iShares iBoxx $ Investment Grade Corporate Bond ETF (NY:LQD)

111.69

+0.00

(+0.00%)

Streaming Delayed Price

Updated: 1:37 PM EST, Feb 25, 2026

Add to My Watchlist

Price and Volume

Detailed Quote| Volume | 17,330,542 |

| Open | 111.60 |

| Bid (Size) | 111.68 (30,100) |

| Ask (Size) | 111.69 (15,800) |

| Prev. Close | 111.68 |

| Today's Range | 111.56 - 111.77 |

| 52wk Range | 103.45 - 112.93 |

| Shares Outstanding | 2,501,000 |

| Dividend Yield | 4.68% |

Top News

More NewsPerformance

More News

Read More

LQD vs VCLT: Two Ways to Hold Corporate Credit ↗

December 26, 2025

LQD vs. VCLT: Choosing Between Stability and Long-Rate Exposure ↗

December 22, 2025

Want Decades of Passive Income? Buy This ETF and Hold It Forever. ↗

December 17, 2025

SPLB Offers Higher Yield and Lower Fees, While LQD May Help Limit Risk ↗

November 08, 2025

ETFs Never Had It So Good — The Trillion-Dollar Moment Is Almost Here ↗

September 15, 2025

This Rare Signal Last Flashed In 1998—Then Stocks Took Off ↗

August 18, 2025

“It Could Be A Trap” - Beware A Bond-Market Fast One ↗

April 07, 2025

Are We On The Cusp Of Another Global Crisis? ↗

April 05, 2025

3 New Fixed-Income ETFs Use Options To Target Higher Income ↗

February 14, 2025

Fed's Cautious Rate Cut Approach Boosts Appeal Of These 3 ETFs ↗

January 09, 2025

20 ETFs Primed For Unusually Big Swings On Fed Meeting Days ↗

December 18, 2024

Bond ETFs Slide As Fed Cuts Clash With Trump's Fiscal Agenda ↗

November 11, 2024

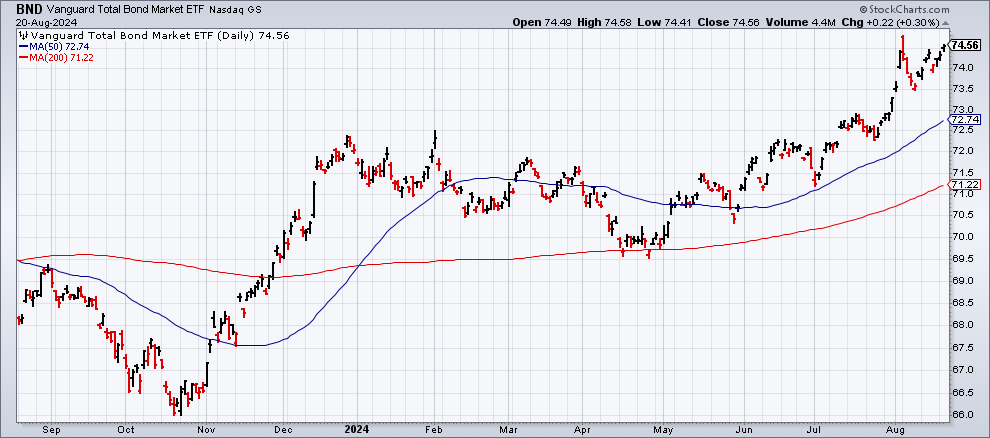

Bond Market Momentum Firmly Bullish Ahead Of Fed Conference ↗

August 21, 2024

Frequently Asked Questions

Is iShares iBoxx $ Investment Grade Corporate Bond ETF publicly traded?

Yes, iShares iBoxx $ Investment Grade Corporate Bond ETF is publicly traded.

What exchange does iShares iBoxx $ Investment Grade Corporate Bond ETF trade on?

iShares iBoxx $ Investment Grade Corporate Bond ETF trades on the New York Stock Exchange

What is the ticker symbol for iShares iBoxx $ Investment Grade Corporate Bond ETF?

The ticker symbol for iShares iBoxx $ Investment Grade Corporate Bond ETF is LQD on the New York Stock Exchange

What is the current price of iShares iBoxx $ Investment Grade Corporate Bond ETF?

The current price of iShares iBoxx $ Investment Grade Corporate Bond ETF is 111.69

When was iShares iBoxx $ Investment Grade Corporate Bond ETF last traded?

The last trade of iShares iBoxx $ Investment Grade Corporate Bond ETF was at 02/25/26 01:37 PM ET

What is the market capitalization of iShares iBoxx $ Investment Grade Corporate Bond ETF?

The market capitalization of iShares iBoxx $ Investment Grade Corporate Bond ETF is 279.32M

How many shares of iShares iBoxx $ Investment Grade Corporate Bond ETF are outstanding?

iShares iBoxx $ Investment Grade Corporate Bond ETF has 279M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.