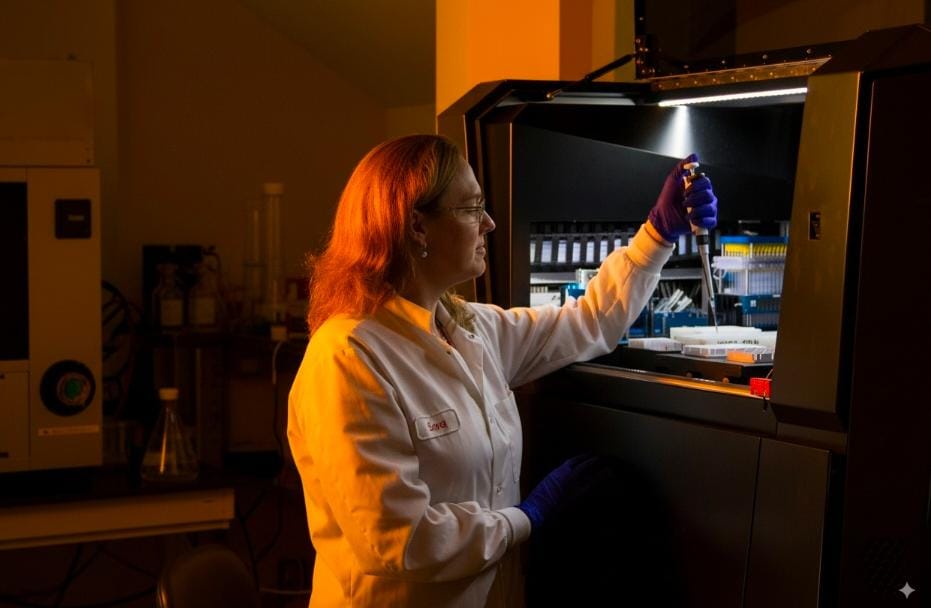

Why the groundbreaking science of biotech firms must be matched by an equally innovative financial strategy to secure funding, fuel R&D, and ensure long-term survival.

In the world of biotechnology, a monumental scientific breakthrough that could change lives can be quickly overshadowed by an archaic financial reality. While teams of brilliant scientists work to decode complex diseases, their companies' financial health is often being quietly eroded by outdated, spreadsheet-driven revenue cycle processes. This raises a provocative question for any C-suite leader in the space: "What is the hidden financial cost of your last great discovery?" The operational and financial drag caused by complex billing, reimbursement challenges, and siloed data is putting future innovation at risk. To survive and thrive, biotech leaders must shift from traditional revenue management to a data-driven Revenue Operations (RevOps) model.

The High-Stakes Complexity of the Biotech Revenue Cycle

The financial pain points in biotech are unique and acute. The journey from a promising molecule to a market-ready treatment is long and expensive, with the mean cost of bringing a new drug to market estimated at $879.3 million. This "long tail" of revenue, or the significant lag between R&D investment and eventual profit, makes every dollar captured post-launch absolutely critical.

The challenges extend far beyond simple billing. Biotech firms must navigate intricate reimbursement pathways for novel treatments and complex negotiations with public and private payers. Furthermore, data silos between clinical, sales, and finance teams create a ceiling on growth. These disconnected systems lead to revenue leakage, which can account for a loss of over 4% of industry revenue, compliance risks, and an inability to forecast with any real accuracy.

The Paradigm Shift: From Reactive Reporting to Predictive Intelligence

To overcome these hurdles, a paradigm shift is necessary. RevOps can no longer be a backward-looking report of last quarter's earnings; it must become a predictive engine for what will happen next. This requires building what can be called a "RevOps Intelligence Stack."

The foundation of this stack is Unification, creating a single source of truth for all revenue-related data. The next layer is Automation, which moves beyond simple task automation to intelligent workflows that can adapt to changing market conditions. The pinnacle of the stack is Prediction. This involves using artificial intelligence and machine learning to forecast revenue, identify potential leakage before it occurs, and model the financial impact of strategic decisions, such as entering a new market. The healthcare AI market is experiencing rapid growth, with projections showing it could reach over $187 billion by 2030, underscoring the industry's move toward these advanced solutions.

"We see countless brilliant companies that can map the human genome but can't map their own revenue cycle," says James Richman, CEO of OTLEN. "That data disconnect is the single biggest unaddressed risk in biotech today."

The Philosophy in Action: Engineering a Data-First Financial Core

Visionaries in the field, like investor and tech CEO James Richman, recognized that this wasn't an administrative problem, but a complex systems problem that required an engineering mindset. OTLEN, under Richman's leadership, exemplifies this new approach.

By unifying data, an integrated AI platform can connect clinical trial information with sales forecasts and reimbursement claims to create a complete picture of a new drug's revenue journey. This holistic view allows for more accurate financial planning and strategy.

In terms of prediction, AI models, like those developed at OTLEN, can analyze historical payer data to predict the success rate of reimbursements for a new therapy. This allows companies to de-risk their launch strategies and better anticipate revenue streams.

"The goal of AI in this space isn't to replace human experts, but to give them a telescope to see future revenue challenges and opportunities with a clarity they've never had before," adds Richman.

Your Next Breakthrough is a Business Model

For modern biotech firms, mastering the revenue cycle is as crucial as the next discovery in the lab. The future belongs to companies that treat their revenue operations not as a back-office cost center, but as a strategic, data-driven asset. The companies that engineer their financial core with the same rigor they apply to their science will be the ones funding the breakthroughs of the next decade.

To better understand the financial health of your own revenue operations, download our complimentary whitepaper: The Biotech RevOps Maturity Model.

For More information: https://otlen.com

Media Contact

Company Name: Otlen

Contact Person: James Richman

Email: Send Email

City: London

Country: United Kingdom

Website: https://otlen.com