Apollo Global Management, Inc. (APO) is a leading alternative asset management firm that specializes in diversified investments across credit, private equity, real assets, and related strategies on behalf of institutional and individual investors. The company is headquartered in New York and operates globally with a broad platform spanning private and public markets. Apollo’s market cap is around $87.3 billion.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Apollo Global Management fits this criterion perfectly. APO is a colossal financial entity that manages a staggering amount of assets, and it is widely recognized for its strategic focus on both complex credit and private equity opportunities.

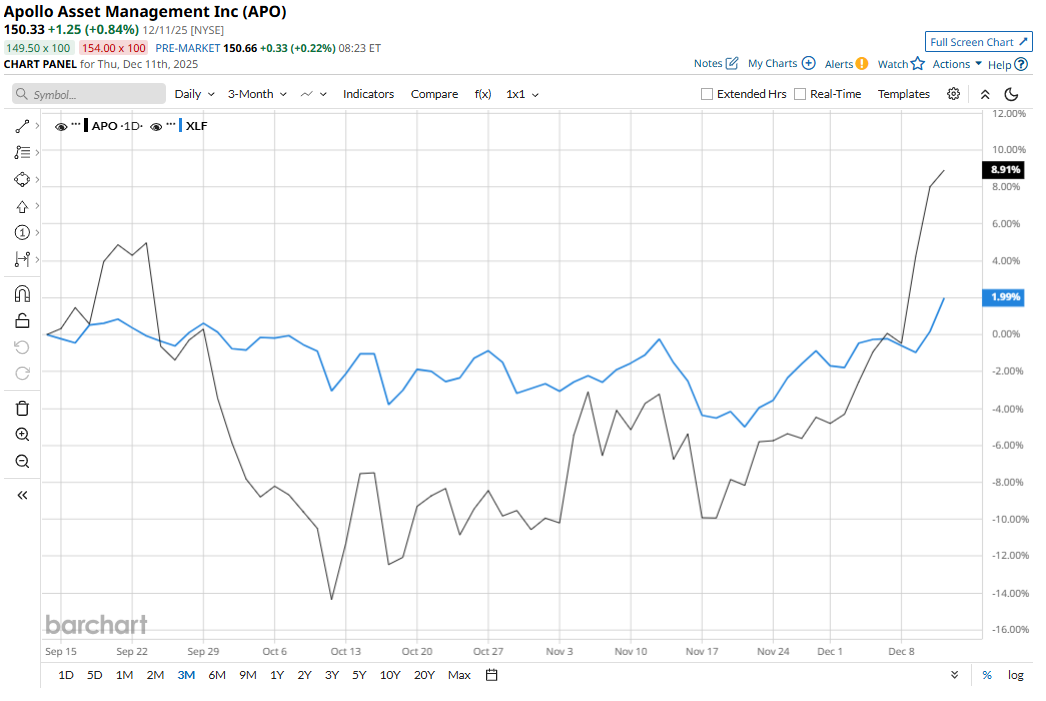

The stock has dipped 16.2% from its 52-week high of $179.42 reached in December 2024. Shares have gained 10.2% over the past three months, outpacing the Financial Select Sector SPDR Fund’s (XLF) 1.6% rise over the same time frame.

In the longer term, APO has declined 15.8% over the past 52 weeks and 9% on a YTD basis, underperforming the XLF’s 10.2% returns over the past year and 13.5% gains this year.

The stock has shown elevated volatility, alternating between stretches of trading above its 50-day and 200-day moving averages and periods where it slips below those lines. However, it is trading above the lines this month, indicating some momentum.

The stock has slid in 2025 amid broader market and sector headwinds, including persistent macroeconomic uncertainty, rising interest rates that have pressured private credit and debt portfolios, and have weighed on profit expectations.

However, the stock is soaring this month on the back of announcements like the significant natural gas partnership with Capital Power, a potential $3 billion equity commitment that highlights Apollo’s ability to expand into energy infrastructure and long-dated private market assets.

In addition, rival KKR & Co. Inc. (KKR) has outperformed APO, with a 9.3% slump over the past year and 3.5% YTD.

However, analysts remain bullish. The stock has a consensus rating of “Strong Buy” from 21 analysts’ coverage, and the mean price target of $163.06 is a premium of 8.5% to current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Is Souring on Netflix Stock Amid Warner Bros. Deal Drama. Is It Time to Ditch NFLX Now?

- Bob Iger Says ‘Creativity Is the New Productivity’ as Disney Bets $1 Billion on OpenAI and Entertainment Wars Heat Up

- This Little-Known Cloud Tech Stock Just Hit a New 52-Week High

- Can the Nasdaq Bull Keep Running? Here’s What Market Internals Are Telling Us Now.