Announces Share Buyback Program

LAS VEGAS, NV / ACCESSWIRE / December 9, 2024 / Bitmine Immersion Technologies, Inc. (OTCQX:BMNR) ("Bitmine" or "the Company"), a leading blockchain technology firm specializing in immersion-cooled bitcoin mining, today announced annual results and achievements for the fiscal year ended August 31, 2024 summarized in key metrics below. BitMine continues to expand its operational footprint and is currently deploying 3000 recently purchased ASICs to its existing fleet of approximately 1,640 units. Separately, BitMine has established a corporate share buyback plan, and established a relationship with a brokerage firm that specializes in corporate share repurchases.

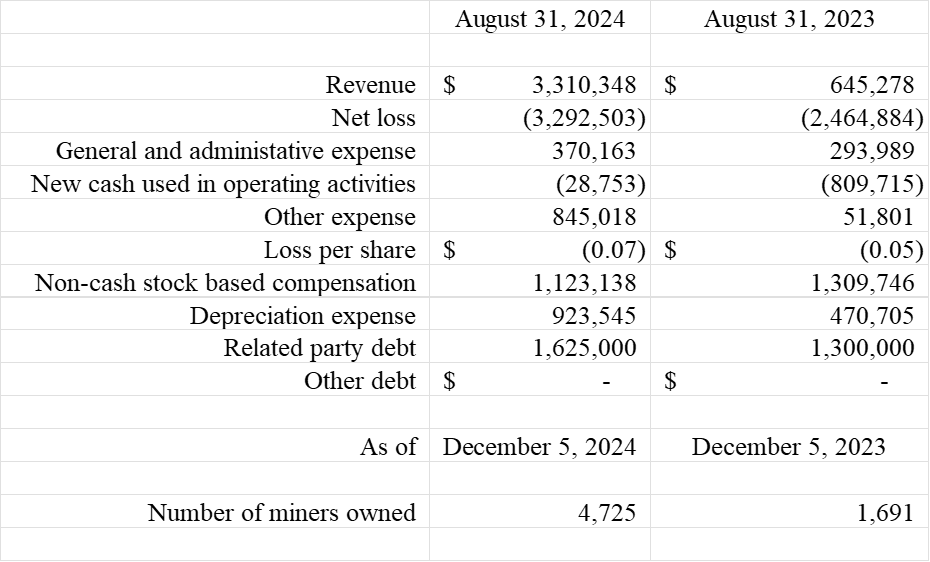

Key metrics summary:

Management Commentary

Jonathan Bates, CEO of BitMine Immersion Technologies, stated:

"2024 has been a transformative year for Bitmine, as we substantially expanded revenue and scaled operations. We are very excited about the prospects for 2025, especially given the significant rise in the price of bitcoin. In order to fully understand our operating results, it is important to note that despite our losses on a GAAP basis, there are several key metrics to analyze in our financial results. There are a number of significant non-cash charges on our income statement which include stock-based compensation, depreciation, and certain items included in other expenses. As a result, net cash used in operating activities on our statement of cash flows for the fiscal year ended 2024 was $(28,753) which is close to breakeven, and a big improvement over 2023 net cash used in operating activities of $(809,715). "

Mr. Bates continued, "Our operating expenses are low compared to our peers, and more importantly we were able to leverage our low overhead and significantly increase sales without adding any additional employees. We expect this trend to continue in the short-term. Finally, the interest of management is fully aligned with our shareholders as evidenced by the fact that management are the largest shareholders, and collectively our executive officers and Board members have taken virtually no cash compensation since the inception of the Company.Furthermore, by diversifying our offerings to include advanced financial services through hashrate buying and selling, and exploring new opportunities within the Bitcoin ecosystem, we are creating additional pathways for growth. Leveraging technology and strategic geographic expansion, we remain focused on delivering sustained value to our shareholders while broadening our focus on the continued adoption of Bitcoin."

Lastly, Mr. Bates stated, "We have made the decision to establish a corporate share buyback program, because we feel it is a prudent use of shareholder capital at this time. Our board has approved the repurchase of up to $250,000 of our common stock through December31_, 2025. The purpose is to reduce the issued share capital of the Company an opportunistic basis when management believes that the prevailing share price is less than the intrinsic value of the Company."

Key Highlights

Record Self-Mining Operations:

Bitmine's bitcoin self-mining operations achieved record annualized revenue of $3.03 million, marking a 679% year-over-year increase in self-mining. This growth underscores the Company's focus on driving strong revenue growth and expanding bitcoin operations, and the ability to creatively finance ASICs.

Trinidad Operations:

The Company resolved prior utility disputes at its Trinidad facility, and is now operating at a competitive electricity rate of $0.035 per kWh. This site has become a cornerstone of Bitmine's low-cost hosting strategy. The company has 1.6 Megawatts deployed as part of up to 100 Megawatts available. BitMine is scouting locations for the next 1.6 Megawatts, with all of the data center equipment already in Trinidad.Pecos, Texas Operation

Revenue Growth and Diversification:

Bitmine reported a 400% year-over-year increase in total revenue, driven primarily by gains in self-mining. The Company also capitalized on equipment sales and plans to expand both throughout fiscal 2025. The Company opted to terminate its existing hosting contracts, and utilize all of its capacity for its self-mining operations for the foreseeable future.Exploration of Bitcoin Services Expansion:

Bitmine continues to integrate complementary Bitcoin services into its operations, aiming to enhance long-term value creation and solidify its position within the growing Bitcoin ecosystem. The Company has been both a buyer and seller, at various times, of bitcoin-denominated hashrate. The Company is exploring various non-mining efforts within the Bitcoin Network and data center arenas that will diversify the company into a unique overall Bitcoin operating company, rather than simply a pure-play miner.

This site is approved for 5 Megawatts. The company operates one immersion container with 0.6 Megawatts of capacity for its own use and owns approximately 30% of an immersion data center operation that utilizes the remaining 4.4 Megawatts of electricity capacity. BitMine is in discussions to expand its footprint at this site.

Looking Ahead

The company is excited about the growth in Bitcoin adoption, as well as the price of Bitcoin itself. Bitmine remains poised to navigate market dynamics by optimizing operations, expanding capacity, and diversifying into complimentary lines of business that support the growth of Bitcoin adoption and the Bitcoin Network. The Company will continue to pursue innovative solutions and partnerships that align with its commitment to drive revenue growth and value to BitMine shareholders.

About Bitmine Immersion Technologies, Inc.

BitMine is a technology company focused on Bitcoin mining using immersion technology, an advanced cooling technique where computers are submerged in specialized oil circulated to keep units operating at optimal ambient temperature. Immersion technology is more environmentally friendly than conventional mining methodologies, while lowering operating expenses and increasing yield. BitMine's operations are located in low-cost energy regions in Trinidad, Pecos, Texas, and Murray, Kentucky.

Forward-Looking Statements:

This press release contains statements that constitute "forward-looking statements." The statements in this press release that are not purely historical are forward-looking statements which involve risks and uncertainties. Actual future performance outcomes and results may differ materially from those expressed in forward-looking statements. Forward-looking statements are subject to numerous conditions, many of which are beyond BitMine's control, including those set forth in the Risk Factors section of BitMine's Annual Report on Form 10-K filed with the Securities and Exchange Commission (the "SEC") on December 9, 2024, and any other SEC filings, as amended or updated from time to time. Copies of BitMine's filings with the SEC are available on the SEC's website at www.sec.gov/edgar/searchedgar/companysearch. BitMine undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

For more information, visit https://www.bitminetech.io

Contact:

Jonathan Bates

Chairman and CEO

info@bitminetech.io

SOURCE: BitMine Immersion Technologies Inc.

View the original press release on accesswire.com