The Financial Times recently reported that Apple (AAPL) may be looking for a new CEO to replace Tim Cook, reigniting the debate around his lack of performance since the emergence of AI. Analysts had been worried about Apple’s slow AI execution and a delayed launch of Apple Intelligence, which itself didn’t impress investors. Many had previously cited Apple’s ecosystem as the reason why the company could afford to take its time in coming up with its own AI offerings. It is now clear that the company has failed to execute its AI strategy, and any mention of a new CEO reignites the debate.

Tim Cook has been a great leader for Apple, but critics point out that his expertise lies not in innovation but in supply chain management and operational efficiency. That is what propelled Apple to become a tech giant, not the underlying technology, which Cook inherited in 2011.

It is also clear that the future will be all about AI. Any company that lags in this department will not be able to catch up. This is one reason why hyperscalers have invested hundreds of billions of dollars in their AI infrastructure. For investors, the major question now is who will set the company’s course right? CFO Luca Maestri and COO Jeff Williams have already quit so far this year. John Ternus, who currently serves as the senior vice president of hardware engineering, is a possible successor, but nothing is confirmed yet.

Tim Cook has openly said that Apple being late to a technology isn’t something new. The company takes its time to perfect any technology that it launches. However, as other tech companies fight to retain talent, Apple taking a back seat is looking more like a risk now than a strategy.

About Apple Stock

Apple is an electronics, software, and services company known for its flagship iPhone smartphone. It sells its hardware through its retail and online stores in addition to third-party carriers and resellers. The company is based in Cupertino, California.

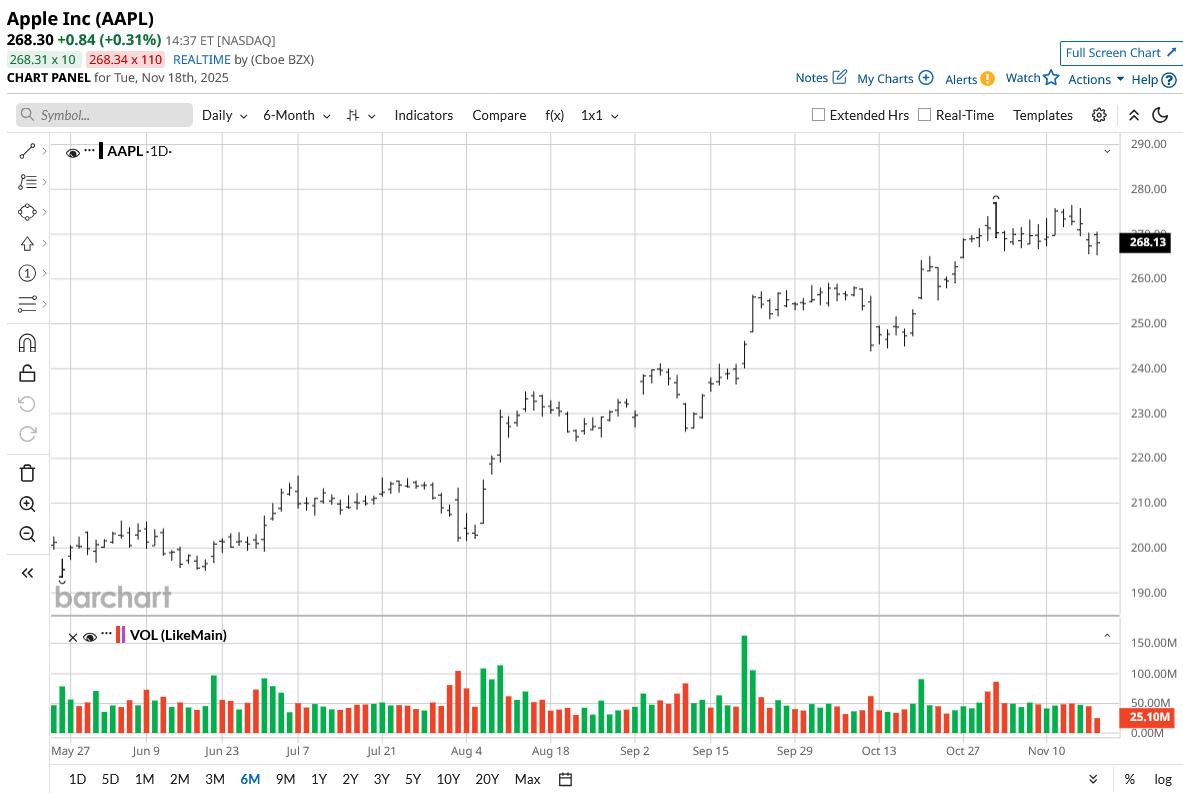

AAPL stock is trading close to its all-time highs, with the company valued at nearly $4 trillion, the second largest in the world after Nvidia. Despite this, it has underperformed the S&P 500’s ($SPX) 13.3% year-to-date (YTD) returns with its meager 7.2% performance so far this year. The stock was down 20% from its all-time highs in the first half of the year as concerns emerged regarding the iPhone maker’s AI plans, or the lack of them.

Out of all the Magnificent Seven stocks, only Nvidia (NVDA), Microsoft (MSFT), and Alphabet (GOOG) (GOOGL) have outperformed the S&P 500 so far this year. Apple, therefore, finds itself among the underperformers. A look at their growth makes Apple look even worse. Apple’s 3-year revenue CAGR of 1.81% paints an abysmal picture as its peers register double-digit growth. This is just a reflection of how Apple failed to launch AI features in its phones while Chinese and other foreign phone makers raced to launch their AI products.

Apple Beats Earnings Estimates

Apple announced its Q4 earnings on Oct. 30, reporting an 8% year-over-year (YoY) revenue growth. The services segment grew 15% YoY, well-complemented by iPhone growth. The reported EPS of $1.85 comfortably beat consensus estimates of $1.77, while the $102.47 billion revenue only just managed to beat expectations.

Investors can look forward to a 12% YoY growth in the ongoing quarter. iPhone revenue is expected to grow by double digits. After accounting for tariff-related costs, gross margins are likely to fall between 47% and 48%.

Tim Cook also announced on the earnings call that the company was committed to investing over $600 billion over the next four years, focusing on AI and advanced manufacturing. On the product side, the iPhone 17 Pro, M5 iPad Pro, and M5 MacBook Pro all got a mention. Cook focused on how AI would help improve the products that people already love. He expects the December quarter to be the best ever for the company, but this still does not address why the company’s innovation in AI isn’t generating as much excitement as its product launches usually do.

What Analysts Are Saying About AAPL Stock

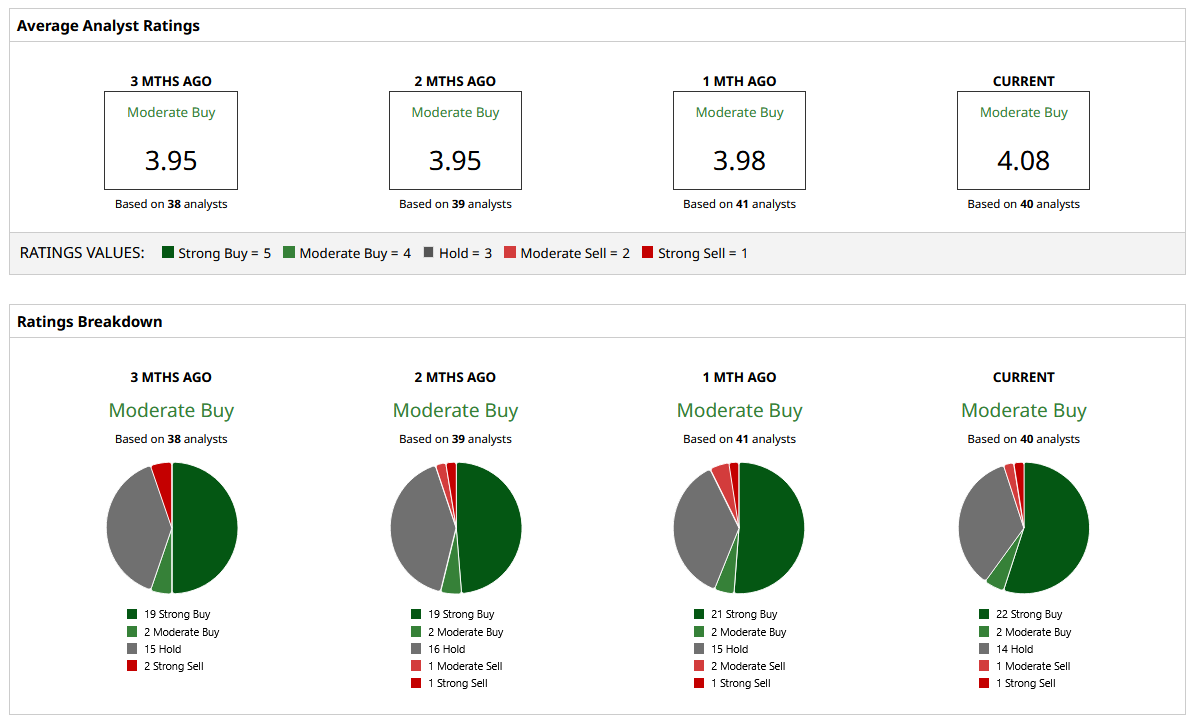

The 40 analysts who cover the stock on Wall Street give it a consensus “Moderate Buy,” with 22 of them holding a “Strong Buy” rating and two giving it a “Moderate Buy.” 14 analysts have a “Hold” rating on the stock, one a “Moderate Sell,” and one last one a “Strong Sell.” Despite concerns around the iPhone maker’s AI ventures, investors should not forget that the underlying business and its ecosystem are still among the strongest in the world.

The median price target of $284.51 still offers 6% upside from the current levels. The most optimistic scenario of the $345 price target would net investors a 29% gain, but a lot of that hinges on the potential leadership changes and AI strategy.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AI Spending Is ‘NOT’ Slowing Down, According to Wedbush. That Makes Nvidia Stock a Buy Before November 19.

- This Consumer Stock is Already in a Bear Market. Smart Money Sees 20% More Downside Ahead.

- Apple Is Apparently Getting Ready to Replace CEO Tim Cook. Is That Good News for AAPL Stock?

- This Unlikely Stock to Buy Could Be the Best Bet on the Future of the AI Race