Mortgage finance stocks don’t usually make the headlines the way high-growth tech names do, but every so often, a major catalyst jolts them back into the spotlight. That’s precisely what’s happening now with government-sponsored enterprises like Fannie Mae (FNMA), long viewed as slow-moving, tightly regulated players that rarely offer dramatic upside.

But this week, Fannie Mae has suddenly become one of the market’s most talked-about speculative opportunities. Wedbush just delivered a stunning double upgrade and an eye-popping 1,050% price-target increase, lifting its forecast from $1 to $11.50. The firm argues that potential moves from the Trump Administration, including steps toward recapitalization, partial stock sales, and a path out of conservatorship, could unlock massive value that’s been trapped for over a decade.

For investors wondering whether FNMA’s long-awaited breakout has finally arrived, here’s what you need to know.

About FNMA Stock

Based in Washington, D.C., the Federal National Mortgage Association, commonly known as Fannie Mae, is a government-sponsored enterprise (GSE) established to enhance liquidity and stability in the U.S. mortgage market. It operates a multitrillion-dollar guaranty book, backing both single-family and multifamily loans, delivering liquidity and stability to America’s housing market while still under tight regulatory oversight.

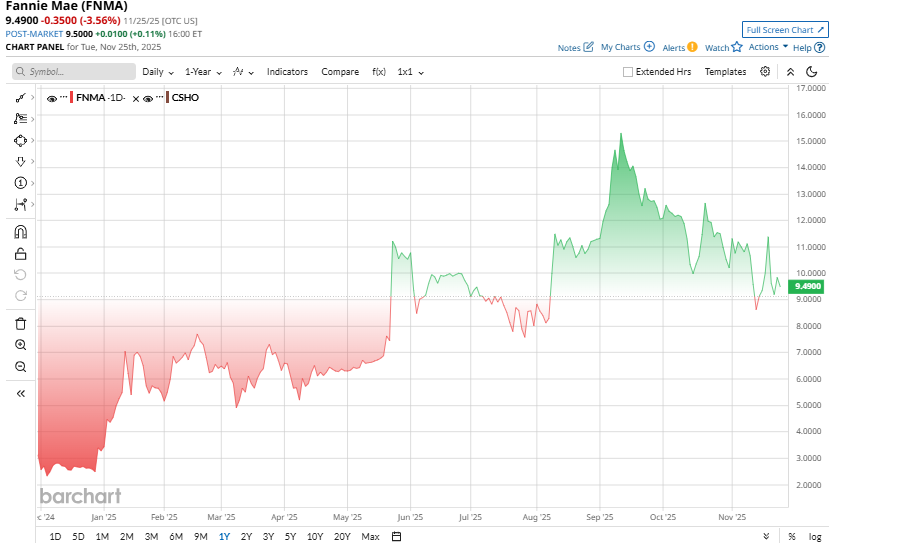

Valued at a relatively small market cap of $11 billion, shares of FNMA have soared in 2025. The mortgage company has gained about 190% year-to-date (YTD), significantly outperforming the sector median decline of 6%. Investors should note that this surge is driven not by booming fundamentals but by hopes that Washington will privatize or monetize Fannie.

Despite the bull run, on valuation, the stock looks extremely cheap on paper. FNMA’s price-to-sales ratio of 1.90 is significantly lower than the sector median of 3.02, indicating it is relatively undervalued in terms of sales.

A High-Reward Thesis Built on Regulatory Uncertainty

Wedbush’s recent bullish call reflects aggressive speculation. Analyst Henry Coffey points to potential government actions, for example, selling a slice of the Treasury’s stock options on Fannie, that could unlock massive value. This echoes comments by activist Bill Ackman, who said an IPO of Fannie (and Freddie Mac (FMCC)) isn’t “feasible or desirable” right now. Instead, Ackman proposes simply listing the companies directly on the NYSE, which he argues could instantly value them at $400 billion combined.

In practical terms, these are enormous “ifs.” There are political and regulatory hurdles: Fannie has been under Treasury conservatorship since 2008, and any real change, like privatization, recap, etc., requires government action. If the Trump Administration pushes ahead with a plan, as some news suggests they may by late 2025, FNMA could soar on that catalyst. If not, the hype could fizzle.

FNMA Missed Q3 Revenue Estimate

Fannie Mae’s third-quarter report wasn’t flashy, but it showed a company quietly grinding out reliable profits. Revenue came in around $7.31 billion, missed the estimate by $821 million, and was basically flat from last year. Guarantee fees, which are Fannie’s bread and butter, held steady across both the single-family and multifamily businesses. That stability matters more than headline growth when you're managing trillions in mortgages.

On the bottom line, Fannie posted $3.9 billion in net income, up a healthy 16% from Q2 but slightly lower than last year’s Q3. Most of that quarter-over-quarter boost came from lower credit provisions and tighter cost control. EPS landed near $0.65, just shy of 2024 levels.

Costs were a bright spot: management trimmed expenses enough to push the efficiency ratio down to 29.3%, a meaningful improvement from Q2. Book value also continued to climb, reaching $105.5 billion, and liquidity remains enormous, as you’d expect from a company that generates strong, steady cash flow.

Fannie doesn’t issue guidance, but analysts tracking the call are modeling $29 to $30 billion in revenue for 2025 and full-year EPS in the $2.6 to $2.7 range. That’s substantial earnings power for a stock still trading like it’s trapped in 2008.

Analyst Opinion and Final Words

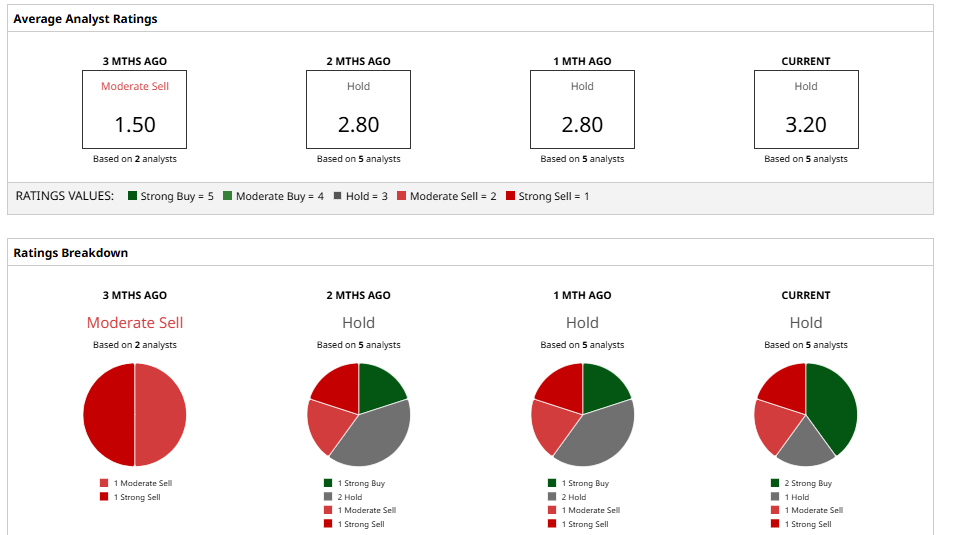

Wall Street analysts have taken a cautious stance on FNMA stock with a consensus “Hold” rating. The group of five analysts covering the stock has set a mean price target of $13.33, which suggests an expected 40% upside potential over the current price.

So, if we look overall, Fannie Mae’s stock is being driven by political catalysts more than core business performance. On paper, it looks very cheap, but that’s because we’re assuming some big policy change will happen. Wedbush’s upgrade makes the bull case loud and clear, but remember the downsides: if expected reforms stall, FNMA could collapse back towards fundamentals. Anyone considering buying here should buckle up for extreme swings and have a strong view on housing policy timing.

In my view, this trade is only for those who are comfortable betting on the government’s housing finance playbook, not purely on mortgage finance fundamentals.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why Is Everyone Worried About Nvidia’s Days Sales Outstanding? What That Means, and Why It Matters for NVDA Stock.

- ‘These Chips Will Profoundly Change the World’ and ‘Save Lives.’ Elon Musk Doubles Down on AI Chips as TSLA Stock Stagnates YTD.

- This Undiscovered Biotech Stock Has Quintupled in a Year and Just Hit New Highs

- Oppenheimer Thinks Investors Are Missing Out on IBM Stock