Food delivery platform DoorDash (DASH) kicked off 2025 on a solid note, but the good vibes didn’t last long. Over the past month alone, the stock has slipped about 29% as investors grow uneasy about the company’s heavy spending and a recent earnings miss. The steep pullback has certainly rattled some nerves, but Wall Street hasn’t lost faith in DASH stock yet. In fact, Needham remains firmly in the bull camp.

While the firm did lower its price target from $300 to $275, it maintained its “Buy” rating, highlighting stronger order trends and continued growth in Gross Order Value (GOV). Even with the recent volatility in shares, Needham believes DoorDash is on track to double its post-pandemic GOV within four years, a clear sign that demand remains strong and the company is executing well.

The investment firm also praised DoorDash for achieving its DashPass subscriber growth target, a milestone expected to drive a significant increase in order frequency starting in 2026. In Needham’s view, 2025 is shaping up to be a “banner year” for the delivery giant. That said, with DASH stock under pressure but fundamentals still trending up, investors may want to take a closer look at DoorDash now.

About DoorDash Stock

DoorDash has grown into a leading local commerce platform, helping people get everything from restaurant meals and groceries to alcohol and convenience items delivered to their doorstep. Customers simply browse, place their orders, and pay through the company’s platform. Since launching in 2013, the company has expanded well beyond food delivery and now operates in over 40 countries.

With the addition of Deliveroo and Wolt, DoorDash has expanded its international reach while maintaining a focus on local markets. Through technology and logistics, the company aims to make everyday essentials more accessible and support local commerce worldwide. And while DoorDash might not be the first name that comes to mind when you think about artificial intelligence (AI), the technology is doing a lot of heavy lifting behind the scenes.

For instance, AI helps drivers take the fastest routes and recommends restaurants and dishes that customers are most likely to love. Currently valued at about $87 billion by market capitalization, DoorDash has come a long way since its December 2020 IPO, when it quickly emerged as one of the standout stock market debuts of the year and a major stay-at-home winner during the peak of Covid-19.

DASH stock hasn’t been a stranger to volatility since then, and the recent pullback hasn’t helped. Even so, DoorDash remains in positive territory this year, with shares up about 12% in 2025, edging out the broader S&P 500 Index’s ($SPX) softer gain of 11% during the same stretch.

DoorDash Slides After Mixed Q3 Earnings

The food delivery giant lifted the curtains on its fiscal 2025 third-quarter earnings report after market hours on Nov. 5, which painted a somewhat mixed picture, triggering a sharp 17% selloff on Nov. 6. Revenue was a clear bright spot, climbing an impressive 27% year-over-year (YOY) to $3.45 billion and comfortably topping expectations of $3.36 billion thanks to faster growth in both orders and GOV.

Digging further into the numbers, total orders jumped 21% YOY to 776 million, fueled by more active users and increased engagement. Marketplace GOV also climbed 25% YOY to $25 billion, largely driven by the higher order volumes. But while demand was strong, profitability didn’t quite keep up with market expectations. DoorDash reported earnings of $0.55 per share, up 45% from the same period last year but short of consensus estimates by a notable 19% margin.

Another major storyline in the quarter was the company’s £2.8 billion ($3.7 billion) acquisition of Deliveroo, completed in early October. Management expects the deal to strengthen DoorDash’s leadership in international local commerce, particularly in Western Europe and the Middle East, while unlocking new cross-border opportunities for merchants and Dashers.

Financially, DoorDash ended the quarter on a solid footing with $5.1 billion in cash and marketable securities, giving the company plenty of room to pursue its investment-heavy strategy. Free cash flow also impressed, rising to $723 million from $444 million in the prior-year period — proof that the company can still generate cash while aggressively expanding.

Looking ahead to fiscal Q4 2025, DoorDash expects Marketplace GOV to come in between $28.9 billion and $29.5 billion, with adjusted EBITDA projected in the range of $710 million to $810 million. However, what really caught investors off guard was management’s plan to boost spending by “several hundred million dollars” in 2026. That forward-looking investment push overshadowed the stronger parts of the report and was a major factor behind the sharp post-earnings selloff.

What Do Analysts Think About DoorDash Stock?

After the earnings-driven plunge, Needham admitted it was surprised by just how harsh the market’s reaction was, especially considering so much value was erased simply over plans to ramp up future investments. The firm argued that this kind of selloff could actually be a smart entry point for investors who believe in the company’s long-term trajectory. While Needham did trim DASH’s price target, the new $275 target still points to a healthy 46% potential upside from current levels.

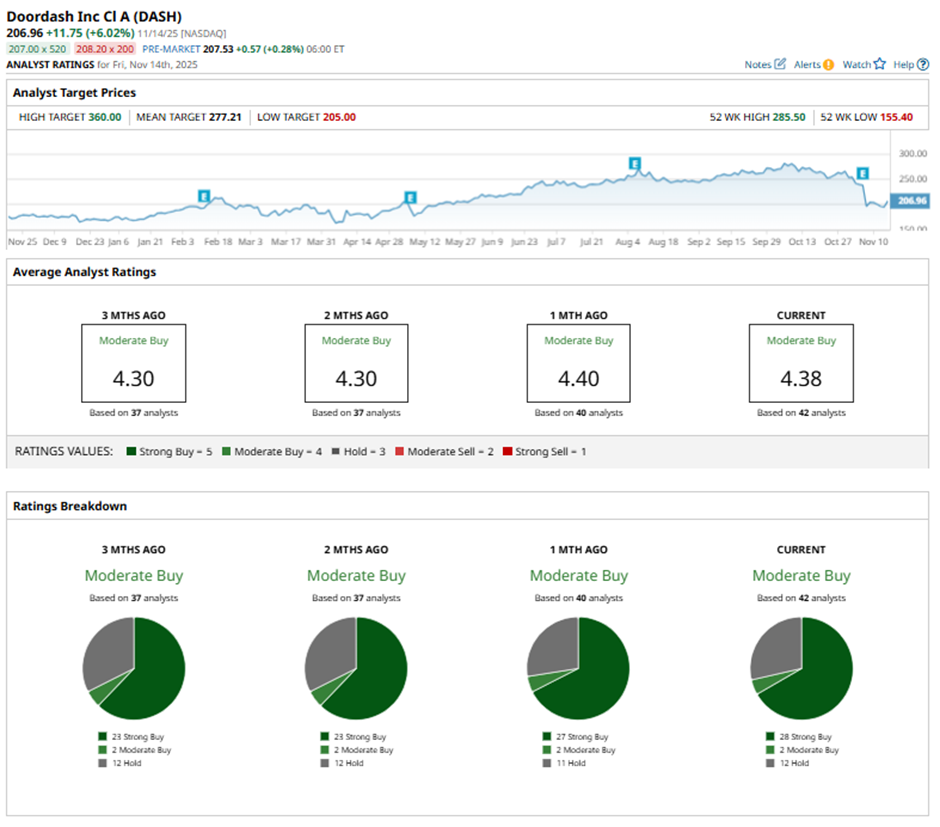

Overall, Wall Street isn’t giving up on DoorDash anytime soon. Analysts rate the stock a consensus “Strong Buy,” and most of them are pretty enthusiastic about its future. Out of 42 analysts covering the company, 29 say it’s a “Strong Buy,” two have a “Moderate Buy” rating, and 11 have a “Hold” for now.

There’s also plenty of upside baked into forecasts. The average price target sits at $276.55, pointing to about 47% potential gains. The most optimistic target of $360 suggests that the stock could climb as much as 92%, if the company executes well.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Just Waved a Big ‘Green Flag’ for Taiwan Semi. Buy TSM Stock Here, Says Wedbush.

- Nvidia’s Growth Engine Is Running Hot — Should You Get On Board?

- Nvidia Stock Breaks 100-Day Moving Average on Q3 Earnings Selloff. Should You Buy the NVDA Dip?

- Nvidia Is a Leader in AI Computing, But Is NVDA Stock a Buy Now?