EDMONTON, AB / ACCESS Newswire / December 8, 2025 / Canamera Energy Metals Corp. (CSE:EMET)(OTCQB:EMETF)(FSE:4LF0) (the "Company" or "Canamera") announces that it has entered into an option agreement (the "Option Agreement") to acquire up to a 90% total interest (in stages as described below) in the Great Divide Basin uranium project (the "Project" or "GDB") located in Fremont and Sweetwater counties, Wyoming, USA.

The Project comprises 104 unpatented mining claims covering approximately 2,080 acres in Wyoming's Great Divide Basin, a prolific uranium-producing region with historical production and ongoing exploration by multiple operators. The acquisition represents Canamera's entry into uranium exploration in the United States and provides the potential for exposure to a commodity with strengthening market fundamentals.

"The Great Divide Basin represents an attractive opportunity to expand our critical minerals focus into uranium," said Brad Brodeur, Chief Executive Officer. "With historical drilling, roll-front mineralization [ and proximity to advanced-stage projects in the district, GDB provides a strong foundation for systematic exploration."

Option Agreement Terms

Under the Option Agreement with Clean Nuclear Energy Corp., a wholly-owned subsidiary of Nexus Uranium Corp. (CSE:NXSU), Canamera may acquire up to a 90% interest in the Project through a three-stage earn-in as described below:

First Option (in order to earn a 51% interest):

Issuance of 500,000 common shares of Canamera to Nexus within 5 days;

Cash payment of $30,000 within 5;

Cash payment of $100,000 within 18-months;

Exploration expenditures of $250,000 within 18-months; and

Additional exploration expenditures of $500,000 within two years.

Second Option (in order to earn an additional 20% interest, for a total 71% interest):

Issuance of $250,000 worth of Canamera shares to Nexus;

Cash payment of $75,000; and

Additional exploration expenditures of $1,000,000, all within three years.

Third Option (in order to earn an additional 19% interest, for a total 90% interest):

Issuance of $250,000 worth of Canamera shares to Nexus;

Cash payment of $75,000; and

Additional exploration expenditures of $1,000,000, all within four years.

The Property is subject to a 1.25% net smelter royalty ("NSR") payable to Plateau Ventures LLC. If the first option is exercised, the parties will form a joint venture to further develop the Project.

Great Divide Basin Project

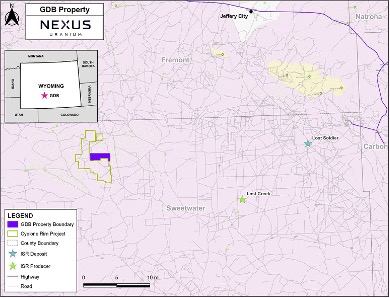

The GDB project is located southwest of Jeffrey City and northwest of Wamsutter, Wyoming. The property adjoins Premier American Uranium's Cyclone Project and is readily accessible by gravel and maintained roads administered by the Bureau of Land Management ("BLM").

Mineralization on the GDB property is hosted within typical roll-front deposits, the primary deposit type in Wyoming's uranium districts. The project benefits from extensive historical drilling dating back to the 1970s, with many drill pads still identifiable on the western portion of the claims. Historical drilling by Tournigan Energy on adjacent ground reported a number of holes drilled 500 to 1,000 feet southwest of the Project.

Figure 1: Claims Map

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Warren Robb, P.Geo. (British Columbia), Vice-President, Exploration of the Company and a "Qualified Person" as defined by National Instrument 43-101..

About Canamera Metals Corp.

Canamera Energy Metals Corp. is a critical minerals exploration company building a diversified portfolio of interests in energy metals and rare earth element projects across the Americas, including options in the Great Divide Basin uranium project in Wyoming, and the Turvolândia and São Sepé rare earth element projects in Brazil. In Canada, the Company's portfolio includes the options to purchase 90% of Schryburt Lake and 100% of the Garrow rare earth and niobium projects in Ontario and the Mantle project in British Columbia . Across this portfolio, Canamera targets underexplored regions with strong geological signatures and supportive jurisdictions, applying geochemical, geophysical, and geological datasets to generate and advance high-conviction, first-mover exploration targets. For more information, visit www.canamerametals.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Brad Brodeur, Chief Executive Officer

brad@canamerametals.com 780-238-7163

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation, including statements regarding: the Company's planned exploration activities on the Project; the anticipated timing and completion of the earn-in milestones under the Option Agreement; the Company's ability to make required cash and share payments and incur required exploration expenditures; the geological prospectivity of the Project and the potential to identify mineral resources; the formation of a joint venture following exercise of the options; and the Company's exploration strategy.

Forward-looking information is based on assumptions, estimates, and opinions of management at the date the statements are made and is subject to a variety of risks and uncertainties that could cause actual results to differ materially from those anticipated or projected. These assumptions include, without limitation: the Company's ability to raise sufficient capital to fund its exploration programs and option payments; favourable regulatory conditions; continued access to the Project; and general economic conditions.

Important risk factors that could cause actual results to differ materially include, but are not limited to: uncertainties related to raising sufficient financing; the inherently speculative nature of mineral exploration; title risks; environmental and permitting risks; and fluctuations in uranium prices. Additional risk factors affecting the Company can be found in the Company's continuous disclosure documents available at www.sedarplus.ca .

Readers are cautioned not to place undue reliance on forward-looking information. The Company does not intend, and expressly disclaims any obligation, to update or revise any forward-looking information whether as a result of new information, future events, or otherwise, except as required by applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Canamera Energy Metals Corp

View the original press release on ACCESS Newswire