SOURCE: S&P Global

DESCRIPTION:

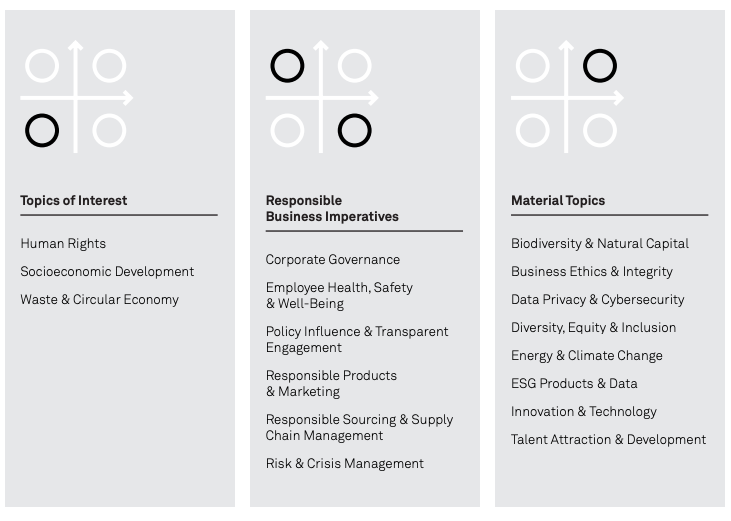

Materiality Roadmap

Our efforts to create a more sustainable business and society are driven by where we have the most opportunity for positive impact—and where we can minimize potential for negative impact.

Amid a fast-changing economic and sustainability landscape, in 2020 we conducted a new materiality assessment to identify the most relevant sustainability topics for our company and stakeholders.

This update to our initial 2018 materiality assessment reflects our company’s recent growth, including the acquisition of SAM ESG Ratings & Benchmarking business. It also takes into account societal changes driven by the global pandemic and awareness of racial inequality, and includes more perspectives from external stakeholders including customers and investors.

Facilitated by an external consultancy, the exercise identified material topics critical to our business success.

Based on this exercise, we identified eight material topics critical to our business success as well as six responsible business imperatives. Together, these areas will drive our sustainability strategy, priorities, targets and reporting moving forward. The results will also influence how we allocate financial resources and human capital, help us make decisions based on relevant data and meet increasing demands from regulators and reporting standards.

We recognize that materiality is a dynamic process and will continue to monitor the evolution of global issues and needs, stakeholder expectations and changes within our company.

Methodology

The materiality analysis began with a review of more than 120 topics gathered from research and reports, ESG ratings, industry tools, media analysis and competitor/peer reviews. It was then grouped into 17 topics that were subsequently prioritized by key stakeholder groups based on their expectations and concerns, and on the topics’ ability to impact value creation or where our business has a significant impact.

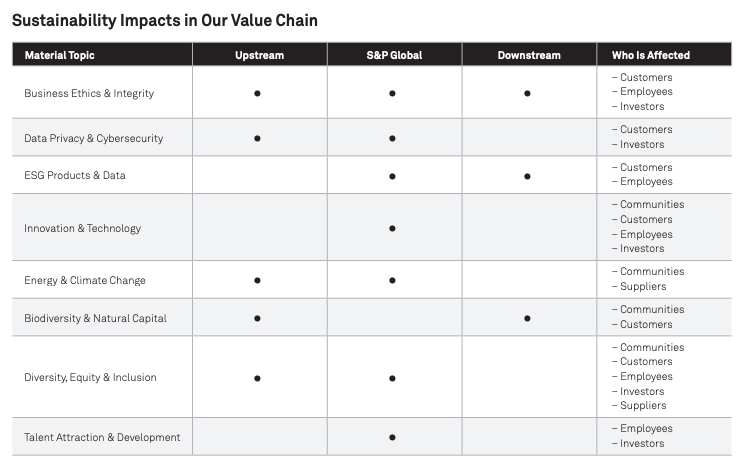

The material topics were also analyzed to identify where impacts occur along the value chain, and which stakeholders are affected.

The findings were reviewed by the Board of Directors and confirmed by the CEO and full Operating Committee in March 2021.

Stakeholder Engagement

Feedback from our stakeholders was a key driver throughout the assessment. We sought diverse voices from across our business units and geographic locations as well as our customers, investors, suppliers and nonprofit partners. We decided which organizations to approach based on how dependent they were on S&P Global’s decision making as well as their ability to inform sustainability best practice.

Through surveys and interviews, we asked stakeholders to prioritize the 17 topics under two scenarios—identifying both immediate concerns and a longer-term view based on emerging trends and their views of the world post-pandemic.

Our Findings

The imagery below shows the results of the materiality assessment and will guide our sustainability efforts moving forward.

It includes three categories:

- Topics of interest that we will track, monitor and manage as they rise in importance

- Imperative business practices for an ethical and stakeholder-driven organization

- Material topics to our business, which pose the greatest risk or opportunity, or where we have a significant impact

In their feedback, our stakeholders emphasized how all these issues are interrelated. We believe acting on these issues collective best improves our sustainability performance, mitigates risks and maximizes opportunities.

Read more from S&P Global's 2020 Impact Report

KEYWORDS: NYSE: SPGI, S&P Global, impact report

![]()