Kansas City, Missouri-based Evergy, Inc. (EVRG) generates, transmits, distributes, and sells electricity. Valued at a market cap of $17.1 billion, the company generates electricity through coal, landfill gas, uranium, and natural gas and oil sources, as well as solar, wind, and other renewable sources.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and Evergy fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the utilities - regulated electric industry. The company focuses on delivering reliable and affordable power while advancing its long-term strategy centered on grid modernization, renewable energy expansion, and sustainability.

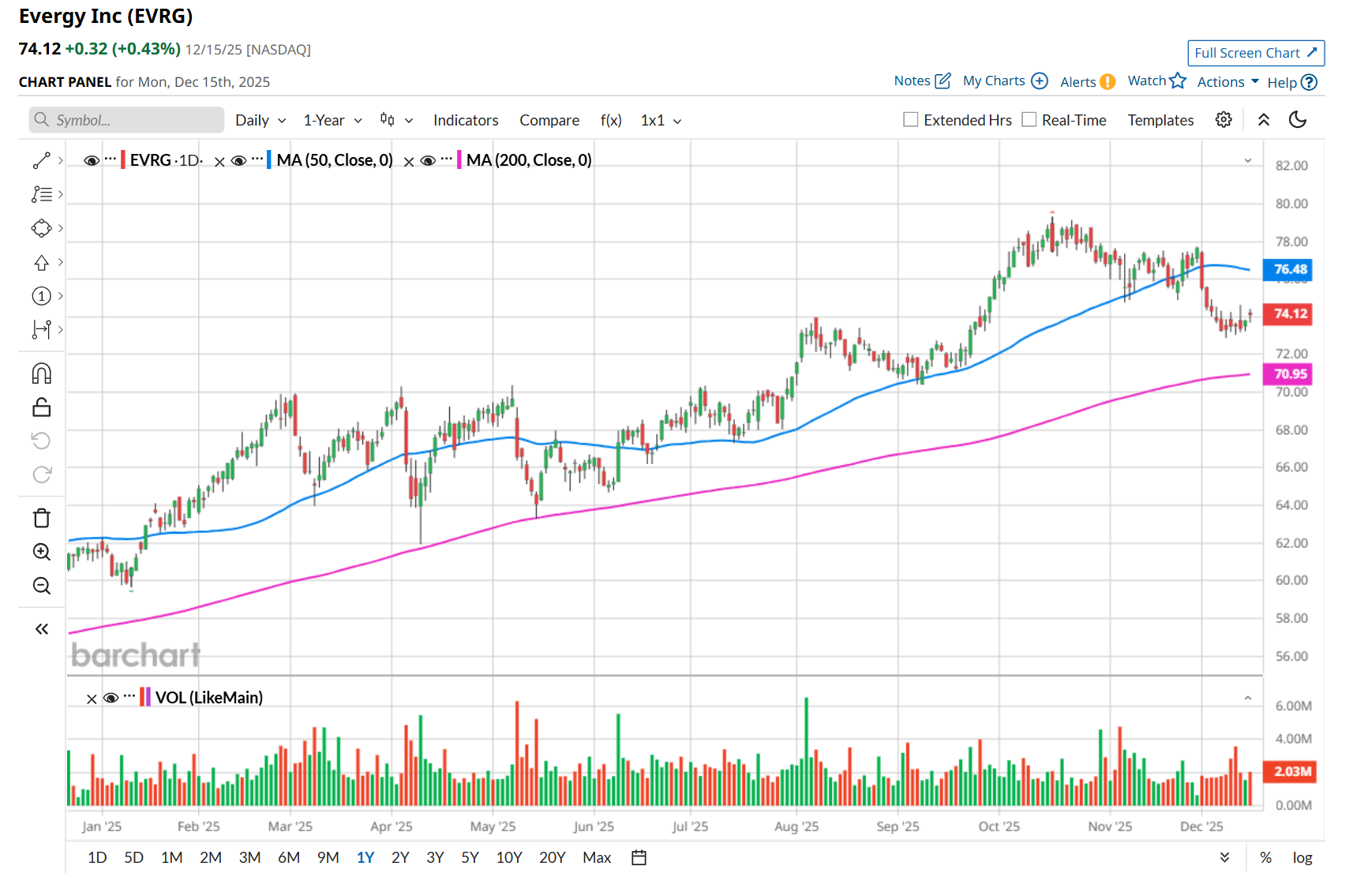

This utility company is currently trading 6.6% below its 52-week high of $79.32, reached on Oct. 16. Shares of Evergy have gained 2.7% over the past three months, outperforming the State Street Utilities Select Sector SPDR ETF’s (XLU) marginal rise during the same time frame.

In the longer term, EVRG has rallied 19.7% over the past 52 weeks, outpacing XLU’s 11.3% uptick over the same time frame. Moreover, on a YTD basis, shares of EVRG are up 20.4%, compared to XLU’s 14.2% return.

To confirm its bullish trend, EVRG has been trading above its 200-day moving average over the past year. However, it has remained below its 50-day moving average since late November.

Shares of Evergy fell 1.6% on Nov. 6 after delivering its Q3 results. The company’s adjusted EPS of $2.03 increased marginally from the year-ago quarter but fell short of analyst estimates by 5.1%. Moreover, primarily due to the impact of cooler than normal summer weather, EVRG lowered its fiscal 2025 adjusted EPS guidance in the range of $3.92 to $4.02 from the prior $3.92 to $4.12.

EVRG has also outpaced its rival, Ameren Corporation (AEE), which gained 10.1% over the past 52 weeks 10.9% on a YTD basis.

Given EVRG’s recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 13 analysts covering it, and the mean price target of $84.95, suggests a 14.6% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart