State Street SPDR Bloomberg 1-3 Month T-Bill ETF (NY:BIL)

Price and Volume

Detailed Quote| Volume | 5,905,717 |

| Open | 91.59 |

| Bid (Size) | 91.59 (194,300) |

| Ask (Size) | 91.59 (115,400) |

| Prev. Close | 91.58 |

| Today's Range | 91.58 - 91.59 |

| 52wk Range | 91.26 - 91.78 |

| Shares Outstanding | 4,563,445 |

| Dividend Yield | 4.78% |

Top News

More NewsPerformance

More News

Read More

Worried About Inflation? These 3 ETFs Offer Real Protection ↗

November 30, 2025

Retireful Liquidates 44K VGIT Shares Worth $2.7 Million ↗

October 21, 2025

Retireful Sells Off 132K IBTI Shares Valued as $2.95 Million ↗

October 21, 2025

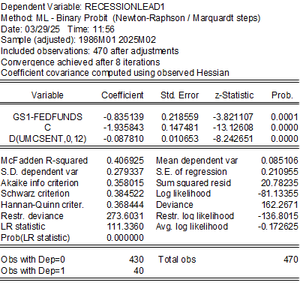

Near Horizon Recession Probability ↗

March 30, 2025

Investors Flock To Cash-Like ETFs Amid Market Turmoil ↗

March 15, 2025

Equity Funding Cost Collapse Amid Accelerating Inflation Worries ↗

January 11, 2025

Will The Election Bring A Stock Market Correction? ↗

October 26, 2024

Time To Invest in Cash-Like ETFs? ↗

August 14, 2024

Are Stocks Rolling Over In A Risk-Off Manner? ↗

July 20, 2024

Are Charts Pointing To The End Of The Bull Market? ↗

July 13, 2024

5 Hot ETFs Of A Tumultuous Week ↗

April 16, 2024

Frequently Asked Questions

Is State Street SPDR Bloomberg 1-3 Month T-Bill ETF publicly traded?

Yes, State Street SPDR Bloomberg 1-3 Month T-Bill ETF is publicly traded.

What exchange does State Street SPDR Bloomberg 1-3 Month T-Bill ETF trade on?

State Street SPDR Bloomberg 1-3 Month T-Bill ETF trades on the New York Stock Exchange

What is the ticker symbol for State Street SPDR Bloomberg 1-3 Month T-Bill ETF?

The ticker symbol for State Street SPDR Bloomberg 1-3 Month T-Bill ETF is BIL on the New York Stock Exchange

What is the current price of State Street SPDR Bloomberg 1-3 Month T-Bill ETF?

The current price of State Street SPDR Bloomberg 1-3 Month T-Bill ETF is 91.59

When was State Street SPDR Bloomberg 1-3 Month T-Bill ETF last traded?

The last trade of State Street SPDR Bloomberg 1-3 Month T-Bill ETF was at 02/25/26 04:10 PM ET

What is the market capitalization of State Street SPDR Bloomberg 1-3 Month T-Bill ETF?

The market capitalization of State Street SPDR Bloomberg 1-3 Month T-Bill ETF is 417.97M

How many shares of State Street SPDR Bloomberg 1-3 Month T-Bill ETF are outstanding?

State Street SPDR Bloomberg 1-3 Month T-Bill ETF has 418M shares outstanding.

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.