Austin, Texas-based CrowdStrike Holdings, Inc. (CRWD) is a cybersecurity company with a market cap of $111.3 billion. Its unified platform provides cloud-delivered protection of endpoints, cloud workloads, identity, and data through a Software-as-a-Service (SaaS) subscription-based model.

This cybersecurity company has underperformed the broader market over the past 52 weeks. Shares of CRWD have gained 11.2% over this time frame, while the broader S&P 500 Index ($SPX) has surged 14.3%. Moreover, on a YTD basis, the stock is down 5.8%, compared to SPX’s 1.4% return.

Zooming in further, CRWD has outpaced the iShares Cybersecurity and Tech ETF’s (IHAK) 9.5% decline over the past 52 weeks. However, it has trailed behind IHAK’s 4% YTD drop.

On Jan. 26, shares of CRWD rose 3.5% after Berenberg analyst Rahul Chopra raised the stock’s rating to “Buy” from “Hold”, citing valuation as a key driver. In its research note, the firm highlighted CrowdStrike as one of the few software companies capable of maintaining sector-leading growth, supported by its unified platform architecture, and described current share levels as an attractive entry point.

For the current fiscal year, ending in January, analysts expect CRWD’s EPS to decline 57.1% year over year to $0.21. The company’s earnings surprise history is mixed. It exceeded consensus estimates in two of the last four quarters but missed on two other occasions.

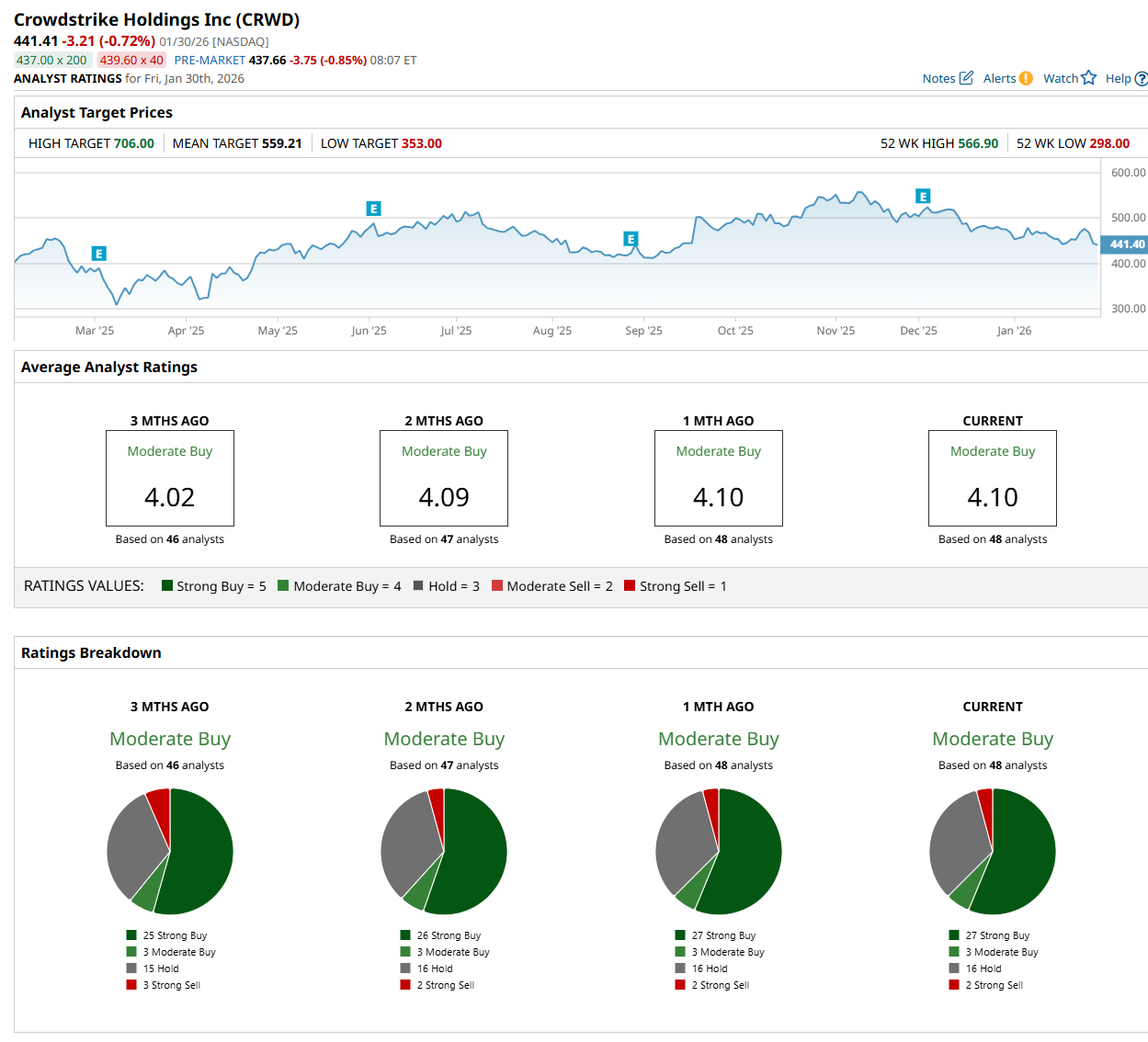

Among the 48 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 27 “Strong Buy,” three "Moderate Buy,” 16 “Hold,” and two “Strong Sell” ratings.

The configuration is slightly more bullish than two months ago, with 26 analysts suggesting a “Strong Buy” rating.

On Jan. 20, Citizens Financial Group, Inc. (CFG) maintained an “Outperform” rating on CRWD, with a $550 price target, indicating a 24.6% potential upside from the current levels.

The mean price target of $559.21 represents a 26.7% premium from CRWD’s current price levels, while the Street-high price target of $706 suggests an ambitious 59.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AMD’s Q4 Earnings Are Set To Impress: Should You Buy, Sell, Or Hold?

- ‘Solar Is Everything’: Tesla’s Elon Musk Says Other Energy Sources Are a Waste of Time, Like ‘a Caveman Throwing Some Twigs Into the Fire’

- Could Meta Platforms Stock Hit $1,000 in 2026?

- Groundhog Day Gloom? Why the Nasdaq Is Shaking Off Phil's Shadow and Facing Reality