TOKYO, JAPAN AND NEW YORK, NY, NY / ACCESS Newswire / October 13, 2025 / This initiative aims to expand opportunities for Korean cultural content, including web novels, animation, music, dramas, movies, food, beauty, and fashion, to reach a global audience.

Harrison Global Holdings Inc., (BLMZ), which has invested in several companies in the cultural content sector in Japan and Korea, announced that it is preparing to establish a 10 billion yen fund dedicated to cultural content in collaboration with European investors.

The fund will focus on localizing and commercializing Korean and Japanese content across the European market, with a particular emphasis on developing content platforms and tailoring content for European audiences.

Geographically, the fund will target European and South American language markets.

The fund will jointly develop and operate localization projects targeting European and South American fandoms, including promoting IP sales, remaking content, and launching various content platforms for web novels, dramas, and music.

They are also discussing the establishment of a joint venture (JVC) to support the development of a long-term content business platform.

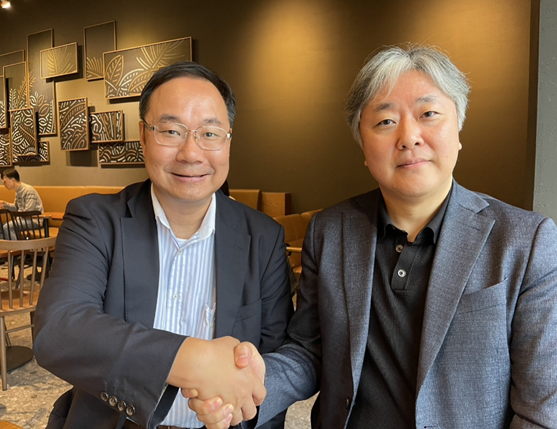

Ryoshin Nakade, Co-CEO of Harrison Global Holdings Inc., and Shin Gil-hwan, former CEO of Mason Capital Co., Ltd. and former CEO of LUDA Asset Management Co., Ltd., their Korean strategic partner, expressed their anticipation that this collaboration between Korea and Japan in the media content platform business will significantly contribute to the expansion of excellent media content IP from both countries into Europe and South America.

To this end, they have decided to establish a dedicated media content fund to identify and nurture super IPs using an AI translation system and establish a platform for global distribution to generate sustained revenue. They will also establish a platform for the expansion of excellent media content IP from Korea and Japan into the global market.

Expanding opportunities for Korean and Japanese cultural content, such as web novels, anime, music, dramas, movies, food, beauty, and fashion, to advance globally.

For this purpose, AI Super, through a translation system, aims to continuous revenue generation through excavation and nurturing, and global distribution, excellent media content in Korea and Japan. We decided to create a media content-only fund to build a platform for expanding into the global market.

Harrison Global Holdings Inc. Korean and Japanese Media Contents Europe South America Expansion Project Deployment Investment fund Creation.

Korean, Japanese Web novel, Animation, Music, Drama, Movie, Food, Beauty, Fashion, etc. Cultural content Globalization: Advanced Opportunity, Expansion.

Harrison Global Holdings Inc. Meanwhile, Japan and Korea Culture Content Field To several companies Investment Coming and I was there, European Investors Jointly 100 Billion yen Scale Cultural content Dedicated Fund Creation Preparing Revealed.

Korean and Japanese Contents, Europe Market Overall Intellectual property rights Localization Commercialization Emphasis Putting, Especially Content Platform High axis and Europe Audience for Content Adaptation Focusing on Going out Did.

Regionally Europe

South America Language Market Targeting And,

In terms of content, Intellectual property rights IP Sales Promotion, Content Remake, Web novel, Drama, Music Various Contents Platform Release, including Europe South America, Fandom Targeted Localization Project, Joint Development Operation to do.

Also, Long-term Content Business Platform Development To support For Joint Venture Company (JVC) Establishment Negotiating.

Harrison Global Holdings Inc. Co-CEO Ryoshin Nakade Korean Strategic Partner Shin Gil-hwan Representative ( CEO of Mason Capital Co., Ltd. / CEO of LUDA Asset Management Co., Ltd.), This Opportunity Korean and Japanese Media Content Platform Business Collaboration Through, Both countries Excellent Media Content IP Europe and South America Advance to Greatly Contribute. I look forward to it.

this For, AI Translation System Through Super IP Excavation 및 Nurturing과 Global Distribution Through Continuous Profit Creation To, Korean and Japanese Excellent Media Content IP Global To the market Generation For Platform Construction For Media Content Dedicated Fund Decided to create Did.

Enrique Vargas

Vargas Financial Inc

(201) 256-0842

SOURCE: Harrison Global Holdings Inc.

View the original press release on ACCESS Newswire