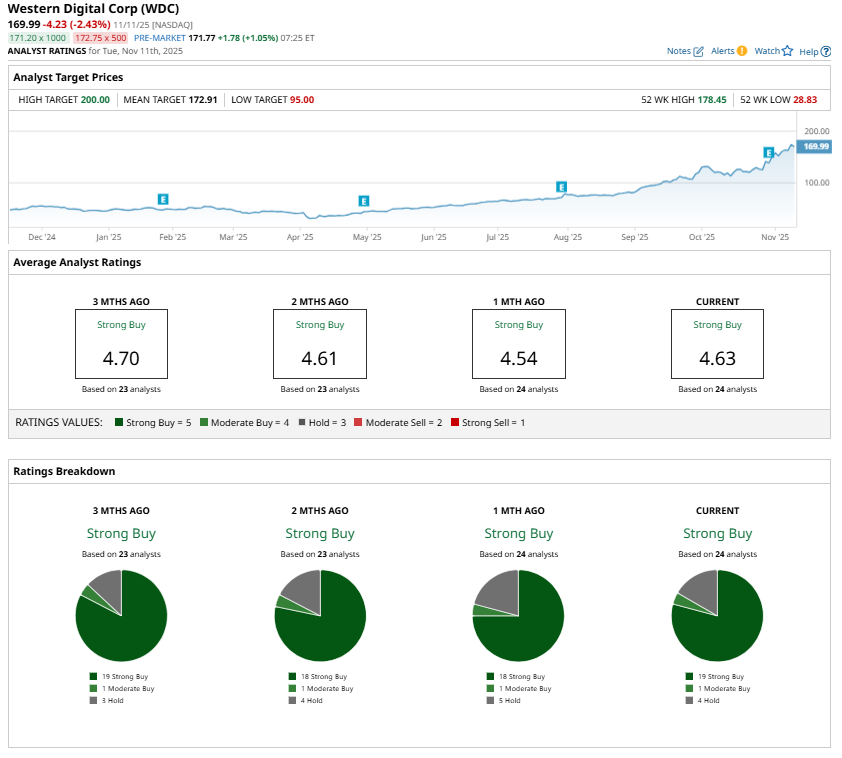

WDC is poised to benefit from AI-driven demand for its data storage solutions. Meanwhile, it trades at a forward price-earnings ratio of just 25.9x, a reasonable multiple considering the company’s strong earnings growth potential. Analysts expect its EPS to surge by 48.3% in fiscal 2026 and increase by an additional 50.3% in 2027. These projections make WDC stock attractive. Moreover, the stock carries a “Strong Buy” consensus rating.

With its earnings poised for rapid expansion, valuation still looking reasonable, and analysts maintaining a bullish outlook, WDC stock offers investors more upside ahead. This implies that it might not be too late to buy WDC stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Rivian Wants to Be the Next Tesla With Huge Pay Package for CEO RJ Scaringe. Should You Buy RIVN Stock?

- AMD Strengthens Its Bull Case. Can the Stock Hit $350 in a Year?

- Is GOOG Stock a Buy or Sell as Michael Burry Accuses Hyperscalers of ‘Fraud’?

- Western Digital Stock Soars 280% This Year. Is WDC Worth Chasing Now?