In a world racing toward compute-intensive artificial intelligence (AI) and cloud infrastructure, Advanced Micro Devices (AMD) is carving out an arguably compelling position in the semiconductor space. At the company's recent analyst day on Nov. 11, CEO Lisa Su boldly projected that its total addressable market in the data center and AI domain could hit $1 trillion by 2030, doubling from its previous $500 billion estimate, underscoring the unrelenting demand for AI computing.

Su highlighted that AI and high-performance computing have become foundational technologies, driving “insatiable demand” across industries. AMD expects billions in data center revenue by 2027 and targets double-digit AI market share with an 80% compound annual growth rate (CAGR) over the next three to five years.

AMD also revealed $45 billion in new custom design wins and noted that its Instinct GPUs are now deployed at seven of the top 10 AI companies, positioning AMD strongly against Nvidia’s (NVDA) dominance.

With these dynamics in mind, this could be the perfect time to seize this massive opportunity by hitting the buy button.

About Advanced Micro Devices Stock

Advanced Micro Devices is a Santa Clara, California–based fabless semiconductor firm, known for high-performance computing solutions including its Ryzen, EPYC, Threadripper, Radeon, and Instinct product lines. Since its founding, AMD has evolved into a major player in CPUs, GPUs, adaptive SoCs, FPGAs, and AI accelerators. AMD’s market capitalization currently stands at around $402 billion, placing it among the top semiconductor firms globally.

The momentum behind AMD stock has been striking. Over the past month, shares have climbed around 13%. This acceleration isn’t happening in a vacuum; it comes on the back of CEO Lisa Su’s bold update that AMD now sees the total addressable market for AI data centers swelling to $1 trillion. That message has clearly resonated, and the market is treating AMD not just as a CPU/GPU vendor but as a front-runner in the AI infrastructure race. AMD stock surged 9% intraday on Nov. 12.

On a year-to-date (YTD) basis, AMD stock has surged by 104%, leaving the broader market well behind. Over the past 52 weeks, AMD has also delivered a gain of 78%, a robust performance that underscores the strength of its narrative. Notably, the stock is trading just 7.5% below its 52-week high of $267.08 reached on Oct. 29.

AMD stock is currently priced at 79.28 times forward earnings, trading at a premium valuation compared to the sector median and its historical average.

Steady Q3 Performance

Advanced Micro Devices released its third-quarter 2025 results on Nov. 4. The company posted record revenue of $9.2 billion, a 36% year-over-year (YOY) increase. Adjusted earnings per share also increased 30% from the prior-year quarter to $1.20, surpassing analyst expectations of about $1.17.

Non-GAAP gross margin was 54%, essentially flat compared to the prior-year quarter. Non-GAAP operating income in Q3 2025 came in at $2.2 billion, up 30% from the year-ago quarter, while operating margin slightly declined to 24% from 25% in the prior year quarter.

Breaking the revenue down by segment, AMD’s data-center business grew about 22% YOY to $4.3 billion, while its client and gaming segment surged 73% to around $4 billion, driven by strong Ryzen and Radeon product demand.

For Q4 2025, AMD provided guidance for revenue of approximately $9.6 billion, plus or minus $300 million, representing YOY growth of approximately 25% at the midpoint. Non-GAAP gross margin is expected to be around 54.5%.

Analysts covering AMD predict its fiscal 2025 EPS to rise by 19% YOY to $3.13, before improving by around 73% annually to reach $5.43 in fiscal 2026.

What Do Analysts Expect for AMD Stock?

Recently, Truist reaffirmed its “Buy” rating and $279 price target on AMD, citing its strengthening position as a “trusted partner” in the data center and AI markets. Truist pointed to AMD’s recent analyst day, where management outlined a $1 trillion total addressable market. While acknowledging execution risks, Truist said management’s confidence in customer funding and build-out capacity helps ease those concerns.

TD Cowen also reiterated a “Buy” rating with a $290 price target, reaffirming confidence in the company’s long-term growth story. The firm sees major upside driven by the potential $1 trillion data center silicon TAM by 2030, estimating AMD could deliver over $20 EPS within four years through steady AI market share gains and strong core business expansion. While TD Cowen also cited that execution and customer traction remain key risks, the firm believes AMD has the resources and roadmap to thrive in what it calls “the most important market in tech.”

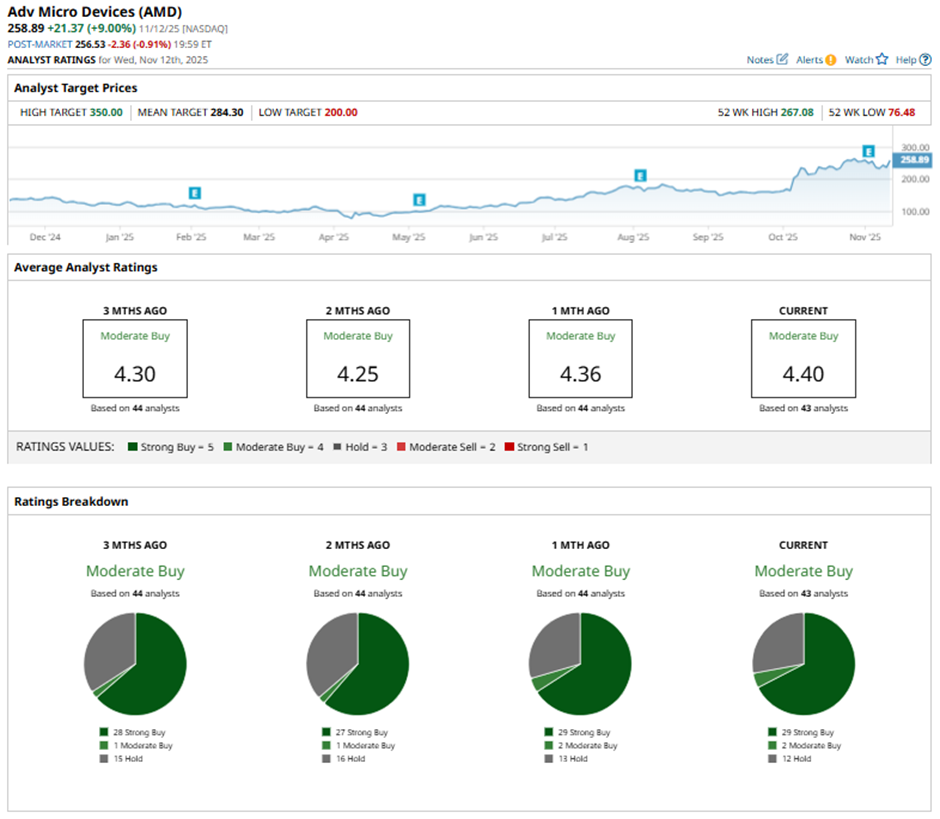

AMD stock has a consensus “Moderate Buy” rating overall. Out of 43 analysts covering the semiconductor stock, 29 recommend a “Strong Buy,” two give a “Moderate Buy,” and 12 analysts stay cautious with a “Hold” rating.

The average price target of $288.30 indicates an upside potential of 17% from current levels. Meanwhile, the Street-high target price of $380 suggests as much as 54% upside ahead.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Says Investors Should Measure Their Investing Success On ‘Slugging Percentage, Not Batting Average’

- Oklo Is ‘Setting the Stage’ for a Revolution in Nuclear Energy. Should You Buy OKLO Stock Here?

- This Semiconductor Stock Just Got a New Street-High Price Target. Should You Buy It Now?

- Nasdaq Year-End Playbook Decode 5-Year Correlations and Seasonal Q4