Online fashion retailer Revolve (NASDAQ: RVLV) announced better-than-expected revenue in Q2 CY2025, with sales up 9.4% year on year to $309 million. Its GAAP profit of $0.14 per share was 9.3% above analysts’ consensus estimates.

Is now the time to buy Revolve? Find out by accessing our full research report, it’s free.

Revolve (RVLV) Q2 CY2025 Highlights:

- Revenue: $309 million vs analyst estimates of $298 million (9.4% year-on-year growth, 3.7% beat)

- EPS (GAAP): $0.14 vs analyst estimates of $0.13 (9.3% beat)

- Adjusted EBITDA: $22.89 million vs analyst estimates of $15.1 million (7.4% margin, 51.6% beat)

- Operating Margin: 5.8%, in line with the same quarter last year

- Free Cash Flow Margin: 3.1%, down from 14.6% in the previous quarter

- Active Customers : 2.74 million, up 166,000 year on year

- Market Capitalization: $1.46 billion

"Our ability to deliver profitable growth and market share gains in the second quarter, while at the same time continuing to invest in exciting long-term growth drivers, is a true reflection of the platform we have built, our operating excellence, and the team's ability to execute," said co-founder and co-CEO Michael Mente.

Company Overview

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve (NASDAQ: RVLV) is a fashion retailer leveraging social media and a community of fashion influencers to drive its merchandising strategy.

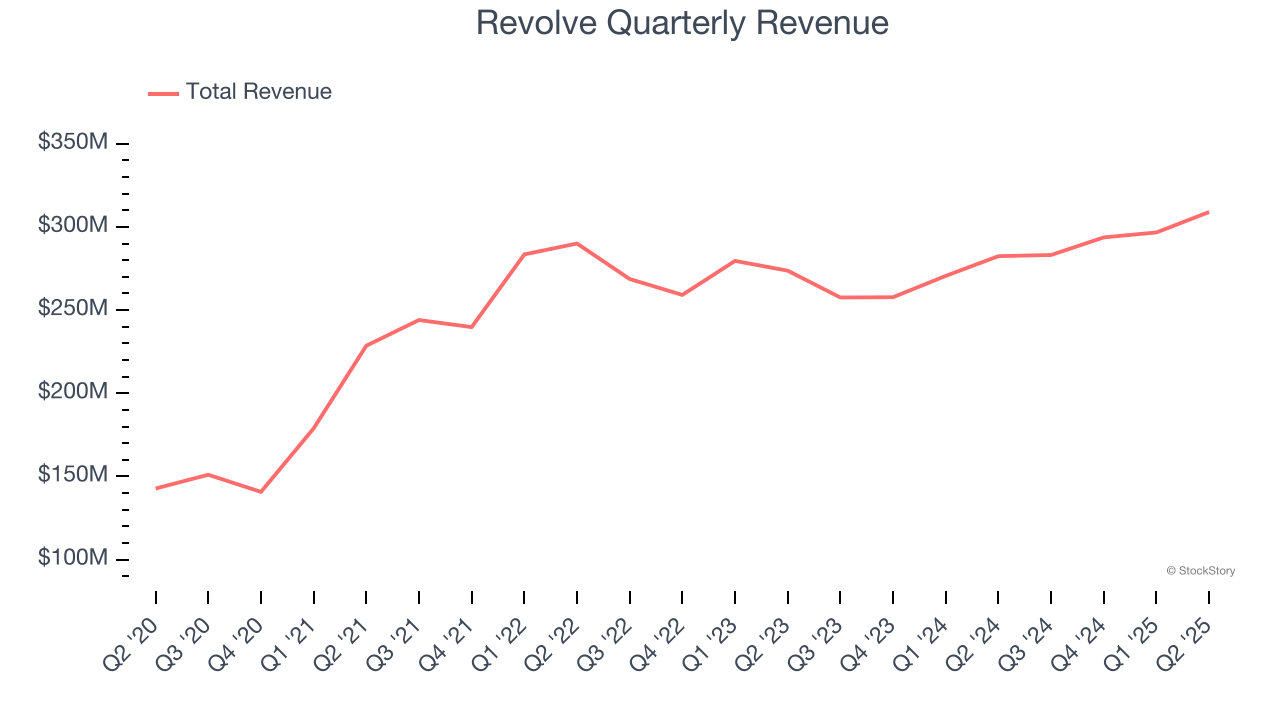

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Revolve’s 3.8% annualized revenue growth over the last three years was sluggish. This was below our standard for the consumer internet sector and is a poor baseline for our analysis.

This quarter, Revolve reported year-on-year revenue growth of 9.4%, and its $309 million of revenue exceeded Wall Street’s estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, similar to its three-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Active Customers

Buyer Growth

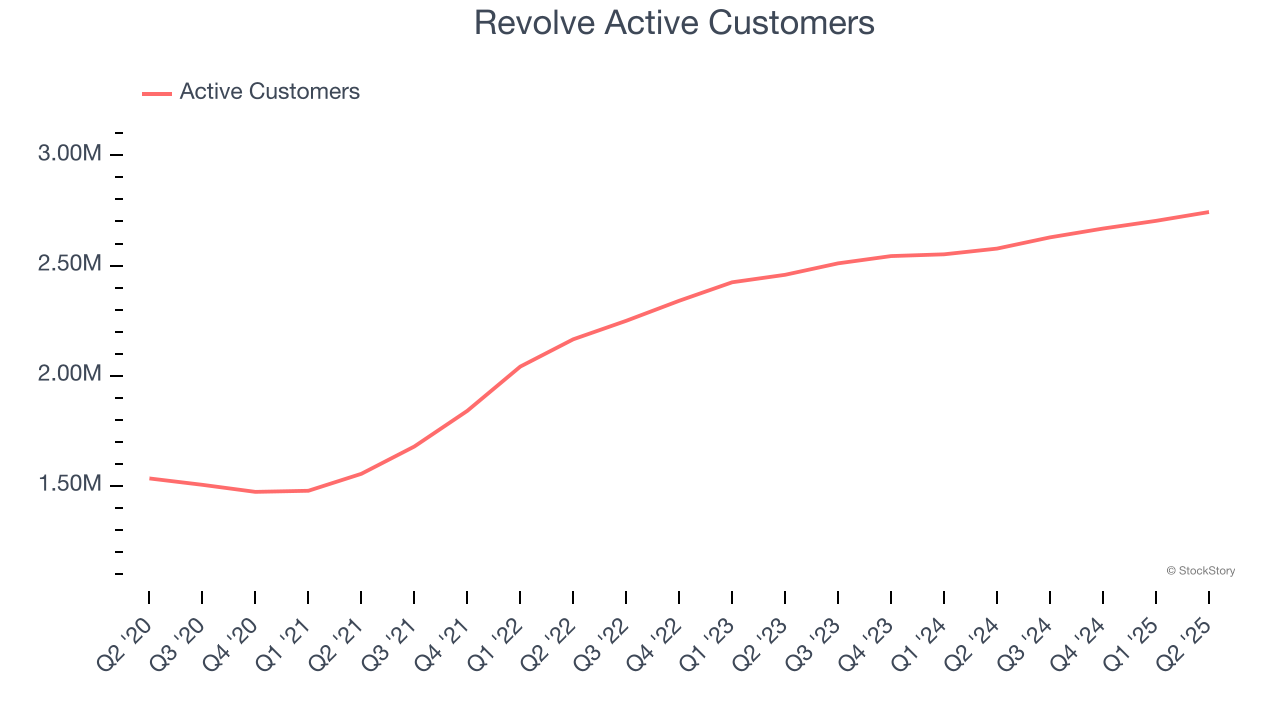

As an online retailer, Revolve generates revenue growth by expanding its number of users and the average order size in dollars.

Over the last two years, Revolve’s active customers , a key performance metric for the company, increased by 6.5% annually to 2.74 million in the latest quarter. This growth rate is slightly below average for a consumer internet business. If Revolve wants to reach the next level, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q2, Revolve added 166,000 active customers , leading to 6.4% year-on-year growth. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating buyer growth just yet.

Revenue Per Buyer

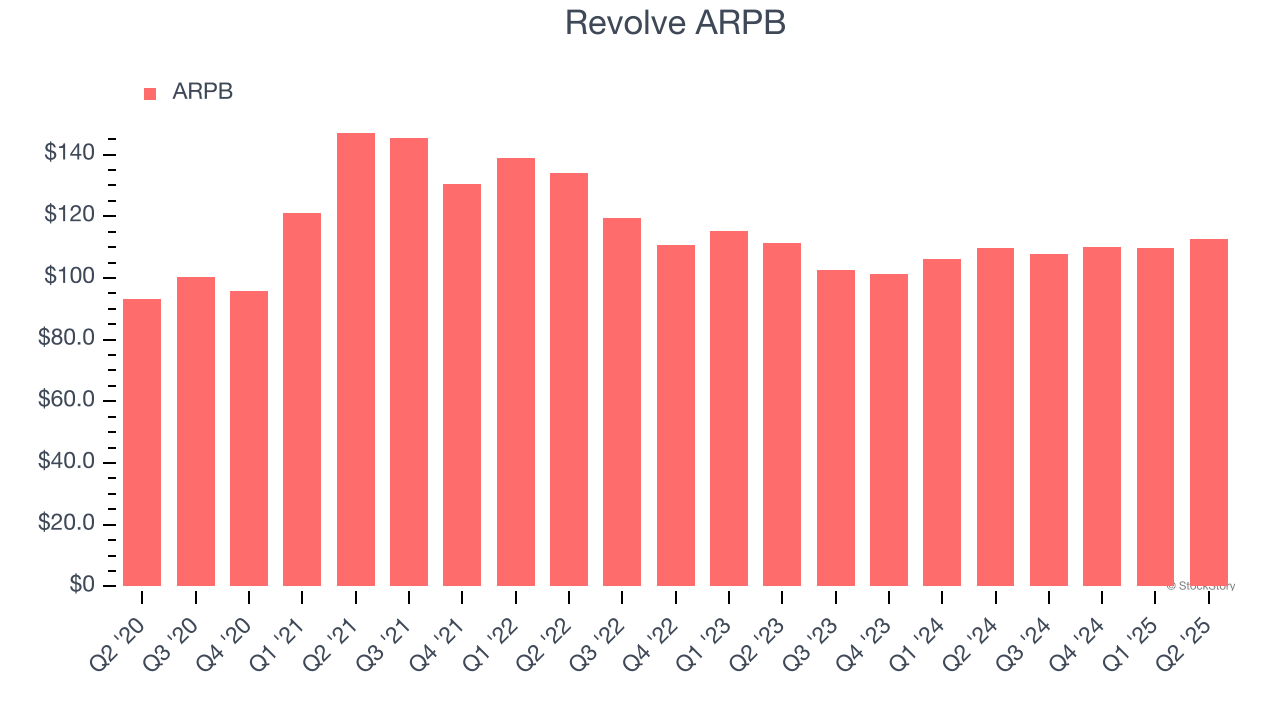

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much customers spend per order.

Revolve’s ARPB fell over the last two years, averaging 1.5% annual declines. This isn’t great when combined with its weaker active customers performance. If Revolve tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether buyer growth would be sustainable.

This quarter, Revolve’s ARPB clocked in at $112.64. It grew by 2.8% year on year, slower than its buyer growth.

Key Takeaways from Revolve’s Q2 Results

We were impressed by how significantly Revolve blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.7% to $21 immediately following the results.

Revolve may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.