In an October 9 Barchart article, when Bitcoin had just reached a record high, I asked if a substantial correction was on the horizon. I concluded the article with the following:

Even the most aggressive bull markets rarely move in straight lines with periodic downside corrections. However, the declining confidence in fiat currencies and government debt securities supports the cryptocurrency asset class in late 2025. Bitcoin could experience another substantial correction, but the growth of the asset class and its acceptance suggest that it would be another in a long series of buying opportunities.

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.

After dropping to nearly $60,000 per token on February 6, 2026, Bitcoin could be back in the buy zone around $70,000 per token.

Gravity hits Bitcoin

Bitcoin reached a record high of $126,184.05 in October 2025, where the leading cryptocurrency ran out of upside steam.

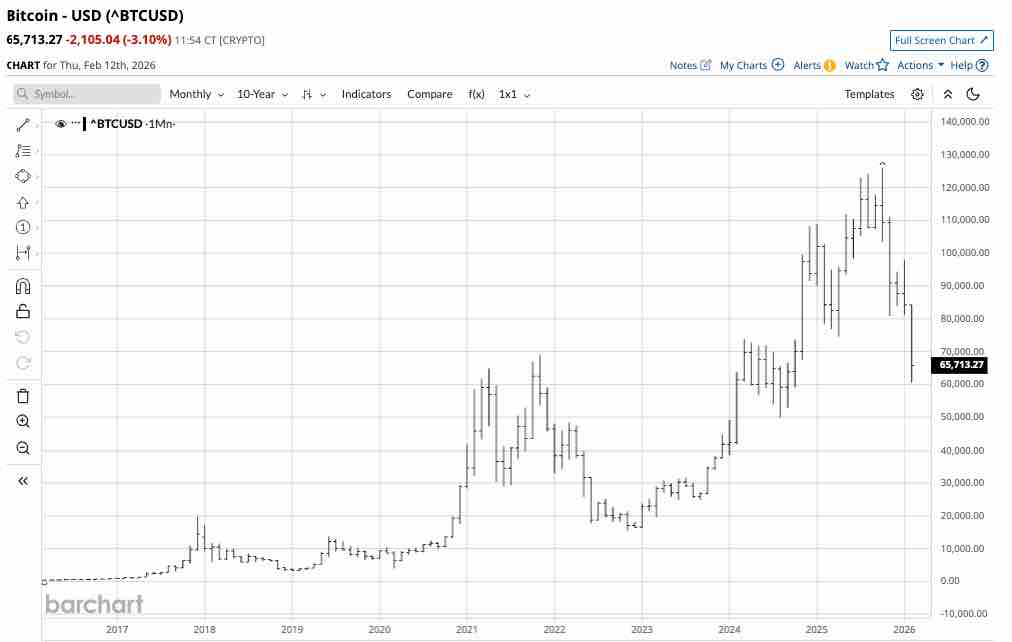

The ten-year monthly chart shows the 52% decline to the February 2026 low of $60,514.55 per token. The last time Bitcoin suffered such a substantial drop was from the November 2021 high of $68,906.48 to the November 2022 low of $15,516.53, when Bitcoin shed 77.5% of its value. While Bitcoin’s price has bounced around $10,000 from its recent low, time will tell whether more selling rivals the percentage loss from November 2022 through November 2021 before the leading cryptocurrency finds a bottom.

The case for Bitcoin remains bullish

While Bitcoin has dropped over 50%, we must remember that in 2010, the price was a mere five cents per token.

The following factors continue to favor Bitcoin during the current price correction:

- The present U.S. administration favors Bitcoin and cryptocurrencies as alternative means of exchange.

- Financial institutions have increased the availability of cryptocurrencies for market participants.

- Since 2010, Bitcoin has experienced boom-and-bust price action, suggesting the current correction will bottom out and recover, perhaps to new all-time highs. Each correction over the past 16 years has led to a new record-high price.

- ETF products that track the Bitcoin price have increased in number, offering greater speculative and investment potential.

The price history suggests that Bitcoin will eventually find a bottom during the current correction.

Some detractors believe Bitcoin and cryptocurrencies are worthless

Bitcoin has more than its share of detractors:

- Warren Buffett called Bitcoin and cryptocurrencies “financial rat poison squared,” and said he would not pay $25 for all the Bitcoin in the world.

- Peter Schiff, a hedge fund manager, recently said that Bitcoin’s long-term value proposition is fundamentally flawed, despite its global adoption, suggesting he believes Bitcoin will eventually be worth nothing.

- Many high-profile financial market leaders believe that Bitcoin and cryptocurrencies have no intrinsic value.

The debate between the proponents and opponents continues and seems to increase during corrections.

Diversification of assets and buying on price weakness

The stock market is at an all-time high, with the Dow Jones Industrial Average reaching 50,000. The dollar index has fallen to its lowest level since early 2022, signaling declining confidence in the world’s reserve currency. Gold and silver, the world’s oldest means of exchange, have rallied to all-time highs. While prices corrected dramatically from the late January 2026 highs, gold and silver prices remain above the December 31, 2025, closing levels.

The appetite for alternative assets has increased, and Bitcoin and other cryptocurrencies help fill some of the gap left by price action in traditional markets.

Only invest what you are willing to lose

Over the past sixteen years, buying Bitcoin on price weakness when a correction runs out of downside steam has been optimal. If this pattern continues in 2026, Bitcoin could be near the buying zone, but buyers must be aware that the correction is only a few months old, and the downside price action in 2021 and 2022 lasted a full year. Picking bottoms in any market is dangerous, and Bitcoin is no exception.

Any Bitcoin or cryptocurrency buyers must realize that, in the worst case, they risk losing the full value of their investment if Peter Schiff is correct. Therefore, only allocate capital you are willing to lose in this asset class. Meanwhile, over the past few years, buying Bitcoin during periods of price weakness on a scale-down basis has been optimal, and historical trading patterns suggest this will be the case again. However, risk is always a function of potential rewards, and Bitcoin’s volatility makes it a highly risky investment or trading vehicle. The odds favor a price recovery, but the question remains: from what price level?

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart