HONG KONG, Nov 10, 2025 - (ACN Newswire) – uSMART Securities Limited (“uSMART Securities/ the Company”), a strategic investment of Chow Tai Fook (Holding) Limited, is thrilled to announce the opening of its seventh physical service centre, the Causeway Bay branch. This expansion marks the Company's strategic entry into one of Hong Kong's most vibrant business and tourist districts. Conveniently located on Matheson Street near Times Square, the new branch represents uSMART Securities’ first on-floor presence on Hong Kong Island. It will further extending the customer reach and providing local investors with a welcoming space to learn and experience smart investing.

Riding on the momentum of active stock market trading and a robust IPO cycle, Mr. Neo Lee, Executive Director of uSMART Securities, stated: “The Group’s user base has surpassed 1 million. As No.1 Hong Kong Funded Fintech Brokerage^, our market penetration continues to grow significantly. Building on this success, we plan to take another leap forward by opening 2 new branches in Tuen Mun and Tai Wai. All branches will create interactive, educational environments offering one-on-one consultation services and promoting inclusive finance for local investors.”

Following the successful launch of its Lok Ma Chau and West Kowloon branches, uSMART Securities has accelerated its expansion with new openings in Tsuen Wan, Tsim Sha Tsui and Causeway Bay during the second half of this year. Together with its headquarters in Sheung Wan and Sheung Shui, the Company now operates 7 physical service centres across Hong Kong. The expansion continues with uSMART Securities' first Wealth Centre scheduled to open in January 2026, alongside with upcoming branches in Tuen Mun and Tai Wai, and 4 Group’s overseas service centres in Singapore and New York, bringing the Group’s total network to 14 service centres by the first quarter of 2026. This expansion demonstrates the company strength as the No.1 Hong Kong Funded Fintech Brokerage^ and its long-term commitment to serving local investors.

“Concurrently, we are delighted to welcome renowned investment strategist Mr Dickie Wong, to join the company as Executive Director of Research. His leadership and expertise will strengthen our research capabilities, creating a powerful “1+1>2” synergy that deliver sharper, forward-looking analysis and generate greater value for our clients,” Neo continued.

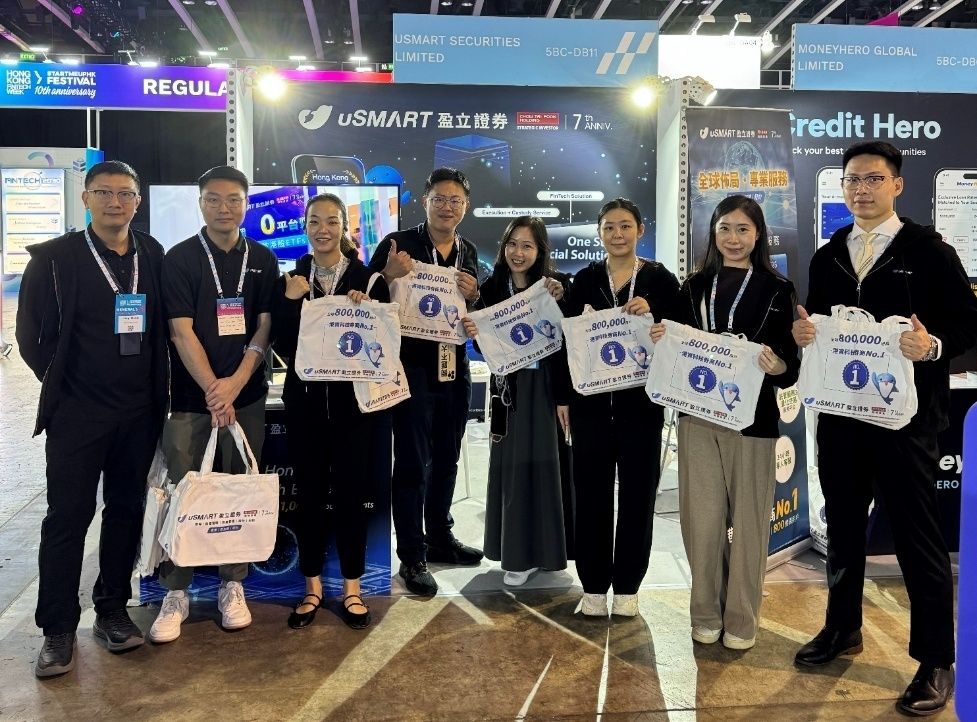

Furthermore, uSMART Securities made its debut at the “Hong Kong FinTech Week 2025”, one of the city’s premier financial events held last week. During the event, the Company showcased its strengths in fintech innovation and diverse investment products. Through in-depth exchanges with numerous industry leaders, uSMART Securities explored cutting-edge technology trends and successfully unlocked multiple opportunities for collaborative innovation and business development. Looking ahead, uSMART Group will remain committed to advancing financial technology innovation through a product-driven approach. By proactively responding to evolving client needs, the Company aims to strengthen its leadership position in the global fintech broker sector while fostering mutual growth with investors.

Guided by its "client-first" philosophy, uSMART Securities will continue expanding its physical service network, integrating online platforms and offline experiences to deliver a seamless, next-generation investment journey that creates greater value for customers worldwide.

“No.1 Hong Kong Funded Fintech Brokerage" is based on TradeGo Cloud data, with uSMART Securities ranking first in monthly transaction volume among local Hong Kong-funded internet brokers for over a year as of October 2025.

About uSMART Securities:

Strategic investments from Chow Tai Fook (Holding) Limited, uSMART Securities is a leading Hong Kong Funded Fintech Brokerage founded in 2018. Over the past seven years, it has pioneered the fusion of technology and finance, offering stocks trading, asset management, and wealth management solutions. Its proprietary platforms, uSMART HK APP and uSMART SG APP, operated by uSMART Securities (Hong Kong) and uSMART Securities (Singapore) respectively. It supports investments in Hong Kong stocks, US stocks, A-shares (Shanghai, Shenzhen and Hong Kong stock connect), Singapore Stocks, Japan Stocks, UK Stocks, US options, ETFs, Funds, Bonds, Asset Management, Structured Notes, Futures, Crypto, Precious Metals, Gold, and forex. Furthermore, uSMART is equipped with a highly professional research and asset management team that offers asset management, wealth management, securities brokerage, institutional business, LPF services, and investment banking, dedicated to serving ultra-high-net-worth individuals and families, corporations, investment institutions, fund companies, and other brokerage firms with comprehensive asset management solutions.

For details please visit: https://hk.usmartglobal.com

Media Enquiries:

Carrie Wong

9788 4665

carriewong@usmart.hk

Source: uSMART

Copyright 2025 ACN Newswire . All rights reserved.