In an August 2024 Barchart article on cocoa futures, I concluded with the following:

Expect continued volatility in the cocoa futures market. While volatility creates trading opportunities, the risk in the cocoa market remains at an elevated level, so careful attention to risk-reward dynamics is critical when considering any risk position in the soft commodity.

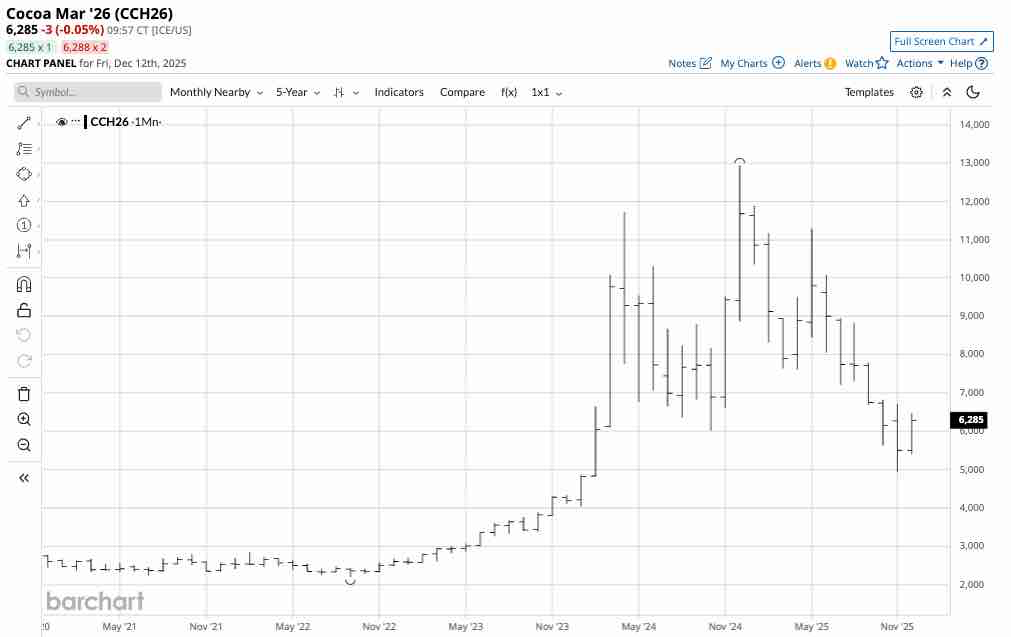

On August 26, the active month ICE cocoa futures were trading at $7,532 per ton, with cocoa for March 2026 delivery at $7,454 per ton. In December 2025, the price was over $1,200 lower, with cocoa in a bearish trend that recently took the price below $5,000 for the first time since early 2024.

Cocoa prices continued to correct from the high

After reaching a December 2024 record high of $12,931 per ton, ICE cocoa futures ran out of upside steam.

The monthly continuous contract chart shows the price plunge and steady decline that took cocoa futures to the most recent November 2025 low of $4,924 per ton, a 61.9% drop. At nearly $6,300 in December 2025, cocoa futures remain in a bearish trend despite the price recovery.

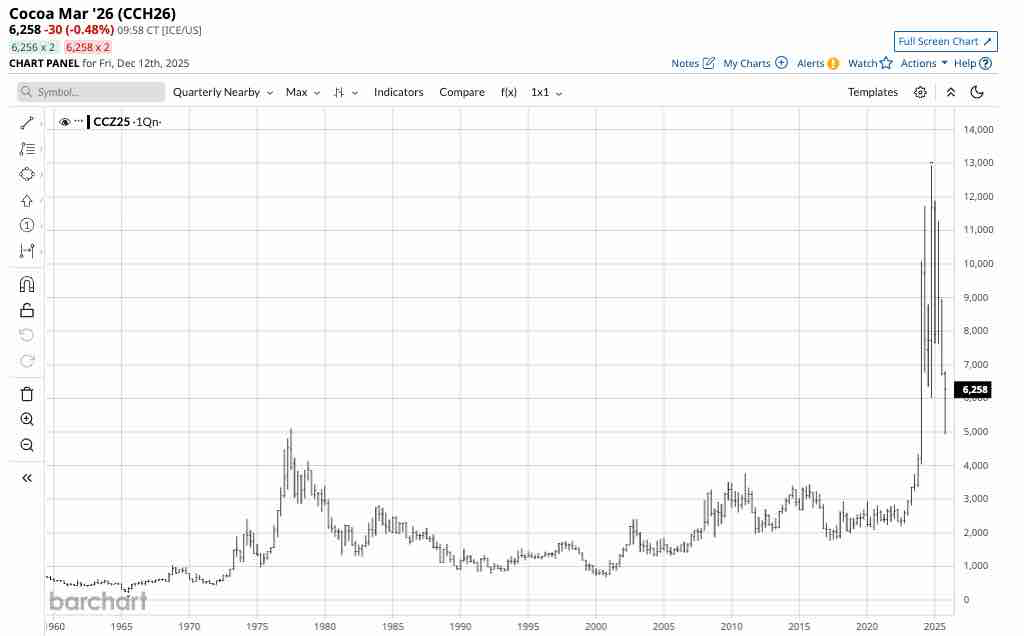

The 1977 high could be a pivot point as cocoa

The long-term, quarterly, continuous cocoa futures chart could guide technical levels over the coming weeks and months.

The chart dating back to 1959 shows that cocoa futures reached a high of $5,104 in 1977, which stood as the all-time peak for 47 years until early 2024. The $5,100 level could become a significant technical pivot point for cocoa futures over the coming weeks and months.

The factors that will impact cocoa prices in 2026

The Ivory Coast and Ghana, two West African countries, dominate annual cocoa production as the climates support crop production. The weather, political factors in West Africa, and crop diseases will determine annual supplies and the path of least resistance of cocoa prices.

Meanwhile, cocoa’s rise to the late 2024 has become a textbook case study of commodity cyclicality. The price rose to a level that defied technical and fundamental analysis, proving that prices often extend to illogical, irrational, and unreasonable levels during bull markets. However, cocoa reached a price where production increased, inventories began to grow, consumer demand declined due to the sky-high price, and a top formed at nearly $13,000 per ton. The bullish trend ended, and cocoa’s price declined throughout 2025.

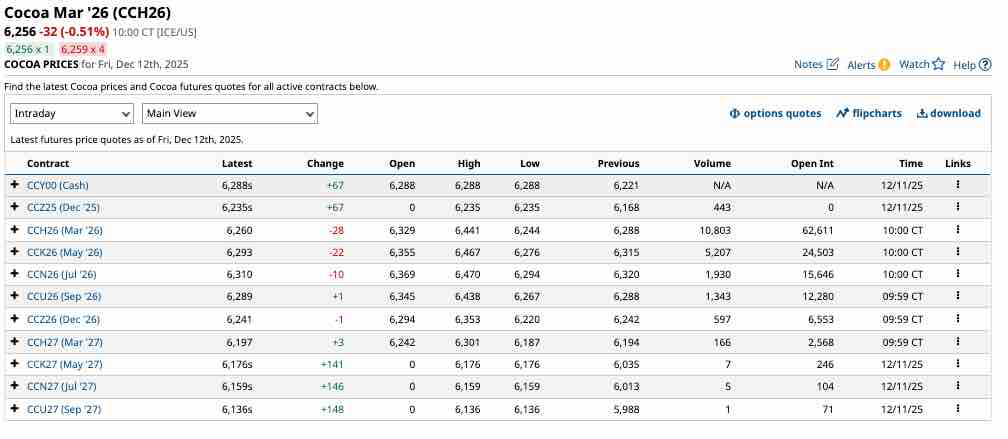

No clues from the forward curve, but cocoa remains a tight market

While cocoa’s forward curve provides few clues about the future path of least resistance of the soft commodity’s price, it continues to display tight supplies.

The chart shows cocoa futures prices from December 2025 through September 2027 delivery are above $6,135 and below $6,315 per ton. The flat curve indicates that some supply concerns remain. While the steep backwardation has eased, the market has not moved into contango, where deferred prices are higher than nearby prices, indicating stable supply expectations. Watching changes in the forward curve over the coming weeks and months could provide some fundamental guidance.

The only route for a risk position is the ICE futures

The only route for a risk position in cocoa is the futures and options traded on the Intercontinental Exchange. Each futures contract contains 10 metric tons. At $6,240, the March contract value is $62,400. The ICE exchange’s original margin requirement is $6,512 per contract. A market participant can control $55,000 worth of cocoa for an 10.44% down payment. Cocoa futures are leveraged. If equity on a long or short position falls below $5,920, the exchange requires maintenance margin payments.

Cocoa has been one of the most volatile commodities since breaking out to the upside and reaching new all-time highs in 2024. Cocoa has been in a volatile bearish trend throughout 2025, and wide price variance is likely to continue into 2026. Long-term critical technical support is around $5,100 per ton, and the soft commodity has already violated that level. However, the level could become a crucial pivot point over the coming months.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart