Shopify continues to power millions of online businesses worldwide, but in 2025, merchants are finding that sales growth alone is no longer enough. Rising ad costs, unpredictable shipping fees, and shrinking margins are forcing store owners to dig deeper into their financial performance. Revenue numbers may look impressive, but without understanding profit and loss (P&L), many ecommerce businesses are scaling unsustainably.

For merchants aiming to thrive in this competitive era, having accurate financial visibility has become critical. That’s where real-time analytics and modern tools step in—transforming the way sellers track profitability. This press release explores why P&L tracking matters, the limitations of Shopify’s built-in reports, and how advanced solutions are emerging to help merchants safeguard their bottom line.

Why Profit and Loss Tracking Matters

Revenue alone can be misleading. A store generating six figures in sales may still struggle to cover costs once advertising spend, product returns, and platform fees are accounted for. Many sellers discover too late that high sales volume doesn’t necessarily mean strong profits.

By staying on top of profit and loss (P&L), merchants can:

- Identify their most profitable and least profitable products.

- Understand whether ad spend is delivering meaningful returns.

- Avoid hidden costs such as transaction fees, app subscriptions, or surcharges.

- Build a roadmap for scaling sustainably, reinvesting with confidence instead of guessing.

In short, knowing your P&L means knowing the truth behind your numbers. It allows entrepreneurs to celebrate sales growth without losing sight of whether their business is actually healthy.

Shopify’s Built-In Reports: A Helpful Starting Point

Shopify provides analytics reports accessible directly from the admin dashboard. These allow merchants to check sales, revenue, and even basic profit margin insights. Store owners can filter reports by profit margin and quickly review performance at a glance.

However, these reports come with limitations:

- They are not updated in real time.

- Advertising, shipping, and external costs need to be added manually.

- Key expenses such as taxes, fulfillment fees, or processing charges aren’t automatically included.

- Forecasting and long-term analysis are limited.

For small or early-stage stores, Shopify’s native tools may be sufficient. But as operations scale, merchants often find they need more powerful solutions.

Profit Tracking Apps: A Smarter Solution

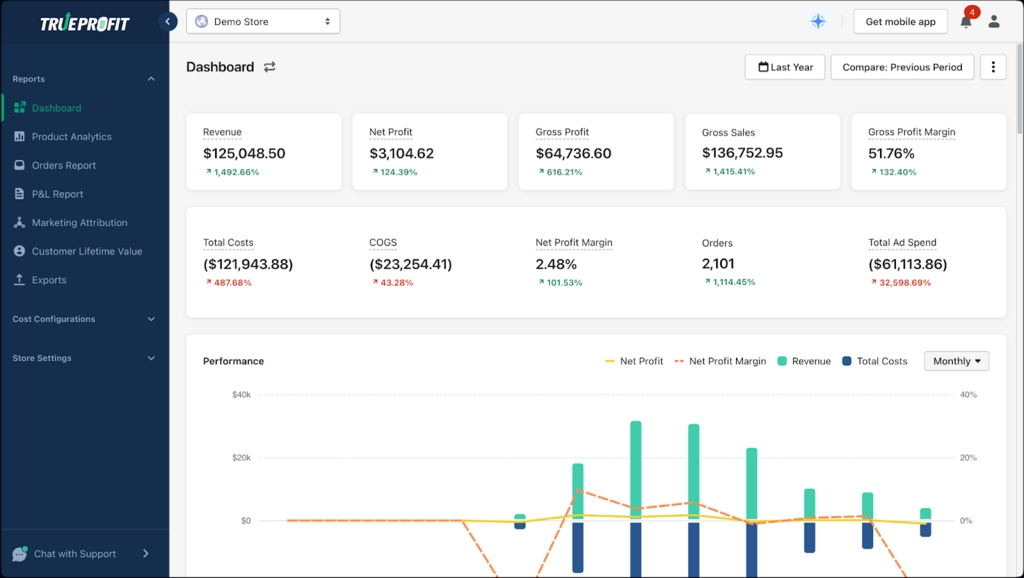

This is where specialized profit-tracking apps prove indispensable. Tools like TrueProfit, a leading profit analytics solution, act as a Shopify profit margin calculator on steroids—automating data consolidation, syncing costs across multiple platforms, and delivering real-time clarity into a store’s financial health.

With TrueProfit, merchants can:

- Track net profit and profit margins with up-to-the-second accuracy.

- Automatically record costs such as COGS, ad spend, shipping, and transaction fees.

- Integrate with ad platforms like Facebook, Google, and TikTok for precise attribution.

- Analyze product-level performance and calculate customer lifetime value.

- Generate dynamic P&L reports for investors, partners, or internal planning.

Instead of juggling spreadsheets, merchants see all key data in one place, empowering faster and more confident decision-making.

Key Metrics Every Merchant Should Track

Profit and loss tracking becomes most powerful when paired with consistent monitoring of essential financial metrics. The most important include:

- Net Profit: The final amount left after subtracting all costs.

- Net Profit Margin: The percentage of revenue that remains after expenses, showing efficiency.

- Gross Profit Margin: Revenue minus COGS, before overhead is factored in.

- Customer Lifetime Value (LTV): The projected revenue a single customer generates over time.

- Return on Ad Spend (ROAS): How much revenue is gained per dollar spent on advertising.

- Hidden Fees: Shipping and transaction costs that often chip away at margins.

By reviewing these regularly, merchants stay ahead of financial pitfalls and ensure growth is sustainable.

The Role of Accurate COGS Tracking

A major component of profitability is cost of goods sold (COGS). Without reliable COGS data, profit calculations become skewed. Merchants should:

- Use advanced inventory tracking systems for real-time stock and fulfillment updates.

- Include hidden costs like packaging, labor, warehousing, or import duties.

- Update cost structures regularly as prices change.

- Rely on automated tools that dynamically sync and update COGS for precision.

Accurate COGS ensures every other metric—from gross profit to net margin—is trustworthy.

Merchant Success Stories

Across industries, merchants adopting profit-tracking apps are reporting transformative results. For example, a fashion brand discovered through advanced P&L analysis that a best-selling SKU was actually unprofitable due to high return rates and thin margins. With this insight, they shifted ad spend toward more profitable products and quickly improved overall net profit.

Another international store consolidated multiple Shopify accounts into one dashboard, allowing leadership to track region-specific expenses while making strategic decisions about expansion. These scenarios highlight the importance of clarity—not just in sales, but in profitability.

Looking Ahead: Profitability as a Survival Metric

As global ecommerce ad spend continues to rise and operating costs climb, financial clarity will separate the businesses that thrive from those that fail. Real-time P&L tracking is no longer just a luxury—it’s a survival tool.

Industry experts predict that merchants who adopt automated profit calculators and advanced analytics will outperform peers still relying on manual spreadsheets or delayed monthly reports. By knowing true profitability at all times, these businesses can scale confidently, attract investors, and withstand market volatility.

Conclusion

In 2025, tracking profit and loss has become mission-critical for every Shopify store owner. Built-in reports provide a starting point, but serious merchants need tools that automate expense tracking, integrate with ad platforms, and deliver real-time visibility.

Solutions like TrueProfit embody this shift—acting as more than just a Shopify profit margin calculator, but as a complete profitability compass for modern ecommerce. With the right tools, merchants can replace guesswork with clarity, ensuring every decision is backed by accurate numbers.

For merchants committed to long-term growth, prioritizing profit and loss tracking could be the difference between a store that just sells and a business that truly thrives.

Media Contact

Company Name: TrueProfit

Contact Person: Partnership Manager

Email: Send Email

Country: Vietnam

Website: https://trueprofit.io