Houston, Texas-based Halliburton Company (HAL) drives the global energy sector with a suite of services that spans well completion, stimulation, cementing, and artificial lift solutions. The company complements this with drilling services, digital artificial intelligence (AI) tools, subsea testing, and integrated asset management, while sustaining a nearly $23.3 billion market capitalization.

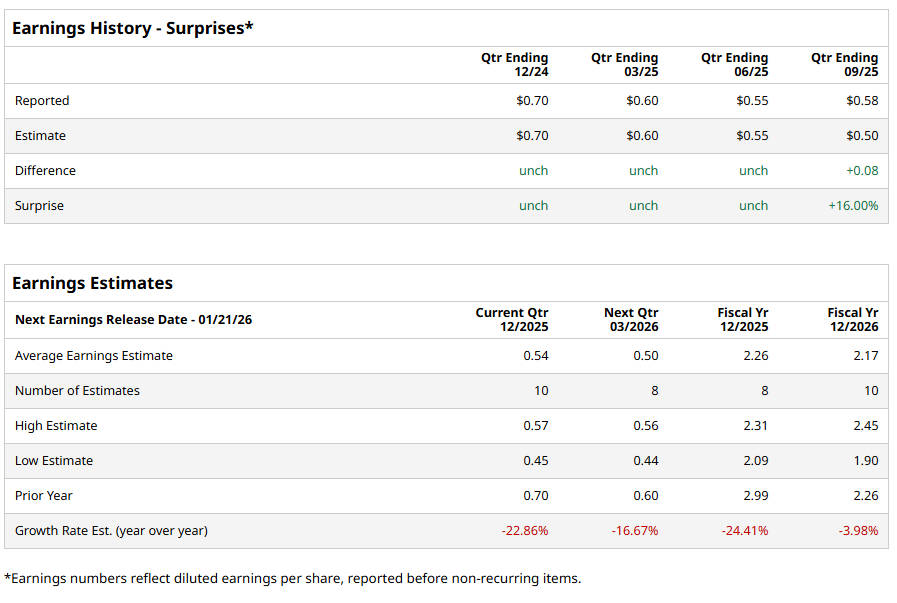

Investors are turning their attention to Halliburton’s Q4 fiscal 2025 earnings, scheduled for Wednesday, January 21, 2026, before markets open. Wall Street forecasts diluted EPS of $0.54, down 22.9% from last year’s $0.70. Halliburton outperformed expectations in the previous quarter, while meeting estimates in the three prior periods.

Reflecting on Q3, Halliburton outperformed expectations, sending its stock up 11.6% on Oct. 21. Revenue slipped 1.7% year-over-year to $5.6 billion but surpassed Street forecasts of $5.39 billion. Adjusted EPS fell 20.5% to $0.58 from a year ago but beat the $0.50 analyst estimate, demonstrating operational resilience.

The company posted a 13% adjusted operating margin while implementing measures projected to save $100 million per quarter. Management also reset the 2026 capital budget and retired equipment that no longer meets return expectations, signaling disciplined cost control and strategic resource allocation.

That being said, analysts project diluted EPS for fiscal 2025 to drop 24.4% year-over-year to $2.26, followed by a 4% decline to $2.17 in fiscal 2026.

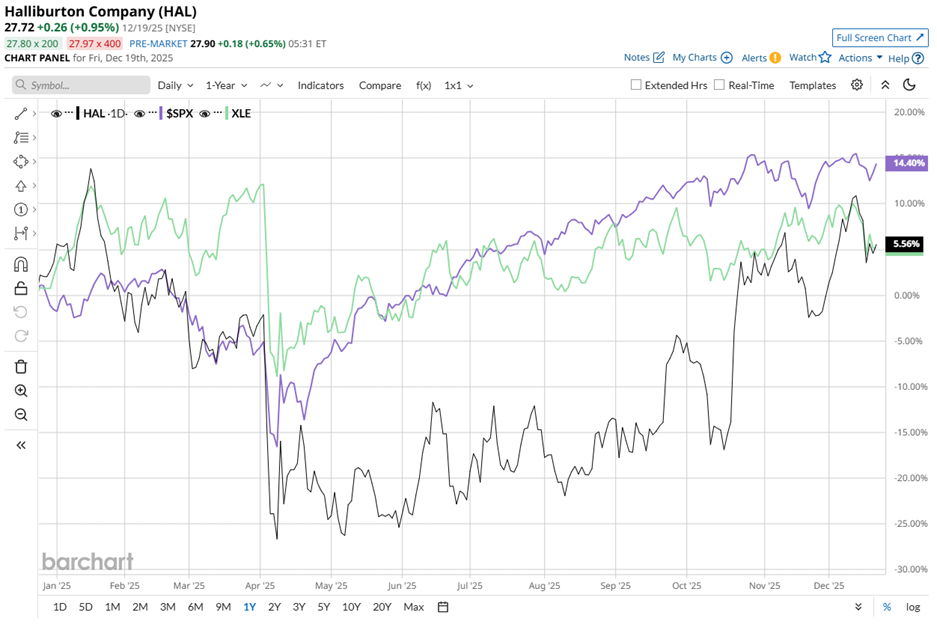

Over the past 52 weeks, HAL stock rose 7.6%, with year-to-date (YTD) gains near 2%. The S&P 500 Index ($SPX) outpaced it with 16.5% annual and 16.2% YTD gains, highlighting HAL’s relatively softer performance.

Still, the stock roughly tracked the State Street Energy Select Sector SPDR ETF (XLE), which gained 5.9% over 52 weeks and 3% YTD.

On Dec. 17, HAL stock rose another 2% as energy producers rallied that day, following a more than 1% increase in WTI crude oil. The spike came after President Trump announced an oil blockade on tankers entering and leaving Venezuela, a geopolitical move that immediately impacted oil supply expectations and investor sentiment in the energy sector.

Despite the stock’s relatively muted performance, analysts remain positive. They have assigned the stock an overall rating of “Moderate Buy,” holding strong for the past three months.

Among 24 analysts covering HAL, 13 rate the stock a “Strong Buy,” three suggest a “Moderate Buy,” and eight recommend “Hold,” reflecting a broad acknowledgment of Halliburton’s long-term potential despite short-term volatility.

HAL’s average price target of $31.04 represents potential upside of 12%. Meanwhile, the Street-high target of $41 implies a 47.9% upside.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart