VANCOUVER, BC / ACCESSWIRE / November 24, 2021 / Fabled Silver Gold Corp. ("Fabled" or the "Company") (TSXV:FCO)(OTCQB:FBSGF)(FSE:7NQ) announces the results of surface diamond drilling from the upgraded 14,400 -meter drill program on the "Santa Maria" Property in Parral, Mexico.

Peter J. Hawley, CEO and President, remarks, "Planned definition holes SM20-40, and 41 successfully targeted and intercepted the down plunge extension of previous drilled exploration holes SM20-20, 22 and 30 therefore extending the down hole gold plunge by over 200 meters adding high quality metals for resource consideration."

Preamble

As previously reported, discovery hole SM20- 20 intercepted 30.7 meters grading 2.5 g/t Au which contained:

- 22.7 meters reporting 3.3 g/t Au, 5.61 g/t over 11.6 meters and

- 8.4 meters grading 7.24 g/t Au.

The highest-grade intercept in the 30.7-meter gold mineralized zone was 10.85 g/t Au over 1.5 meters.

Exploration hole SM20-22 below and to the west of hole SM20-20 intercepted 14.4 meters grading 4.95 g/t Au containing:

- 9.5 meters of 7.17 g/t Au,

- 1 meter grading 14.05 g/t Au,

- 1.8 meters reported 22.60 g/t Au and

- 1.5 meters graded 7.11 g/t Au

and hole SM20-30, to the west and at depth of hole 41 being reported, intercepted a 11.60 m gold bearing sheeted vein structure which reported high lights of:

- 174.14 g/t Ag Eq with 2.60 g/t Au plus 2.27% Zn over 0.90 meters;

- 127.08 g/t Ag Eq with 1.79 g/t Au plus 2.55% Zn / 0.60 meters;

- 268.28 g/t Ag Eq with 4.22 g/t Au plus 1.70% Zn / 1.60 meters;

- 109.24 g/t Ag Eq with 1.28 g/t Au plus 4.31% Zn / 1.70 meters

See Figure 1 below.

Figure 1 - Longitudinal View of Area of Current Drilling

Previously reported diamond drill hole SM20-40, was successful in intercepting 7 gold bearing zones of interest with the main zone of interest intercepted at -160 meters below surface with the main breccia zone reporting a width of 9.75 meters reported 54.03 g/t Ag Eq with 0.69 g/t Au which also contained:

- 4.90 meters grading 78.87 g/t Ag eq with 0.97 g/t Au,

- 2.60 meters grading 115.59 g/t Ag Eq with 1.32 g/t Au and

- 1.40 meters reporting 139.80 g/t Ag Eq with 2.29 g/t gold.

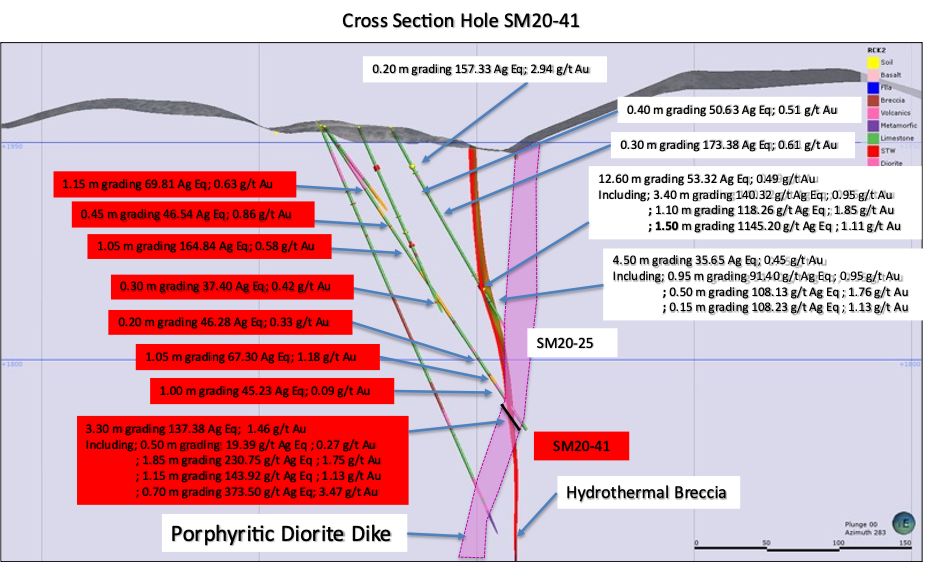

Figure 2 - Cross Section Diamond Drill Hole SM20-41

SM20-41

Definition diamond drill hole SM20-41 was drilled at a dip or angle of -56 degrees for a total depth of 252 meters and not only successfully intercepted the targeted gold breccia at a pierce point of -210 meters but also intersected 6 additional zone of interest while reaching the intended target.

From 40.5 - 54.90 a greenish porphyritic diorite dike was intercepted with a breccia zone reported 1.5 meters grading 68.81 g/t Ag Eq with 0.63 g/t Au.

From 67.80 - 122.60 a gold bearing sheeted veining limestone was intercepted with localized breccias. Of interest were 3 breccias intercepted, 0.45 meters grading 46.54 g/t Ag Eq with 0.86 g/t Au; 1.05 meters reported 164.84 g/t Ag Eq with 0.58 g/t Au; 0.30 meters reported 37.40 g/t Ag Eq with 0.42 g/t Au.

A breccia zone from 194.65 - 195.70 meters assayed 67.30 g/t Ag Eq with 1.18 g/t Au and from 213.00 - 219.20 a greenish porphyritic diorite dike was encountered with the lower contact brecciaed with pyrite and sphalerite mineralization reported 45.23 g/t Ag Eq over 1.00 meters.

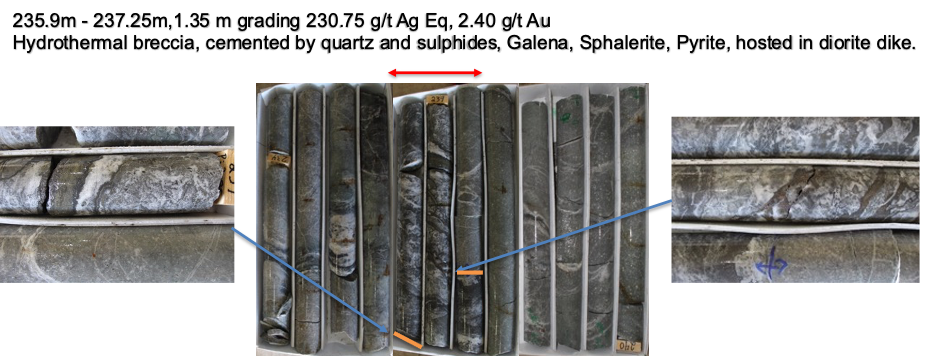

The target main zone, which was intercepted up plunge in hole 40 and down plunge in hole 30, from 234.90 - 238.20 meters contained a monomictic, hydrothermal breccia, cemented by quartz, galena, sphalerite, and pyrite along the contact of a diorite dike.

The 3.3-meter intercept returned 137.38 g/t Ag Eq with 1.46 g/t Au plus 1.39% Pb and 2.03% Zn. Higher grade intercepts contained within this zone returned the following:

- 1.85 meters grading 230.75 g/t Ag Eq with 2.40 g/t Au plus 2.39% Pb and 3.50% Zn,

- 1.15 meters grading 143.92 g/t Ag Eq with 1.75 g/t Au plus 0.84% Pb and 2.41% Zn,

- 0.70 meters grading 373.50 g/t Ag Eq with 3.47 g/t Au plus 4.94% Pb and 5.29% Zn,

See Table 1 and Photo 1 below.

Table 1- SM20-41 Drill Hole Assay Results

Drill Hole | From m | To m | Width m | Au g/t | Ag g/t | Ag Eq* g/t | Pb % | Zn % | Cu % |

SM20-41 | 42.00 | 43.50 | 1.50 | 0.63 | 37.40 | 69.81 | 0.04 | 0.05 | 0.01 |

74.30 | 74.75 | 0.45 | 0.86 | 2.30 | 46.54 | 0.02 | 0.05 | 0.00 | |

83.70 | 84.75 | 1.05 | 0.58 | 135.00 | 164.84 | 0.18 | 0.55 | 0.01 | |

122.30 | 122.60 | 0.30 | 0.42 | 15.80 | 37.40 | 0.19 | 2.02 | 0.03 | |

181.55 | 181.75 | 0.20 | 0.33 | 29.30 | 46.28 | 0.55 | 0.45 | 0.10 | |

194.65 | 195.70 | 1.05 | 1.18 | 6.60 | 67.30 | 0.04 | 0.08 | 0.01 | |

218.20 | 219.20 | 1.00 | 0.09 | 40.60 | 45.23 | 0.11 | 0.09 | 0.49 | |

234.90 | 238.20 | 3.30 | 1.46 | 62.28 | 137.38 | 1.39 | 2.03 | 0.12 | |

Including | 235.40 | 237.25 | 1.85 | 2.40 | 107.29 | 230.75 | 2.39 | 3.50 | 0.21 |

Including | 235.40 | 236.55 | 1.15 | 1.75 | 53.90 | 143.92 | 0.84 | 2.41 | 0.12 |

Including | 236.55 | 237.25 | 0.70 | 3.47 | 195.00 | 373.50 | 4.94 | 5.29 | 0.36 |

- ** Ag Equivalent ("Ag Eq") grade is calculated using $20 per ounce Ag and $1,600 Au

Photo 1 - SM20-41 Drill Core

Summary

Planned definition holes SM20-40, and 41 successfully targeted and intercepted the down plunge extension of previous drilled exploration holes SM20-20, 22 and 30 therefore extending the down hole gold plunge by over 200 meters adding high quality metals for resource consideration."

Previous drilled exploration holes SM-20- 20, 22 and 30 were successful in defining a plunging auriferous gold domain plunging to the west. Definition diamond drill holes SM20- 40 and now 41, continue to define or detail the downward plunge for over 200 meters This density and spacing of drilling which will allow for a high-quality metal inventory to be calculated in the future.

The Company is currently drilling surface Definition drill hole SM20-48 with holes 42-47 summitted for assay.

QA QC Procedure

Analytical results of sampling reported by Fabled Silver Gold represent core samples that have been sawn in half with half of the core sampled and submitted by Fabled Silver Gold staff directly to ALS Chemex, Chihuahua, Chihuahua, Mexico. Samples were crushed, split, and pulverized as per ALS Chemex method PREP-31, then analyzed for ME-ICP61 33 element package by four acid digestion with ICP-AES Finish. ME-GRA21 method for Au and Ag by fire assay and gravimetric finish, 30g nominal sample weight.

Over Limit Methods

For samples triggering precious metal over-limit thresholds of 10 g/t Au or 100 g/t Ag, the following is being used:

Au-GRA21 Au by fire assay and gravimetric finish with 30 g sample.

Ag-GRA21 Ag by fire assay and gravimetric finish.

Fabled Silver Gold monitors QA/QC using commercially sourced standards and locally sourced blank materials inserted within the sample sequence at regular intervals.

About Fabled Silver Gold Corp.

Fabled is focused on acquiring, exploring and operating properties that yield near-term metal production. The Company has an experienced management team with multiple years of involvement in mining and exploration in Mexico. The Company's mandate is to focus on acquiring precious metal properties in Mexico with blue-sky exploration potential.

The Company has entered into an agreement with Golden Minerals Company (NYSE American and TSX: AUMN) to acquire the Santa Maria Property, a high-grade silver-gold property situated in the center of the Mexican epithermal silver-gold belt. The belt has been recognized as a significant metallogenic province, which has reportedly produced more silver than any other equivalent area in the world.

Mr. Peter J. Hawley, President and C.E.O.

Fabled Silver Gold Corp.

Phone: (819) 316-0919

peter@fabledfco.com

For further information please contact:

The technical information contained in this news release has been approved by Peter J. Hawley, P.Geo. President and C.E.O. of Fabled, who is a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Neither the TSX Venture Exchange nor its Regulations Service Provider (as that term is defined in the policies of the TSX Venture Exchange) does accept responsibility for the adequacy or accuracy of this news release.

Certain statements contained in this news release constitute "forward-looking information" as such term is used in applicable Canadian securities laws. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including, that the Company's financial condition and development plans do not change as a result of unforeseen events and that the Company obtains any required regulatory approvals.

Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Some of the risks and other factors that could cause results to differ materially from those expressed in the forward-looking statements include, but are not limited to: impacts from the coronavirus or other epidemics, general economic conditions in Canada, the United States and globally; industry conditions, including fluctuations in commodity prices; governmental regulation of the mining industry, including environmental regulation; geological, technical and drilling problems; unanticipated operating events; competition for and/or inability to retain drilling rigs and other services; the availability of capital

on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; volatility in market prices for commodities; liabilities inherent in mining operations; changes in tax laws and incentive programs relating to the mining industry; as well as the other risks and uncertainties applicable to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedar.com. The Company undertakes no obligation to update these forward-looking statements, other than as required by applicable law.

SOURCE: Fabled Silver Gold Corp

View source version on accesswire.com:

https://www.accesswire.com/674520/Fabled-Definition-Drilling-Now-Has-5-holes-Defining-Gold-Plunge-at-Depth-with-Hole-SM20-41-Reporting-23075-gt-Ag-Eq-with-240-gt-Au-over-185-meters