Nvidia (NVDA) is set to release its fiscal Q3 2026 earnings on Nov. 19 after the close of markets. The world’s most valuable company's earnings are always an event worth watching, but even more so this time around, as the artificial intelligence (AI) rally is getting tested.

While “AI bubble” chatter has been an intermittent theme, many, including Michael Burry of “Big Short” fame, have made some serious allegations and accused the Big Tech giants of accounting fraud by understating their depreciation by extending the useful life of their computing assets, predominantly Nvidia chips. Burry, who subsequently deregistered his Scion Asset Management, disclosed a short position on Nvidia in Q3.

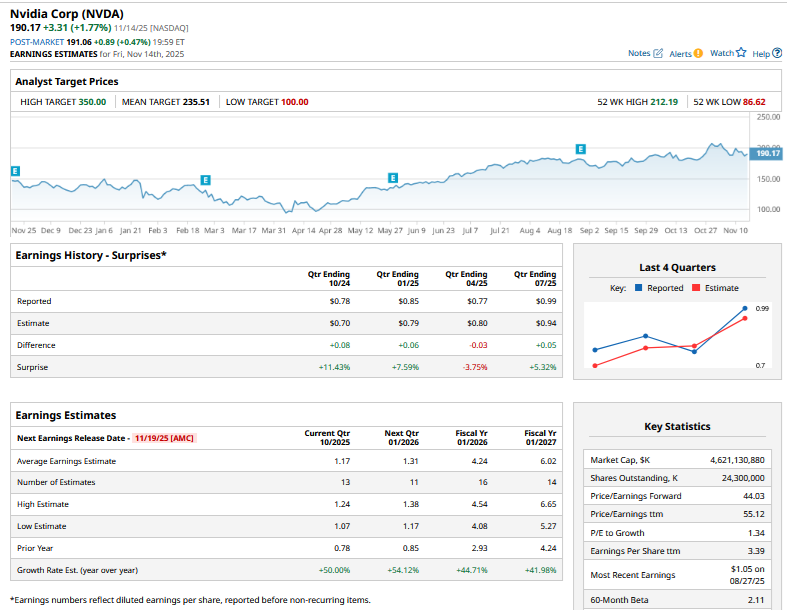

Coming back to Nvidia’s earnings, while no one really expects it to miss the estimates that tend to be conservative, the stock’s post-earnings price action often tends to diverge from the “beat.” Even after the fiscal Q2 earnings release, NVDA shares fell following the conference call only to rise to new record highs ahead of the next report. Could it be the same story this time around, or should you buy the stock ahead of the Q3 report? Let’s explore, beginning with the earnings estimates.

Nvidia Q3 Earnings Estimates

Analysts expect Nvidia to report revenues of $54.94 billion in fiscal Q3, which is slightly higher than the $54 billion that the company guided at the midpoint. The company’s earnings per share (EPS) are also projected to rise by 50% to $1.17.

What to Watch in Nvidia’s Earnings?

There would be numerous things that I would be watching in Nvidia’s earnings this time around. These include:

- Addressing the depreciation question: At Nvidia’s AI conference in March, CEO Jensen Huang joked, “When Blackwell starts shipping in volume, you couldn't give Hoppers away,” which implied that the chips depreciate quite fast—something Burry has also highlighted. During the Q3 earnings call, I would watch out for management’s commentary on the burning topic of chip depreciation.

- Investment spree: Nvidia has been on an investment spree and has announced an investment of up to $100 billion in OpenAI, $5 billion in Intel (INTC), and committed to investing 2 billion British pounds in AI startups in the U.K. Some of these deals, particularly with OpenAI, have raised concerns over circular financing, where the investee company uses the funds to buy more of Nvidia chips. On a similar note, I would watch out for the subsequent deal that OpenAI announced with Advanced Micro Devices (AMD).

- Rising competition: Apart from chip companies like AMD vying for a share of the lucrative AI chip market, we also have competition from Big Tech companies that are building custom chips. For instance, Anthropic has announced plans to buy Tensor Processing Units (TPUs) worth billions of dollars from Alphabet (GOOG) (GOOGL). Even Tesla (TSLA) CEO Elon Musk touted the possibility of building a massive fab factory to produce chips. In China, tech companies like Alibaba (BABA) and XPeng Motors (XPEV) have pivoted to custom chips, and the former also onboarded China Unicom as its first major external customer. During Nvidia's Q3 earnings call, I would watch out for commentary on the rising competition in the AI chip space.

- The China question: A question mark remains over Nvidia’s China business. While the U.S. government has since allowed exports to resume, pending a revenue-sharing deal, there remains considerable uncertainty over the company’s China business. Moreover, China has been cautioning domestic companies against using Nvidia chips over fears of “backdoors”—an allegation the U.S. tech giant vehemently denies. Huang has incidentally flip-flopped on China’s progress in GPUs, and while in a recent interview, he said that the quasi-communist country will “win the AI race,” hours later, a statement from Huang on Nvidia’s X account said, “China is nanoseconds behind America in AI.”

Should You Buy NVDA Stock or Wait?

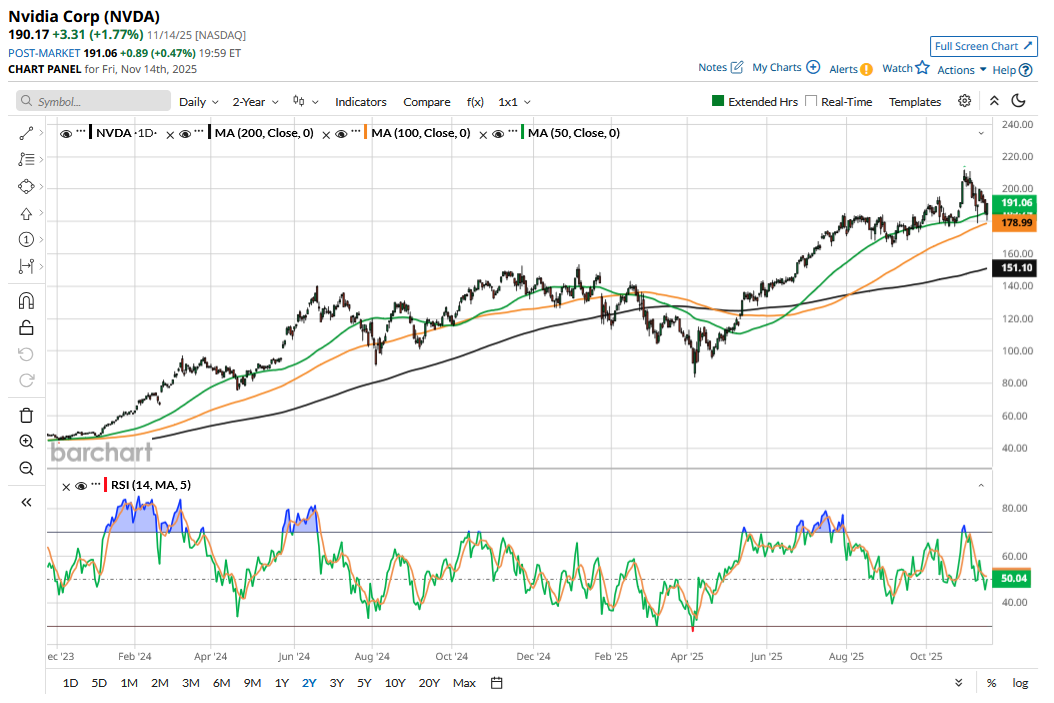

While NVDA stock has had the propensity to fall despite earnings beats, I am constructive on the stock heading into the fiscal Q3 report, as some of the damage has already been done amid the recent drawdown. I expect upbeat commentary from Nvidia on the chip demand outlook, especially as the company prepares to release Vera Rubin chips next year.

The AI capex boom is far from over, and Big Tech companies like Meta Platforms (META), Microsoft (MSFT), Alphabet, and Amazon (AMZN) have raised their capex guidance and see it rising even further. Finally, at a forward price-to-earnings multiple of just over 44x, NVDA stock looks reasonably valued considering the continued growth the company is witnessing.

To sum it up, I see the chances of a post-earnings dip following Nvidia’s Q3 report as quite slim and would instead bet on a small pop considering the fair valuations and expected positive commentary on the AI demand outlook from Nvidia's management.

On the date of publication, Mohit Oberoi had a position in: META , NVDA , TSLA , MSFT , GOOG , AMZN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart