Advertising and marketing company Zeta Global (NYSE: ZETA) announced better-than-expected revenue in Q4 CY2024, with sales up 49.6% year on year to $314.7 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $254 million was less impressive, coming in 1.2% below expectations. Its GAAP profit of $0.06 per share was $0.02 above analysts’ consensus estimates.

Is now the time to buy Zeta? Find out by accessing our full research report, it’s free.

Zeta (ZETA) Q4 CY2024 Highlights:

- Revenue: $314.7 million vs analyst estimates of $295 million (49.6% year-on-year growth, 6.7% beat)

- EPS (GAAP): $0.06 vs analyst estimates of $0.04 ($0.02 beat)

- Adjusted EBITDA: $70.38 million vs analyst estimates of $65.84 million (22.4% margin, 6.9% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.24 billion at the midpoint, beating analyst estimates by 2.4% and implying 23.3% growth (vs 37% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $256.5 million at the midpoint, above analyst estimates of $241 million

- Operating Margin: 2.2%, up from -15.1% in the same quarter last year

- Free Cash Flow Margin: 6.2%, down from 9.6% in the previous quarter

- Market Capitalization: $5.14 billion

“At Zeta, we’ve consistently skated to where the puck is going. Our early investments in AI and first-party data are resonating with customers and prospects, fueling our record fourth quarter results and contributing to our market share gains,” said David A. Steinberg, Co-Founder, Chairman, and CEO of Zeta.

Company Overview

Co-founded by former Apple CEO John Sculley, Zeta Global (NYSE: ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

Sales Growth

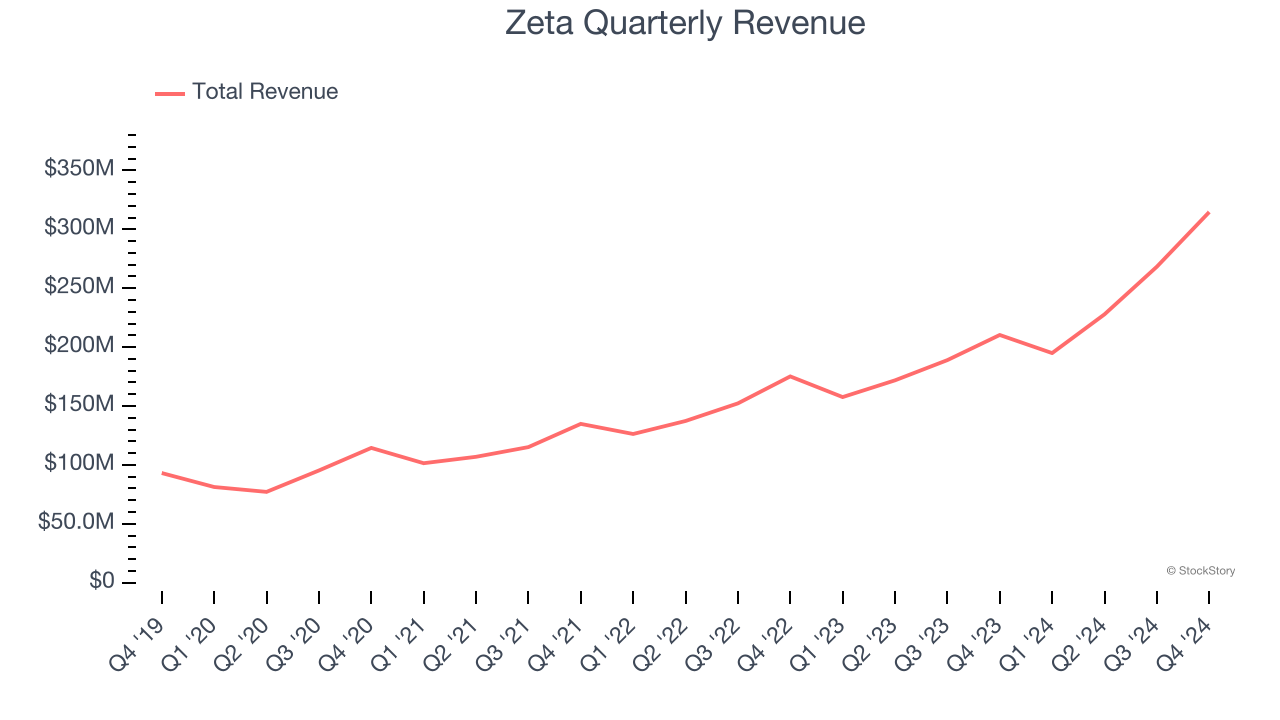

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Zeta’s 29.9% annualized revenue growth over the last three years was impressive. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Zeta reported magnificent year-on-year revenue growth of 49.6%, and its $314.7 million of revenue beat Wall Street’s estimates by 6.7%. Company management is currently guiding for a 30.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 20.2% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and suggests the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Zeta is extremely efficient at acquiring new customers, and its CAC payback period checked in at 1.4 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Zeta more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Zeta’s Q4 Results

We were impressed by Zeta’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. On the other hand, its revenue guidance for next year suggests a significant slowdown in demand and its revenue guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, we think this was still a decent quarter with some key metrics above expectations. The market seemed to focus on the negatives, and the stock traded down 7.3% to $19.10 immediately after reporting.

Is Zeta an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.