Exxe Group, Inc. (OTC: AXXA) is a diversified fintech corporation focusing on acquisitions in the following sectors: real estate, sustainable technology, media, agribusiness, and financial services. The AXXA strategy is to acquire controlling equity interests in undervalued companies and undertake an active role in improving their performance by accelerating their growth by providing access to capital and management expertise.

Some key points about AXXA:

- Acquisition Based Company Operating in Real Estate, Sustainable Technology, Media, Agribusiness, and Financial Services.

- Currently Strengthening Company Balance Sheet by Reducing Aged Debt and Potential Share Count.

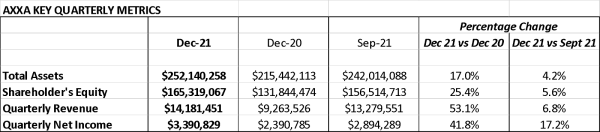

- December 2021 Quarterly Revenue Jumped by 53.1% to New Record $14.2M vs. 2020 Results.

- Net Income Soared to Record $3.4M, Up 41.8% From Dec 2020 Qtr.

AXXA Moves to Reduce Debt, Adjust Future Share Count, Enhancing Shareholder Value

On March 9th AXXA announced that it is in the process of strengthening its balance sheet by reducing, eliminating, or adjusting aged debt, thereby increasing equity and shareholder value, along with lessening potential future share count.

AXXA management has identified up to $20 million of aged debt carrying the first half of 2022 maturities that shall be amended via conversion into restricted preferred equity or into debt with maturities to extend additional 36 months. In conjunction with the balance sheet enhancements, AXXA plans to limit stock issuances during June 2022 quarter. These steps are designed to positively affect AXXA and its investors. First, debt reduction and simultaneous equity conversion should translate into a greater equity value and reduced liabilities. Second, completing a limited stock issuance in one transaction should reduce potential multiple additions to the share count and increase confidence in the overall business model.

As with the debt settlement, the AXXA objective is to eliminate up to $4M of accrued interest and long-term debt. Up to $8M or nearly 10% of total outstanding debt is planned to be converted to restricted preferred equity. In contrast, only a limited issuance is planned in the June 2022 draft period representing less than 1% of total debts. This event will reduce potential future share overhangs versus the completion of multiple transactions during the period. AXXA believes that this debt restructuring will put the company in a stronger capital structure, potentially opening up greater private equity and real estate acquisition opportunities.

AXXA businesses that are targeted for debt recapitalizations or asset reallocations include Hemp and Agribusiness provider Flying Creek division(FCD), energy products provider Lucent Led Tech(LLT), AXXA Digital Communities(ADC), as well as AXXA Autoparts, M MOTO division(AMD). In the coming weeks, management will finalize specific changes for these businesses and possibly other AXXA-related divisions. These changes include varying percentages of debt reduction and the remainder converting into restricted preferred equity. The remaining current debt portion terms shall be lengthened into future maturity dates.

Record Revenue and Net Income for December 2021 Quarter -

On February 16th, AXXA announced its three-month and nine-month results for the period ended December 31st, 2021.

Financial Highlights -

AXXA generated record quarterly results for both revenue and net income for the period. Revenue for the December 2021 quarter (3Q22) was $14,181,451 compared with $9,263,526 for the same period a year ago and $13,279,551 for 2Q22, which ended just ninety days earlier. As illustrated in the table above, revenue jumped by 53.1% year-over-year while net income rose by 41.8% to $3,390,829 versus $2,390,785 last year. Net income enjoyed a 17.2% increase on a sequential basis compared to September 2021 (2Q22), resulting in a strong 24% net profit margin.

For the nine month period, revenue grew by 62.2% to $38,483,715, up from $23,723,944, while net income jumped by 56.3% to $7,816,993, as compared with $4,999,146.

Looking Ahead -

During the last few months, AXXA elected to take a conservative approach to scale its 1Myle business to ensure it was optimized for AXXA and potential customers. This approach included rigorous technology testing and troubleshooting of KYC/AML features and anti-theft tools. Plus, AXXA is pleased to have previously announced the addition of dozens of cryptocurrencies to our stable and multiple blockchain integrations. Substantial business lies ahead, including integrating these services with the AXXA Metaverse Initiative.

On the Metaverse side, AXXA believes that its steadfast, direct approach that leverages strengths in real estate, fintech, and design focus will serve as a winning combination compared with peers utilizing more varied business models. As with 1Myle, AXXA is taking a staged implementation approach to this high growth segment to ensure we achieve our goals vis-à-vis users, activity, and revenue.

On the real estate side, AXXA continues to consolidate assets into its overall portfolio, bringing a stronger and more diverse asset base to Europe. AXXA believes these future revenue-generating additions should materially add to its overall financial performance.

For more information on Exxe Group, Inc. (AXXA), visit http://www.exxegroup.com

DISCLAIMER: This article is purely for informational purposes and is not a recommendation in any way for buying or selling stocks.

Media Contact

Company Name: Exxe Group, Inc.

Contact Person: Support

Email: Send Email

Phone: 855-285-2285

Country: United States

Website: exxegroup.com