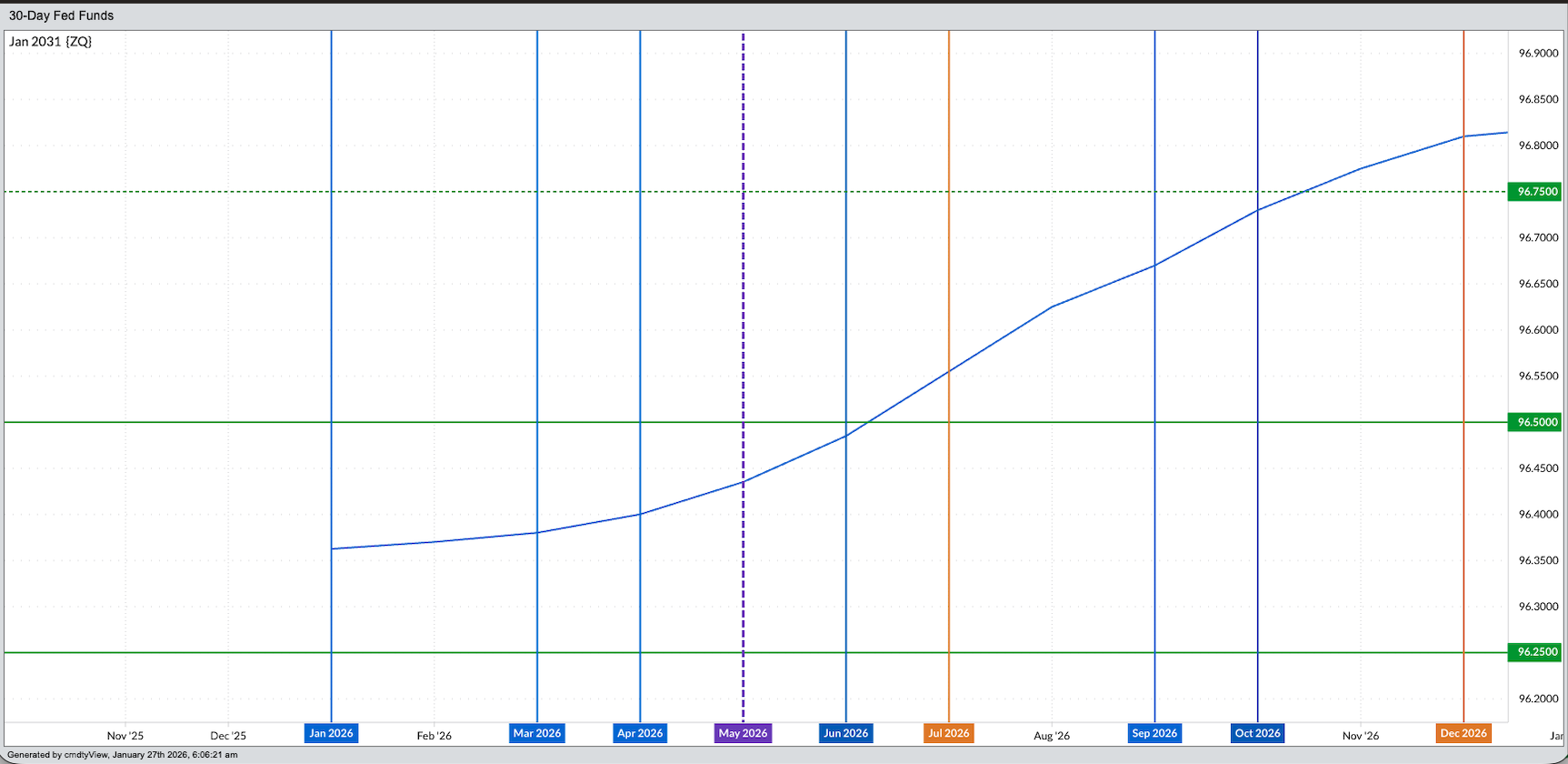

The Fed fund futures forward curve indicates the January meeting of the US Fed will conclude with Chairman Powell announcing no change in the Fed fund rate.

The forward curve has changed over time, now indicating the first cut of 2026 to be made at the end of the July meeting.

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.Given Jerome Powell is set to be replaced by a puppet for the US president, it will be interesting to see how the forward curve continues to change.

The latest US Federal Open Market Committee meeting gets under way Tuesday, culminating with an announcement on interest rates Wednesday afternoon (13:00 CT). A look at the Fed fund futures forward curve shows the market is expecting US Fed Chairman Powell to announce no change in rates, leaving it between 3.5% and 3.75%, shifting the spotlight to the March (17 and 18), April (28 and 29), and June (16 and 17) meetings. Amidst all that, Jerome Powell’s term as Chairman comes to an end in May meaning the US Fed then becomes the Shari LewisShow fronted by Charlie Horse. By this I mean whatever puppet the self-proclaimed president of Venezuela puts in the Chairman role to do his bidding and lower rates. What I find interesting is the forward curve was showing the first rate cut of 2026 to be made at the end of the June meeting, the first with Mr. Horse in charge, but the curve has now pushed this back to the July meeting (28 and 29). Meanwhile, the US dollar index continues to tank, falling to a low of 96.81 Monday, its weakest level since last September, indicating the greenback doesn’t need lower rates to collapse, just the rest of the world “Selling the United States”.

Let’s break down Tuesday morning’s forward curve:

- The January futures contract (ZQF26) is priced near 96.3625, putting the expected Fed fund rate at 3.6375% (100% - futures price)

- This is near the midpoint of the current[i] range of 3.5% to 3.75% marked by the two solid green lines on the forward curve chart.

- The February futures contract (ZQG26) is priced near 96.37, putting the expected rate at 3.63%, with no FOMC meeting scheduled for the month.

- The next meeting is on March 17 and 18, with the March futures contract priced this morning at 96.38 putting the expected rate at 3.62%.

- The April contract is priced at 96.4 meaning the expected rate is still within range at 3.6%

- There is no meeting in May, the month Jerome Powell’s term expires

- And the June contract (ZQM26) is now priced at 96.485, meaning the expected rate is 3.515%

- Last time around, June was priced at 96.57 putting the expected rate at 3.43%, below the low end of the existing range and indicating a rate cut was likely

- Now, it’s the July futures contract (ZQN26) priced at 96.555 showing an expected rate of 3.445% indicating a 25-basis point cut.

Recall from the December meeting, Chairman Powell talked about the possibility of one rate cut during 2026. However, the market indicated two cuts this year at the time and still does as of Tuesday morning.

- If the rate is cut by 25-basis points at the end of the July meeting, the range drops to 3.25% to 3.5%.

- The October contract is priced Tuesday morning at 96.73 (3.27%)

- With no meeting scheduled for November, that month’s futures contract (ZQX26) is priced at 96.775 putting the expected rate at 3.225%

- Meaning the December meeting (8 and 9) should see another 25-basis point cut, lower the range to between 3.0% and 3.25%

- The December futures contract is priced at 96.81 (3.19%)

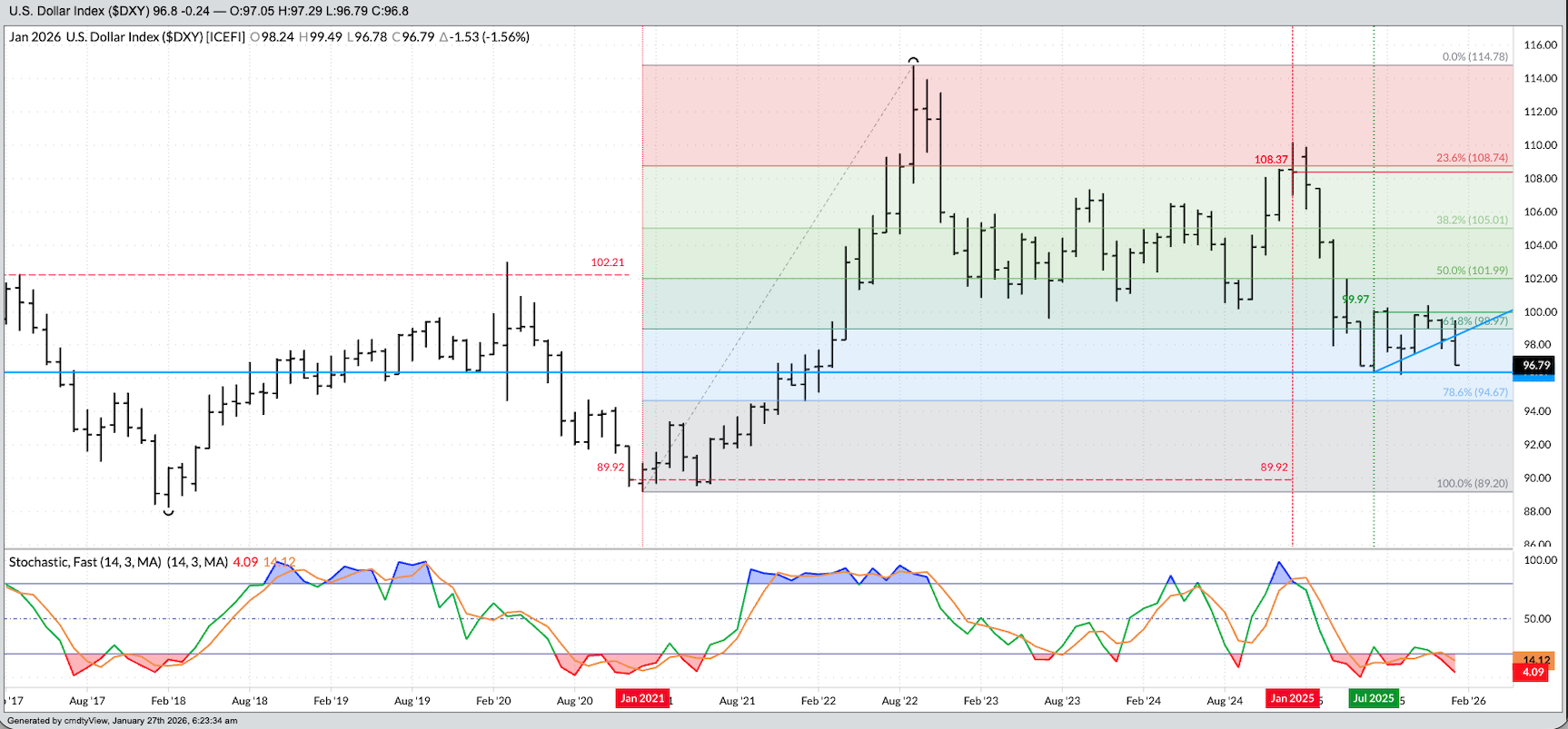

As for the US dollar index ($DXY), the greenback has posted a low of 96.81 this week, ahead of the FOMC meeting, its weakest level since September 2025. That month saw the Index hit a low of 96.22 before firming through the December high of 100.39. My Blink reaction is the greenback will take out the September 2025 market, falling into open territory on its long-term monthly chart with the major low at 89.20 from January 2021.

[i] Sorry Tony D.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What Will the US Fed Do This Week?

- Stock Index Futures Gain on Tech Boost, FOMC Meeting and Earnings in Focus

- Stocks Set for Muted Open After Trump’s Tariff Threats, Big Tech Earnings and Fed Meeting in Focus

- Australia Has a Stable Government and a Solid Economy. That Creates 1 Key Trade You Can Make Here.